- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

A Fresh Look at BioLife Solutions (BLFS) Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

BioLife Solutions (BLFS) shares have shown a steady climb over the past month, catching the attention of investors looking for growth in the biotech sector. The stock’s recent performance suggests underlying momentum as market participants search for reliable opportunities.

See our latest analysis for BioLife Solutions.

BioLife Solutions’ 11.4% gain in 1-month share price return stands out, building on positive momentum that has been gathering since the beginning of the year. With a 25.3% total shareholder return over the past year and a strong stretch of recent gains, the stock’s rally suggests renewed optimism about BioLife’s growth potential compared to where it was just a year ago.

If the strength in BioLife’s rally has you thinking bigger, now could be the perfect time to discover fast growing stocks with high insider ownership

Yet with shares not far from analyst price targets and significant gains already in the books, investors are left with a key question: Is BioLife Solutions still trading at an attractive valuation, or is future growth already factored in?

Most Popular Narrative: 8.1% Undervalued

The most widely followed narrative suggests BioLife Solutions is trading below its estimated fair value, with the last close price offering a potential upside according to their forecast. As market excitement grows, many are analyzing what could drive valuations higher, or what might limit gains from here.

Momentum in cell and gene therapy commercialization and R&D, as shown by 28% YoY cell processing revenue growth and BioLife's products embedded in 16 approved therapies and 250+ clinical trials, is driving sustained, recurring demand, positioning the company for long-term revenue expansion as advanced therapies move through regulatory approval and adoption cycles.

Want to know the growth blueprint behind this high valuation? Analysts are betting on surging revenues, major margin gains, and a profit transformation that rivals the hottest names in biotech. Which make-or-break projections push this stock higher? Unpack the bold estimates at the core of this compelling narrative.

Result: Fair Value of $31.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a concentrated customer base and declining margins could quickly undermine the current bullish outlook if these challenges continue.

Find out about the key risks to this BioLife Solutions narrative.

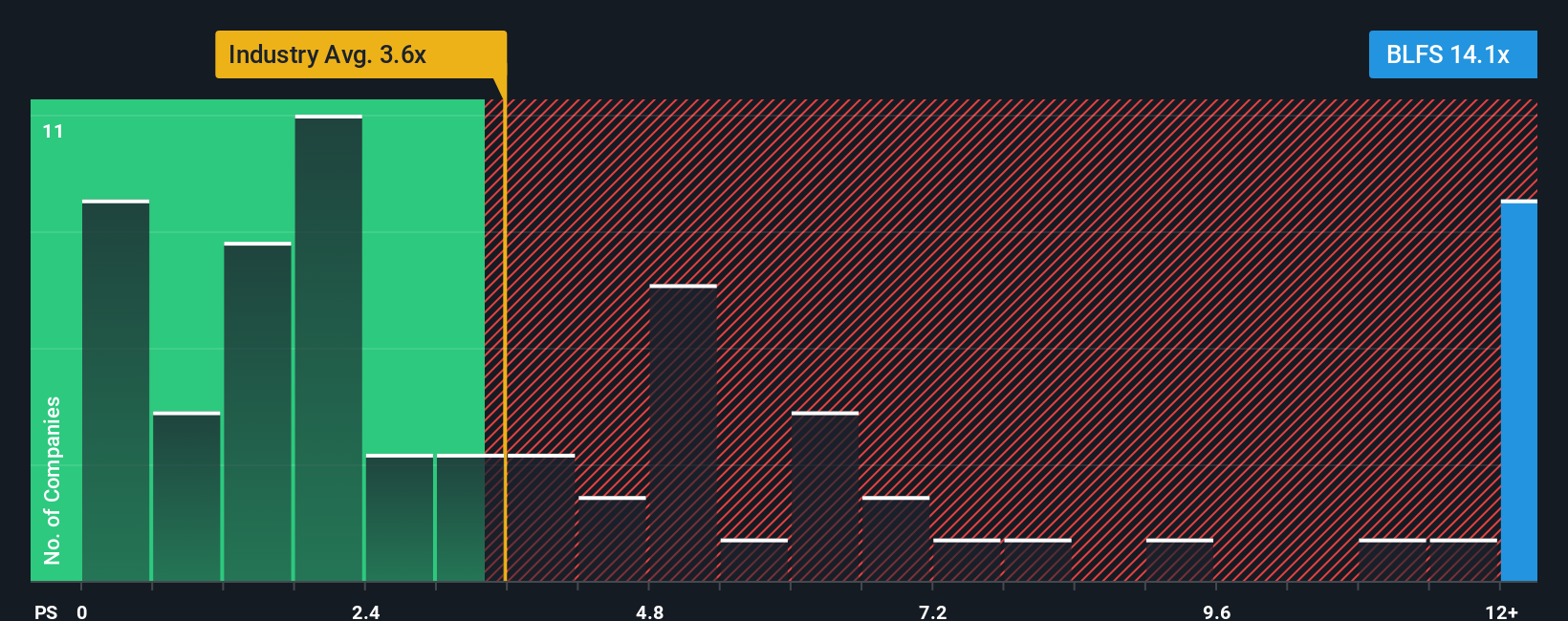

Another View: The Market Multiple Gap

Looking at market multiples brings a different perspective. BioLife Solutions is currently priced at 14.7 times sales, which is dramatically higher than both its peer average of 2.2x and the US Life Sciences industry average of 3.3x. Even its fair ratio is just 4.8x. This large gap signals investors may be taking on more valuation risk than they realize with this stock. Will the company’s future earnings growth truly justify such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioLife Solutions Narrative

If you see the story differently or want to dig into the data yourself, you can build your own narrative in just a few minutes: Do it your way

A great starting point for your BioLife Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Great opportunities extend far beyond just one stock. Act now to broaden your horizons with investment themes that could accelerate your portfolio’s growth and resilience.

- Tap into rising trends and spot potential market leaders with these 24 AI penny stocks, which are driving next-generation artificial intelligence breakthroughs and real-world adoption.

- Secure dependable income streams by checking out these 18 dividend stocks with yields > 3%, featuring companies that deliver yields above 3% for steady, inflation-beating returns.

- Position yourself early in the future of finance with these 79 cryptocurrency and blockchain stocks, where innovative enterprises are shaping blockchain-based industries and digital asset solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioLife Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLFS

BioLife Solutions

Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026