- United States

- /

- Pharma

- /

- NasdaqGM:AXSM

Axsome Therapeutics (AXSM): Valuation Perspective Following Paragraph IV Challenge to Symbravo Exclusivity

Reviewed by Simply Wall St

Axsome Therapeutics (AXSM) just dropped some news that should have every shareholder paying attention. Apotex has officially filed an ANDA with the FDA, complete with a Paragraph IV certification, aiming to launch a generic version of Symbravo. This move signals the possibility of a legal battle over patents, which could determine how long Symbravo remains protected from generic competition. For investors, that means the stakes are high. Any change in exclusivity could reshape revenue streams down the line.

The announcement came during a stretch when Axsome's stock has actually been on a roll, climbing 36% since the start of the year and up almost 35% over the past twelve months. The company’s multi-year return more than doubles that, reflecting real momentum behind the business. While revenue is growing at a double-digit pace, investors have watched similar patent cases impact peers. Awareness of future risk is likely contributing to some recent choppiness in the share price.

With Axsome holding steady just below $120 while navigating both opportunity and risk, some may question whether markets are undervaluing the threat from generic entry, or whether future growth is already fully reflected at current levels.

Most Popular Narrative: 33% Undervalued

According to community narrative, Axsome Therapeutics is considered significantly undervalued, with analysts expecting dramatic future growth to justify a much higher price target.

The company is advancing multiple late-stage clinical programs (AXS-05, AXS-12, AXS-14, and several solriamfetol indications). This positions Axsome to benefit from the aging population and rising prevalence of CNS disorders. The result could be a diversified revenue base, higher earnings, and reduced risk of overreliance on a single product.

This is not your average pharma play. Axsome’s valuation narrative centers on bold future milestones and ambitious margin expansion. Interested in learning which financial leaps and science-backed breakthroughs support that notable price target? The details behind these projections could change your view of what is possible for this stock.

Result: Fair Value of $176.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, uncertainty remains if new competitors outperform Axsome's lead drugs, or if higher expenses and slow launches delay expected profitability.

Find out about the key risks to this Axsome Therapeutics narrative.Another View: DCF Model Looks Deeper

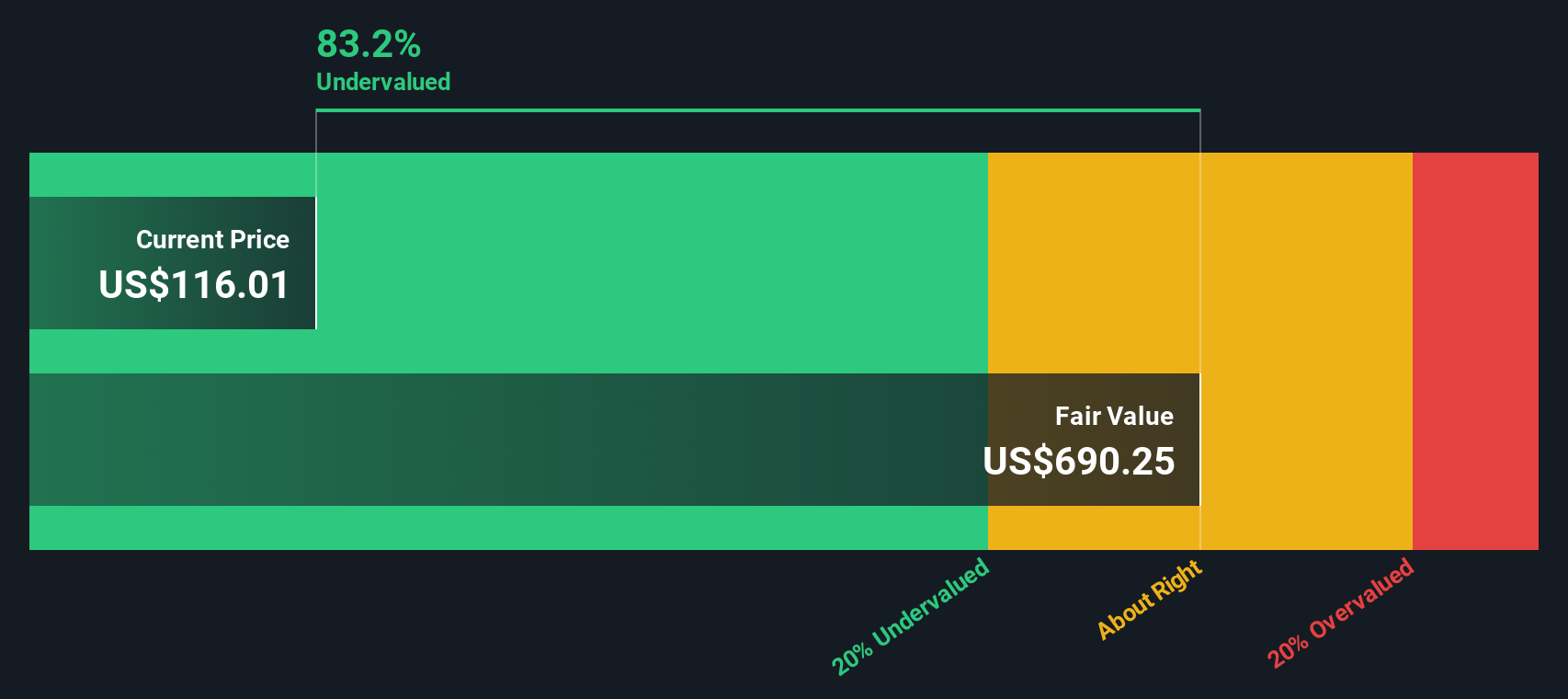

Taking a step back from traditional price comparisons, our DCF model reviews Axsome's future expected cash flows. This approach currently signals the shares may be deeply undervalued. However, it raises the question of whether the market is overlooking certain factors.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axsome Therapeutics Narrative

If you want to dive deeper or build your own perspective, don't just take our word for it. See the numbers and arguments yourself and do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Axsome Therapeutics.

Looking for Your Next Smart Investment?

Your next portfolio winner could be just a click away. Hundreds of stocks offer unique opportunities right now, and using the Simply Wall Street Screener gives you the upper hand to catch them before the crowd. Don’t let these market movers pass you by. Jump on the best ideas before everyone else does.

- Tap into the booming digital future by finding AI penny stocks showing explosive growth potential in artificial intelligence innovation and applications.

- Supercharge your passive income by selecting from dividend stocks with yields > 3% that deliver strong yields and robust dividend histories, so your money keeps working for you.

- Ride the next healthcare wave and spot healthcare AI stocks making breakthroughs at the cutting edge of medicine and AI-powered patient care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AXSM

Axsome Therapeutics

A biopharmaceutical company, develops and delivers novel therapies for the management of central nervous system (CNS) disorders in the United States.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives