- United States

- /

- Pharma

- /

- NYSE:ANRO

Promising US Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed trading environment with major indexes slipping after recent gains, investors are keenly observing opportunities that might arise from smaller segments of the market. Penny stocks, often representing smaller or newer companies, remain relevant for their potential to offer significant returns when backed by solid financials. In this article, we will explore several penny stocks that stand out due to their financial strength and growth potential, providing an intriguing option for those looking to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Biomea Fusion (NasdaqGS:BMEA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Biomea Fusion, Inc. is a clinical-stage biopharmaceutical company dedicated to developing covalent small molecule drugs for genetically defined cancers and metabolic diseases, with a market cap of $135.17 million.

Operations: Biomea Fusion, Inc. currently does not report any revenue segments as it is focused on developing covalent small molecule drugs for specific cancers and metabolic diseases.

Market Cap: $135.17M

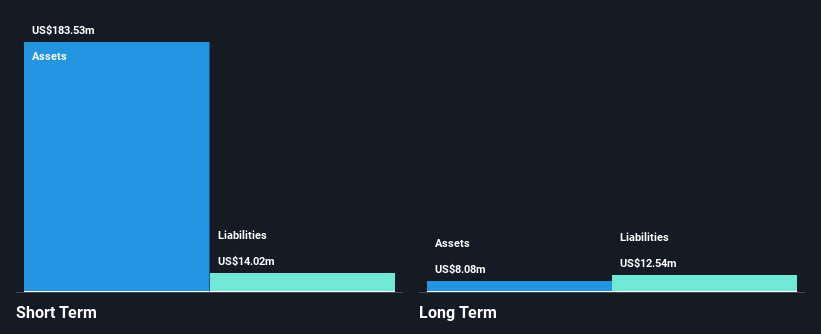

Biomea Fusion, Inc., a clinical-stage biopharmaceutical company with a market cap of US$135.17 million, remains pre-revenue as it focuses on developing covalent small molecule drugs for genetically defined cancers and metabolic diseases. Recent announcements highlighted promising preclinical results for icovamenib in combination with semaglutide, suggesting potential advancements in diabetes treatment. Despite the absence of revenue, Biomea's short-term assets cover both its short and long-term liabilities. However, the company faces financial constraints with less than a year of cash runway and continues to operate at a loss without expected profitability in the near term.

- Navigate through the intricacies of Biomea Fusion with our comprehensive balance sheet health report here.

- Evaluate Biomea Fusion's prospects by accessing our earnings growth report.

IGM Biosciences (NasdaqGS:IGMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGM Biosciences, Inc. is a clinical-stage biotechnology company focused on developing Immunoglobulin M (IgM) antibodies for treating cancer and autoimmune and inflammatory diseases, with a market cap of $85.03 million.

Operations: IGM Biosciences generates revenue primarily from developing engineered IgM antibodies for cancer treatment, amounting to $2.92 million.

Market Cap: $85.03M

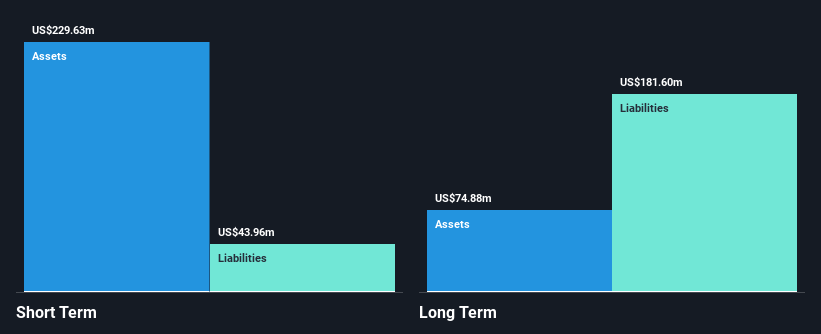

IGM Biosciences, Inc., with a market cap of US$85.03 million, is navigating significant challenges as it remains pre-revenue while focusing on IgM antibodies for cancer and autoimmune diseases. Recent strategic shifts include halting development of key programs due to insufficient clinical results, leading to a 73% workforce reduction aimed at preserving cash. Despite these setbacks, the company maintains strong short-term assets (US$229.6 million) exceeding liabilities and holds no debt. The board and management are experienced, offering stability during this transitional phase as they explore strategic alternatives to enhance shareholder value amidst high share price volatility.

- Click here to discover the nuances of IGM Biosciences with our detailed analytical financial health report.

- Explore IGM Biosciences' analyst forecasts in our growth report.

Alto Neuroscience (NYSE:ANRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alto Neuroscience, Inc. is a clinical-stage biopharmaceutical company in the United States with a market cap of $90.62 million.

Operations: Alto Neuroscience, Inc. does not report any revenue segments.

Market Cap: $90.62M

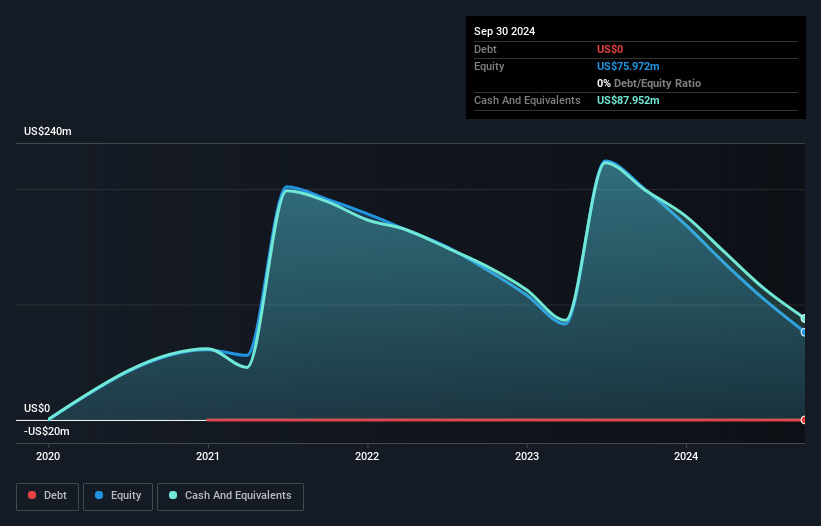

Alto Neuroscience, Inc., with a market cap of US$90.62 million, is pre-revenue and focused on developing treatments for major depressive disorder (MDD). The company recently announced positive interim results from its Phase 2b trial of ALTO-300, an adjunctive treatment for MDD, which will continue with additional patient enrollment. Despite being unprofitable and facing declining earnings forecasts over the next three years, Alto has a strong cash position exceeding both short-term and long-term liabilities. Recent financial maneuvers include a $75 million follow-on equity offering and an amended loan agreement extending debt maturity to 2029.

- Jump into the full analysis health report here for a deeper understanding of Alto Neuroscience.

- Gain insights into Alto Neuroscience's outlook and expected performance with our report on the company's earnings estimates.

Make It Happen

- Click here to access our complete index of 705 US Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANRO

Alto Neuroscience

Operates as a clinical-stage biopharmaceutical company in the United States.

Excellent balance sheet moderate.

Market Insights

Community Narratives