- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

BioLife Solutions (BLFS) Valuation After Strong Q3 Beat, Guidance Raise, and New Biopreservation Center Opening

Reviewed by Simply Wall St

BioLife Solutions (BLFS) has given investors plenty to chew on after Q3, with an earnings beat, stronger revenue guidance for its cell processing platform, and a new biopreservation center opening in Bothell.

See our latest analysis for BioLife Solutions.

Even with the upbeat Q3 and the new biopreservation center signaling a long runway for its CGT tools, BioLife’s recent share price return has been slightly negative and its 1 year total shareholder return is modestly underwater, suggesting near term caution but still reflecting a solid 3 year total shareholder return that points to longer term momentum.

If BioLife’s pivot into higher growth bioproduction tools has your attention, it could be a good time to scan other innovative healthcare stocks that might be riding similar structural trends.

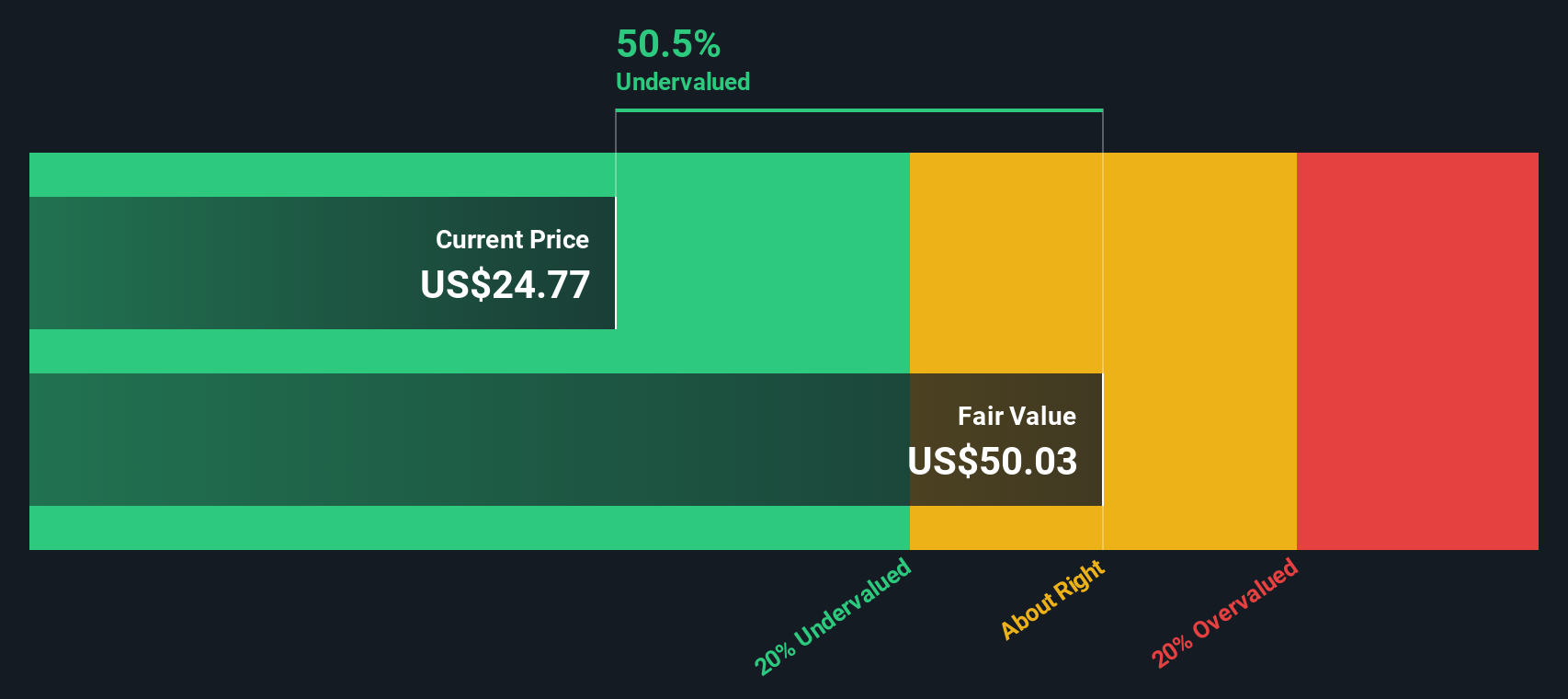

With revenue and earnings momentum building, shares still sitting below analyst targets and a sizable intrinsic discount, investors now face the real question: is BioLife quietly undervalued, or is the market already baking in that growth?

Most Popular Narrative: 18.7% Undervalued

Compared with the last close at $25.46, the most popular narrative points to a higher fair value, framing BioLife as a long term growth asset rather than a short term trade.

Ongoing customer adoption of multiple integrated products (cross-selling), with evidence of key accounts trialing and potentially implementing new technologies (e.g., CT-5 automated fill, CryoCase), is expected to significantly boost average revenue per dose and improve customer stickiness, supporting both top-line growth and higher net margins over time.

Curious how this cross selling story turns into a higher fair value? The narrative leans on rapid revenue expansion, a margin flip to profitability, and a future earnings multiple more commonly reserved for category leaders. Want to see exactly which growth and margin assumptions power that target?

Result: Fair Value of $31.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a concentrated cell therapy customer base and persistent margin pressure from product mix shifts could quickly challenge this bullish valuation story.

Find out about the key risks to this BioLife Solutions narrative.

Another Lens on Valuation

Analysts see BioLife as roughly 18.7% undervalued at $31.30, but our SWS DCF model is far more generous, putting fair value near $49.97, almost double today’s $25.46 price. Is the market deeply mispricing long term cash flows, or are these forecasts too rosy?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BioLife Solutions Narrative

If you see the story unfolding differently, or want to stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your BioLife Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning a few targeted stock ideas on Simply Wall St, you will not want to miss these.

- Capture early stage potential by checking out these 3573 penny stocks with strong financials that pair tiny price tags with surprisingly solid fundamentals.

- Explore structural tech shifts by reviewing these 26 AI penny stocks involved in productivity, automation, and next generation software.

- Seek income and stability through these 15 dividend stocks with yields > 3% that aim to keep paying you while markets stay unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BioLife Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLFS

BioLife Solutions

Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)