- United States

- /

- Pharma

- /

- NasdaqCM:BFRI

Take Care Before Jumping Onto Biofrontera Inc. (NASDAQ:BFRI) Even Though It's 29% Cheaper

Biofrontera Inc. (NASDAQ:BFRI) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. For any long-term shareholders, the last month ends a year to forget by locking in a 89% share price decline.

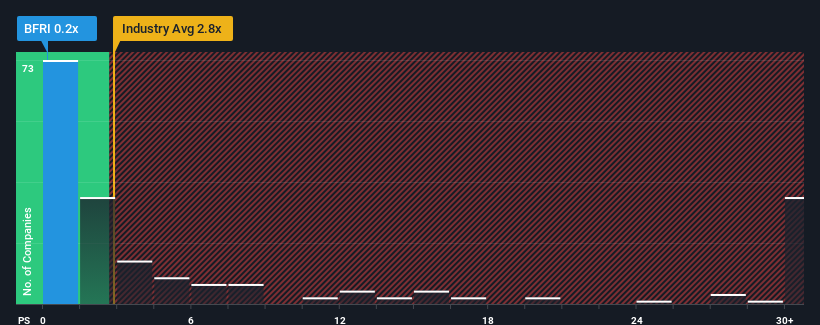

Since its price has dipped substantially, Biofrontera's price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 2.8x and even P/S above 13x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Biofrontera

How Biofrontera Has Been Performing

There hasn't been much to differentiate Biofrontera's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Biofrontera will help you uncover what's on the horizon.How Is Biofrontera's Revenue Growth Trending?

Biofrontera's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 75% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 30% per annum over the next three years. That's shaping up to be materially higher than the 17% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Biofrontera's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Biofrontera's P/S

Biofrontera's P/S looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Biofrontera currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 5 warning signs for Biofrontera that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Biofrontera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BFRI

Biofrontera

A biopharmaceutical company, engages in the commercialization of pharmaceutical products for the treatment of dermatological conditions in the United States.

High growth potential with moderate risk.

Market Insights

Community Narratives