- United States

- /

- Software

- /

- NYSE:DV

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has shown a robust 23% increase over the past year, with earnings projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Arbe Robotics (NasdaqCM:ARBE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arbe Robotics Ltd. is a semiconductor company that offers 4D imaging radar solutions to tier 1 automotive suppliers and manufacturers across various countries, with a market cap of $290.93 million.

Operations: Arbe Robotics generates revenue primarily from the Auto Parts & Accessories segment, amounting to $1.02 million. The company focuses on providing advanced radar solutions to automotive industry leaders in several key international markets.

Arbe Robotics, amidst a flurry of activity, has demonstrated its commitment to innovation in the automotive safety sector through a strategic collaboration with NVIDIA. This partnership aims to enhance vehicle autonomy by integrating Arbe's high-resolution radar technology with NVIDIA's DRIVE AGX platform, promising advanced free space mapping and AI-driven capabilities. Despite recent financial struggles indicated by a net loss of $12.57 million in Q3 2024 and an overall challenging revenue trajectory, Arbe is positioning itself at the forefront of radar technology for autonomous driving systems. Their recent equity offerings and anticipated revenue growth suggest efforts to stabilize finances while pushing technological boundaries in ADAS applications and beyond.

- Click to explore a detailed breakdown of our findings in Arbe Robotics' health report.

Assess Arbe Robotics' past performance with our detailed historical performance reports.

BioCryst Pharmaceuticals (NasdaqGS:BCRX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BioCryst Pharmaceuticals, Inc. is a biotechnology company focused on developing oral small-molecule and protein therapeutics for the treatment of rare diseases, with a market cap of $1.67 billion.

Operations: BioCryst Pharmaceuticals generates revenue primarily from its biotechnology segment, particularly focusing on startups, with reported revenues of $412.58 million. The company is engaged in the development of therapeutics for rare diseases using oral small-molecule and protein technologies.

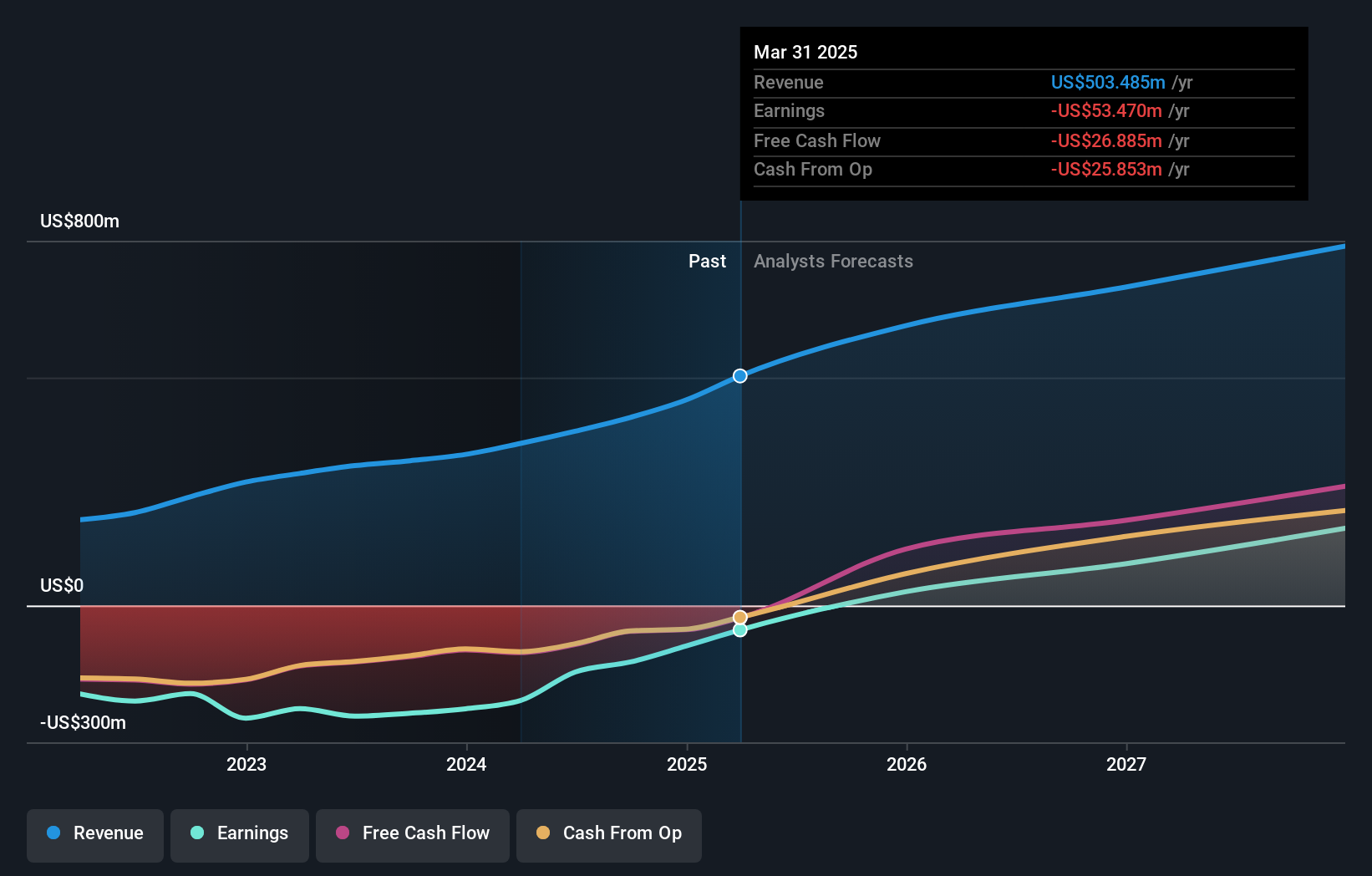

BioCryst Pharmaceuticals is making significant strides in the biotech sector, particularly with its groundbreaking oral treatment, ORLADEYO, for hereditary angioedema. Recently recommended by Ireland's Health Services Executive and licensed in 44 countries, this innovation marks a pivotal shift towards accessible patient care. Financially, BioCryst has adjusted its 2024 revenue outlook to between $443 million and $448 million following robust ORLADEYO sales. Despite a historical net loss of $14.03 million in Q3 2024, the company's strategic focus on this novel treatment and anticipated profitability by 2026 reflect a resilient growth trajectory amidst market challenges.

DoubleVerify Holdings (NYSE:DV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DoubleVerify Holdings, Inc. offers a software platform focused on digital media measurement and data analytics services globally, with a market capitalization of approximately $3.38 billion.

Operations: DoubleVerify Holdings, Inc. generates revenue primarily from its data processing services, totaling approximately $638.46 million. The company focuses on providing digital media measurement and analytics solutions internationally.

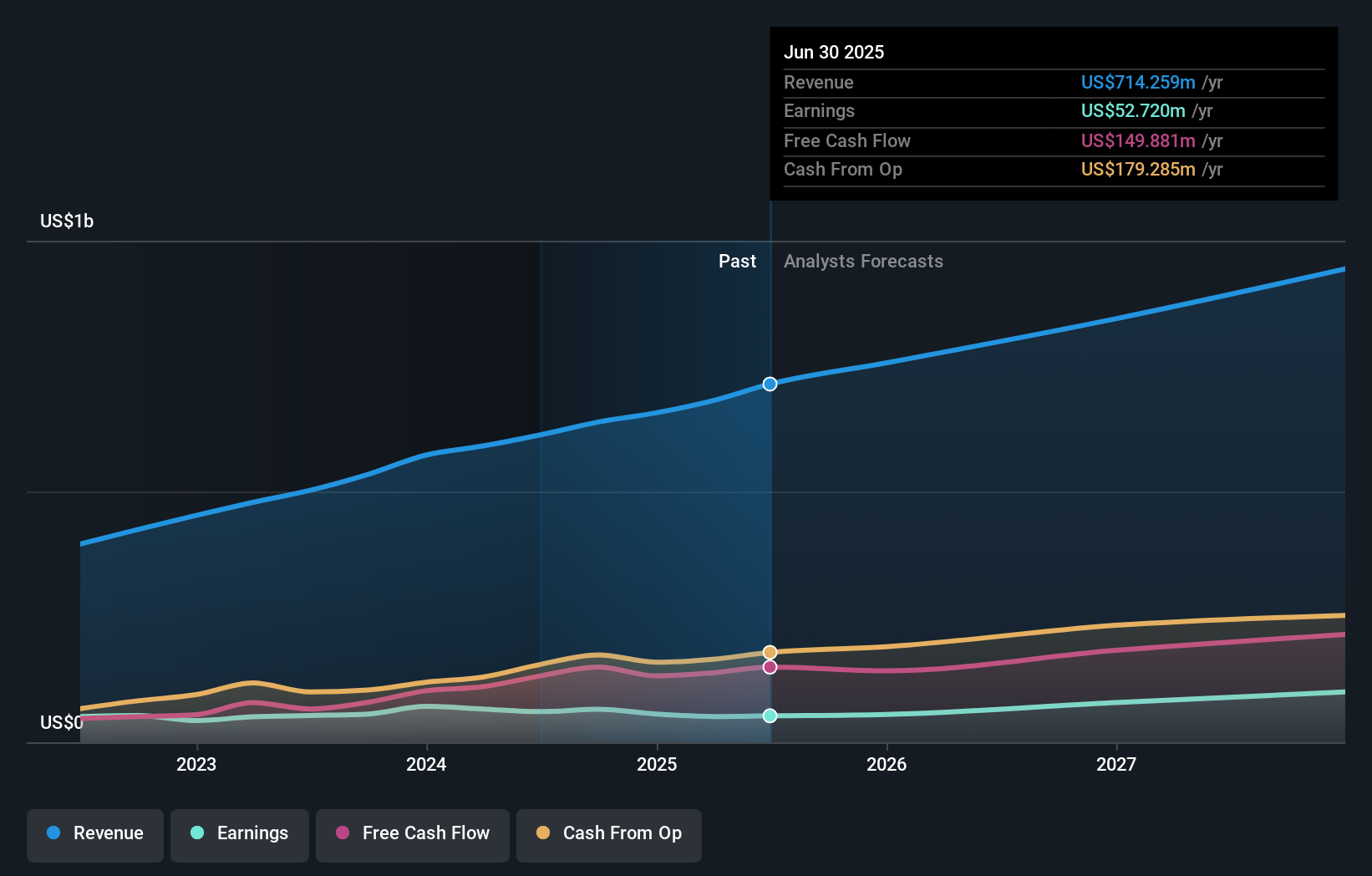

DoubleVerify Holdings is carving a niche in the high-tech landscape with its focus on enhancing digital advertising quality through AI-driven solutions. In 2024, the company introduced groundbreaking tools like the Generative AI Website Avoidance & Detection solution, addressing the challenges posed by low-quality, AI-generated content which affects 54% of marketers. This innovation complements their robust financial performance with a notable third-quarter revenue of $169.56 million and net income growth to $18.2 million from $13.35 million year-over-year. Their strategic partnerships and proprietary technologies not only optimize ad performance but also ensure brand safety, positioning them favorably in a competitive market where precision and reliability are paramount.

- Take a closer look at DoubleVerify Holdings' potential here in our health report.

Gain insights into DoubleVerify Holdings' past trends and performance with our Past report.

Key Takeaways

- Reveal the 237 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives