- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (BBIO): Evaluating Valuation in Light of New Acoramidis Clinical Data Reveal

Reviewed by Kshitija Bhandaru

If BridgeBio Pharma (BBIO) is on your radar after its recent announcement, you are not alone. The company is in the spotlight this week as it prepares to present new clinical data for Acoramidis, its treatment for transthyretin amyloid cardiomyopathy, at the upcoming Heart Failure Society of America Annual Scientific Meeting. With multiple oral and poster presentations set to highlight Acoramidis’s impact on cardiovascular outcomes, mortality, and biomarkers, many investors are watching for signs that these results could move the needle on BridgeBio’s commercial story.

This wave of scientific updates arrives after a year of momentum for BridgeBio Pharma, with shares up over 100% in the past twelve months. Returns for the year-to-date are also strong, suggesting growing optimism around BridgeBio’s drug pipeline and its prospects for sustained revenue growth. While the company posted double-digit revenue and net income growth last year, much of the current excitement is now tied to Acoramidis and the potential for it to become a leading therapy in its segment.

With BridgeBio’s valuation and recent surge front and center, investors have to ask themselves whether this is a buying opportunity if the new data meets expectations, or if the market is already pricing in a full share of future growth.

Most Popular Narrative: 20.8% Undervalued

The prevailing narrative sees BridgeBio Pharma trading well below its calculated fair value. This highlights investor optimism about the company’s future potential and near-term pipeline milestones.

The company's late-stage pipeline, with three Phase III readouts imminent across high unmet need rare disease indications, positions BridgeBio to leverage advancements in biotechnology for potential first-to-market and best-in-class therapies. This creates the opportunity for multiple revenue inflection points and margin improvement as the portfolio diversifies.

Curious what’s driving this bullish view? There is a bold profitability forecast, eye-catching margin assumptions, and a confidence in dramatic future growth. The ingredients in this model are not for the timid. Which financial bet is the linchpin for that projected value leap? Find out by exploring the full narrative behind this stock’s runway.

Result: Fair Value of $65.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on one drug and the high costs of advancing the late-stage pipeline still pose real risks to BridgeBio’s bullish case.

Find out about the key risks to this BridgeBio Pharma narrative.Another View: What Multiples Suggest

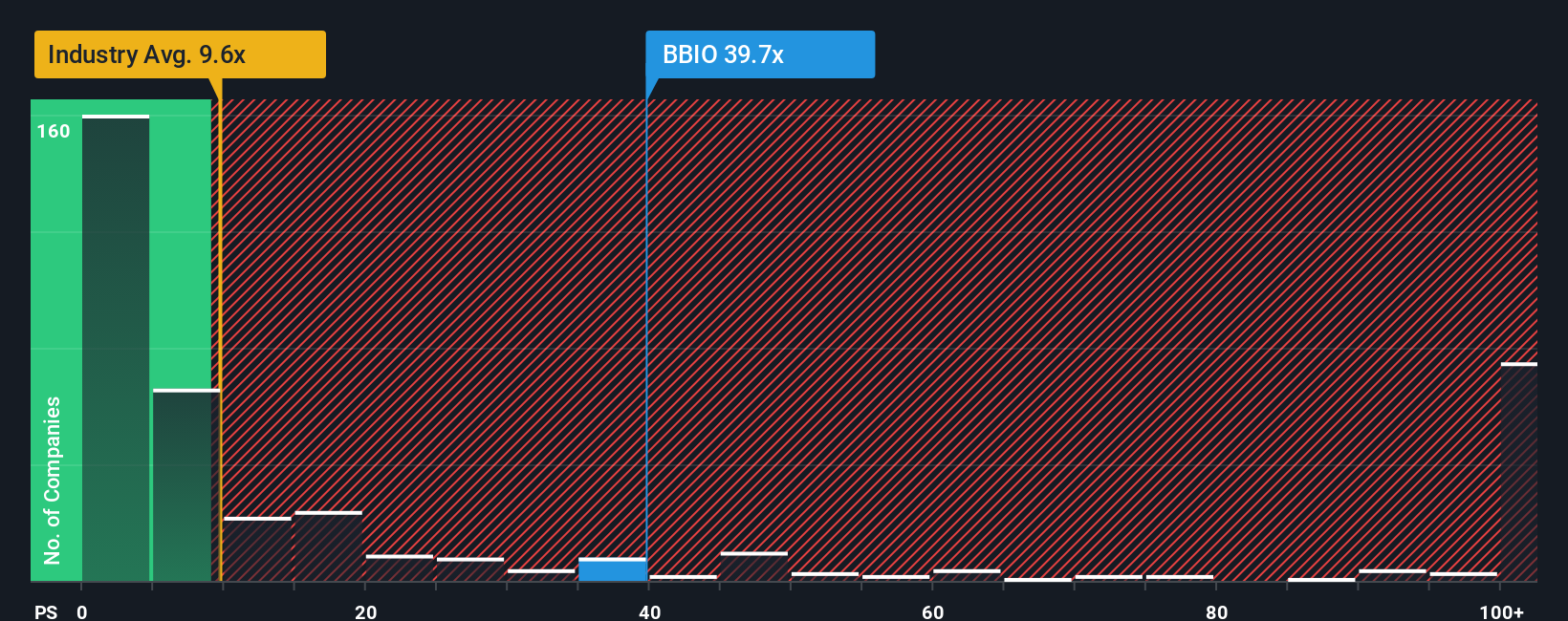

Looking from a different perspective, the latest pricing based on sales is well above what is typical for US biotech stocks. This raises questions about the discounted cash flow results. Which picture offers a more accurate view of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can craft a personal narrative in just a few minutes. Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity. Use the Simply Wall Street Screener to seek out stocks with exciting growth stories and unique financial strengths in today’s market.

- Uncover companies shaking up digital payments and decentralized tech by checking out our cryptocurrency and blockchain stocks for powerful blockchain and crypto trends.

- Boost your passive income potential by scanning our dividend stocks with yields > 3% for stocks offering robust yields over 3% and stable cash returns.

- Get ahead by evaluating breakthrough innovators with our AI penny stocks, where artificial intelligence leaders are redefining what’s possible in tomorrow’s economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives