- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Can Analyst Optimism Around BEAM's Base Editing Progress Reveal Its Edge in Genetic Disease Treatment?

Reviewed by Sasha Jovanovic

- In recent days, analysts from H.C. Wainwright and BMO Capital reiterated positive outlooks for Beam Therapeutics, citing strong momentum in its in vivo and ex vivo base editing programs for genetic diseases like sickle cell disease and alpha-1 antitrypsin deficiency. Notably, management's confidence in the competitive potential of BEAM-302 and advancements in base editing technology have drawn increased attention from industry observers.

- We'll examine how analyst optimism around Beam's technological progress and competitive position may refine its investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Beam Therapeutics Investment Narrative Recap

To be a Beam Therapeutics shareholder, you need confidence in the commercial viability of base editing therapies for genetic diseases and belief that pipeline progress will offset risks tied to safety and intense competition. Recent analyst optimism spotlights strong clinical momentum, but the biggest short term catalyst remains further BEAM-302 data, while major risks still center on the safety profile of conditioning regimens, these latest updates have not notably shifted these considerations.

Among the latest announcements, the August 2025 update from the BEAM-302 Phase 1/2 trial is particularly relevant, as positive safety and efficacy signals in early-stage AATD patients underpin analyst enthusiasm and tie directly to the most significant near-term catalyst for Beam. The well-tolerated profile across 17 patients gives investors a clearer window into what may drive later-stage trial outcomes and future regulatory progress.

By contrast, investors should be aware that continued reliance on clinical-stage results means outcome risks from safety monitoring persist, especially when ...

Read the full narrative on Beam Therapeutics (it's free!)

Beam Therapeutics' narrative projects $89.1 million in revenue and $14.3 million in earnings by 2028. This requires 13.9% yearly revenue growth and a $412.9 million earnings increase from current earnings of -$398.6 million.

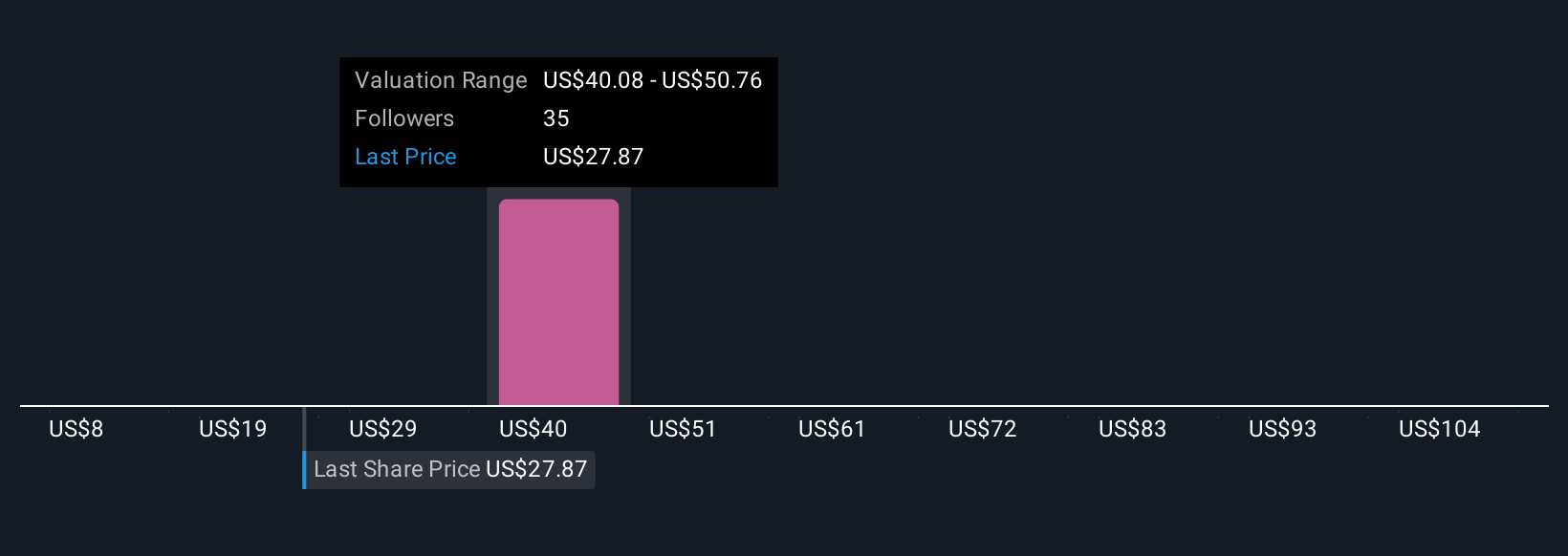

Uncover how Beam Therapeutics' forecasts yield a $45.92 fair value, a 70% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates span US$8.05 to US$114.83 across five individual perspectives. This diversity of views exists alongside the catalyst of accelerated clinical development for BEAM-302, highlighting how market expectations for Beam's performance remain highly variable.

Explore 5 other fair value estimates on Beam Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Beam Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Beam Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beam Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)