- United States

- /

- Biotech

- /

- NasdaqCM:ELUT

Aziyo Biologics (NASDAQ:AZYO) shareholder returns have been favorable, earning 47% in 1 year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. To wit, the Aziyo Biologics, Inc. (NASDAQ:AZYO) share price is 47% higher than it was a year ago, much better than the market decline of around 22% (not including dividends) in the same period. That's a solid performance by our standards! We'll need to follow Aziyo Biologics for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

The past week has proven to be lucrative for Aziyo Biologics investors, so let's see if fundamentals drove the company's one-year performance.

Our analysis indicates that AZYO is potentially overvalued!

Aziyo Biologics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Aziyo Biologics saw its revenue shrink by 5.7%. Despite the lack of revenue growth, the stock has returned a solid 47% the last twelve months. To us that means that there isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

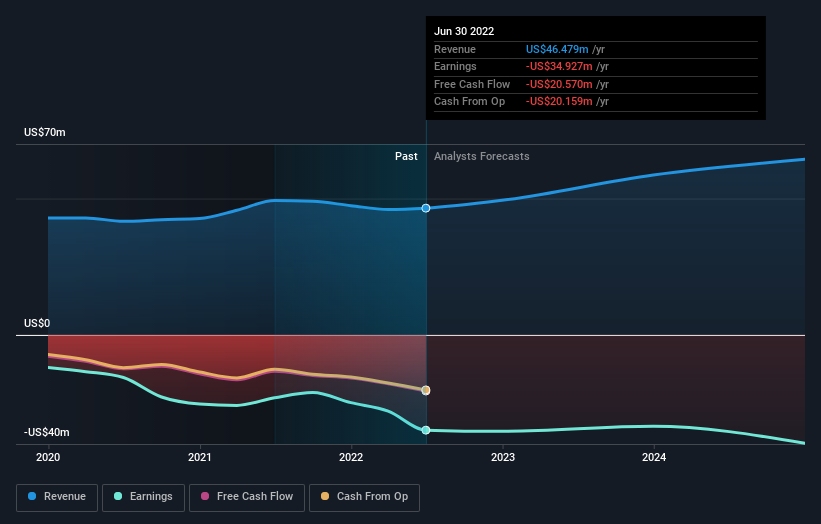

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Aziyo Biologics

A Different Perspective

Aziyo Biologics shareholders should be happy with the total gain of 47% over the last twelve months. And the share price momentum remains respectable, with a gain of 27% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Aziyo Biologics (of which 3 don't sit too well with us!) you should know about.

Aziyo Biologics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Elutia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ELUT

Elutia

A commercial-stage company, develops and commercializes drug-eluting biologics products for neurostimulation and breast reconstruction in the United States.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives