- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Biogen (NasdaqGS:BIIB) Awaits EU Decision On Lecanemab After CHMP Reaffirms Positive Opinion

Reviewed by Simply Wall St

Biogen (NasdaqGS:BIIB) experienced a price movement of 2% over the past week, partly influenced by significant product-related announcements. The reaffirmation of the CHMP’s positive opinion on lecanemab has heightened interest, signaling potential future market expansion and reinforcing investor confidence. This development, alongside the FDA's approval for a new dosing regimen, underscores Biogen's progress in Alzheimer's treatment. While Biogen showed resilience, broader market trends were less favorable, with the Dow Jones and Nasdaq declining after a period of volatility; a Benign inflation report couldn't prevent major indexes from posting monthly losses. The S&P 500 fell 3% for February. Biogen's performance is particularly remarkable against this backdrop, suggesting investor perception of strong fundamentals amidst market uncertainty. This disparity illustrates how specific company achievements can provide a buffer against broader market downturns.

See the full analysis report here for a deeper understanding of Biogen.

Over the three-year period, Biogen's total shareholder return, incorporating both share price and dividends, declined by 33.78%. This downturn stands in contrast to the broader market in the past year, where Biogen underperformed against the US market and Biotechs industry. A deeper look into the company's recent activities offers insights that might explain this. Significant product-related milestones, such as the launch of LEQEMBI in China and the approval of the OPUVIZ™ biosimilar, underscore Biogen's commitment to expanding its treatment portfolio. However, despite these advances, anticipated revenue declines and a class-action lawsuit related to ADUHELM have raised concerns.

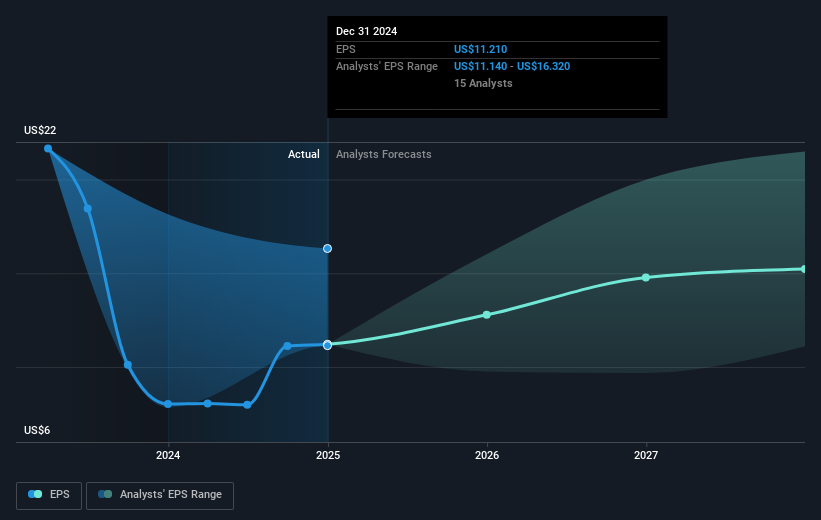

Operationally, Biogen has seen an earnings growth of 40.6% year-over-year, beating the broader industry, though this hasn't offset the broader challenges over a three-year horizon. The completion of a substantial US$2.95 billion share buyback program could suggest efforts to return value to shareholders, but it did not seem to reverse the overall declining trend in shareholder returns.

- Understand the fair market value of Biogen with insights from our valuation analysis—click here to learn more.

- Gain insight into the risks facing Biogen and how they might influence its performance—click here to read more.

- Shareholder in Biogen? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.