- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

BioNTech (BNTX): Is the Current Valuation Supported by Its Recent Share Price Recovery?

Reviewed by Simply Wall St

BioNTech (BNTX) has been in focus as investors weigh up its recent performance and growth metrics. The stock has climbed 8% over the past month, despite a year-to-date decline of 8% and annual revenue growth just above 2%.

See our latest analysis for BioNTech.

BioNTech’s share price has seen a solid bounce recently, with a 1-month share price return of 7.6% capturing investors’ renewed interest. Even as the broader 1-year total shareholder return remains slightly negative, long-term investors are still in the green over five years. While momentum appears to be building in the short term, the overall trend highlights how the stock can swing as sentiment shifts around new developments and evolving risk perceptions.

If you want to see what other healthcare innovators are catching investor attention right now, it’s worth taking a look at the full list in our See the full list for free..

The big question now, with BioNTech’s recent upswing and modest revenue growth, is whether the market is underestimating its long-term potential or if share prices already reflect all the expected upside for investors.

Most Popular Narrative: 21% Undervalued

BioNTech’s most tracked narrative suggests a fair value that stands well above its last close of $106.23. With analysts converging on a target valuation over $130, there is clear market skepticism regarding where expectations meet reality, especially after recent shifts in the biotech sector.

Robust pipeline expansion in oncology, with multiple late-stage (Phase II/III) clinical trials for BNT327 and mRNA cancer immunotherapies across high-prevalence cancers (lung and breast), positions BioNTech to launch multiple new products, driving significant top-line revenue growth and enhancing earnings visibility over the next several years.

Want to know which clinical breakthroughs and revenue estimates are fueling this bullish stance? The underlying model leans heavily on a potential turnaround in profit margins and blockbuster launches, with a premium-level earnings multiple rarely seen outside high-growth industries. Discover what ambitious forecasts are shaping BioNTech’s estimated fair value.

Result: Fair Value of $134.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on COVID-19 vaccine sales and delays in oncology trial results could quickly weigh on BioNTech’s expected growth story.

Find out about the key risks to this BioNTech narrative.

Another View: Market Multiples Suggest a Cautious Stance

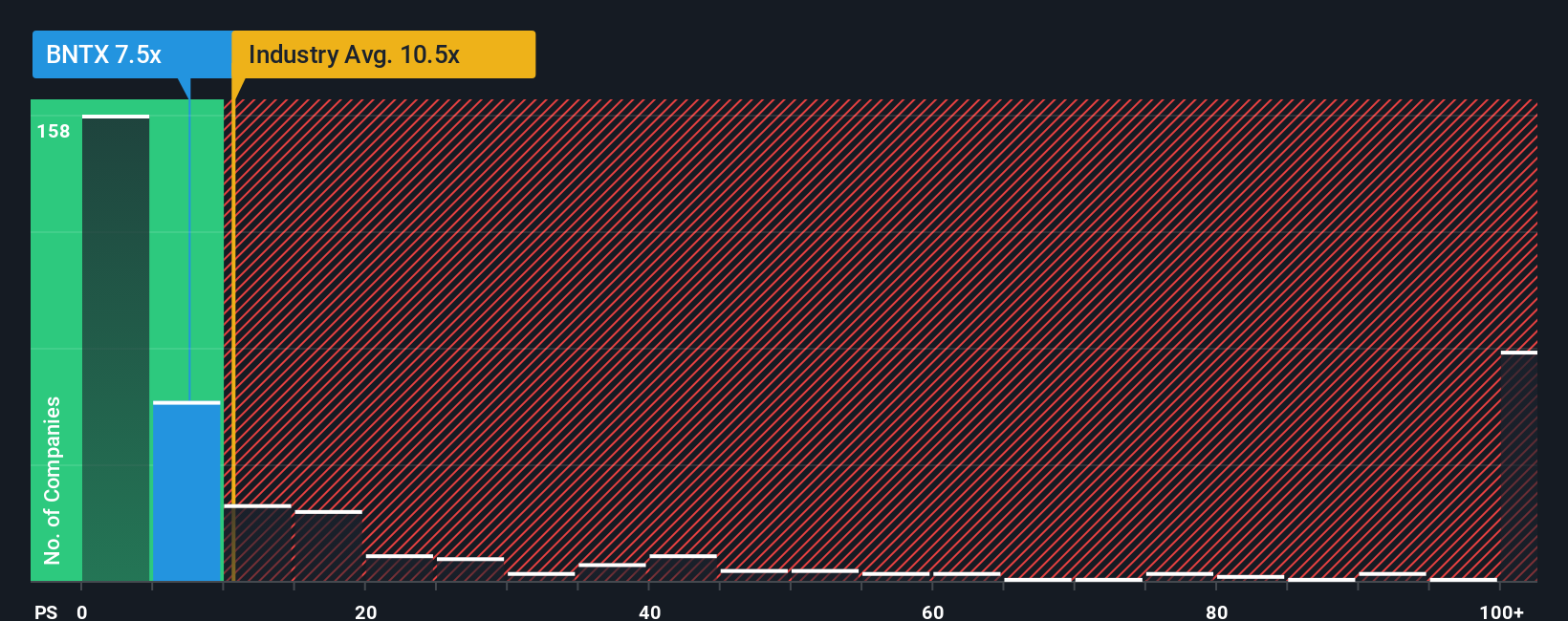

Looking through the lens of the price-to-sales ratio, BioNTech trades at 7.6x, which is higher than its direct peers at 3.9x but below the US biotech industry average of 11.3x. Its fair ratio sits at 6.5x, suggesting that current prices leave little margin for error and may expose investors to valuation risk if future growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you see things differently or want to draw your own conclusions from the latest numbers, you can shape your own perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for more investment ideas?

Unlock new opportunities others might overlook on Simply Wall St. Don’t sit on the sidelines while smart investors get ahead with these powerful tools:

- Maximize your yield potential and boost your passive income by targeting these 17 dividend stocks with yields > 3% with robust returns and strong payout histories.

- Catch the next wave of innovation and growth by following these 26 AI penny stocks shaping the future of artificial intelligence across every industry.

- Beat the crowd by acting early on these 871 undervalued stocks based on cash flows that are currently flying below Wall Street’s radar based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives