- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

A Fresh Look at BioNTech (NasdaqGS:BNTX) Valuation Following AI Day and Renewed Investor Optimism

Reviewed by Kshitija Bhandaru

BioNTech (NasdaqGS:BNTX) shares climbed nearly 4% following its Innovation Series, AI Day, where the company showcased advancements in artificial intelligence. Investors are paying attention as AI gains more traction in biotechnology and pharma.

See our latest analysis for BioNTech.

BioNTech’s share price has seen renewed momentum following its AI showcase. However, zooming out, the bigger narrative is that the 1-year total shareholder return remains in the red at -12.8%, reflecting ongoing industry challenges even as fresh growth drivers emerge. Despite the latest enthusiasm, the stock’s long-term performance shows both potential and volatility as the biotech sector undergoes rapid change.

If the wave of AI innovation in biotech has you curious, this is the perfect opportunity to explore other promising players with our See the full list for free.

With BioNTech trading at a significant discount to analyst price targets but still facing industry headwinds, the key question now is whether there is genuine upside for investors, or if the market has already factored in future growth.

Most Popular Narrative: 23.1% Undervalued

With BioNTech trading at $104.51 and the most followed narrative placing fair value near $135.85, sentiment suggests significant upside potential versus the current share price. This creates an ambitious context for forward-looking growth assumptions that support the higher valuation.

Robust pipeline expansion in oncology, with multiple late-stage (Phase II/III) clinical trials for BNT327 and mRNA cancer immunotherapies across high-prevalence cancers (lung and breast), positions BioNTech to launch multiple new products. This may drive significant top-line revenue growth and enhance earnings visibility over the next several years.

Want to uncover what’s powering this bold fair value? The narrative’s high expectations rest on future profit margins and revenue shifts rarely projected for biotechs. Which surprising financial leaps could justify the valuation jump? Click through to see the full calculation and discover the details that analysts are betting on.

Result: Fair Value of $135.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if COVID-19 vaccine sales continue to decline or late-stage oncology trials encounter setbacks, BioNTech’s growth narrative could face significant hurdles.

Find out about the key risks to this BioNTech narrative.

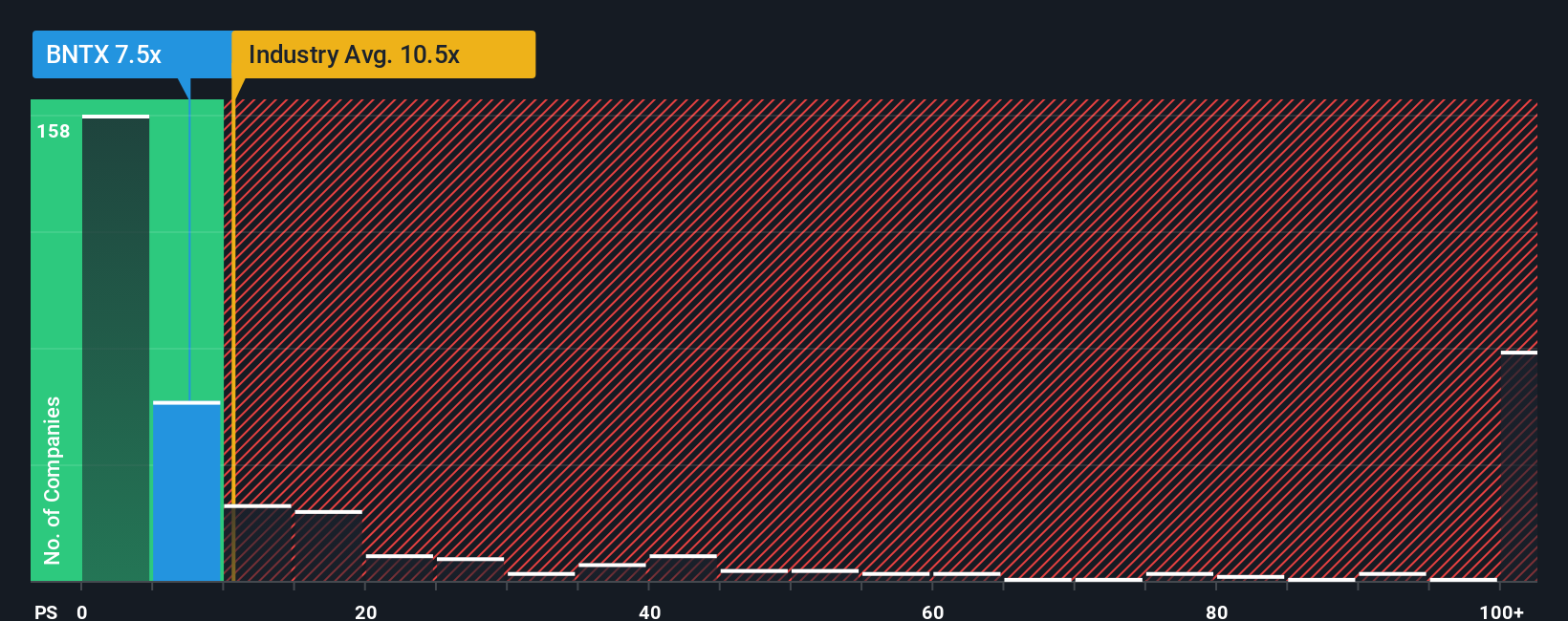

Another View: Looking at Market Multiples

While analyst price targets point to compelling upside, BioNTech trades at a price-to-sales ratio of 7.4x. This is higher than its peer average of 4x and the fair ratio of 6.5x, but sits below the broader US biotech industry average of 9.7x. Such a premium can signal optimism; however, it also warns of potential overvaluation if growth does not accelerate. Is this market premium a sign of forward-looking faith, or is it setting up for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioNTech Narrative

If you want to draw your own conclusions or put the data to the test yourself, you can easily build a custom story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding BioNTech.

Looking for More Investment Ideas?

Don’t let smart opportunities pass you by. Take charge of your portfolio and use the right tools to find your next potential winner.

- Spot companies with robust yields and consistent growth by checking out these 19 dividend stocks with yields > 3% for top picks delivering impressive dividends.

- Seize the innovation advantage as you scan these 24 AI penny stocks making waves in artificial intelligence and powering tomorrow’s biggest breakthroughs.

- Target stocks that may be trading below their worth by sorting through these 910 undervalued stocks based on cash flows and get a head start before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives