- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:MASS

February 2025 US Penny Stocks To Watch

Reviewed by Simply Wall St

The U.S. stock market has shown mixed performance recently, with major indices like the S&P 500 and Dow Jones Industrial Average nearing record highs amid a flurry of earnings reports. In this context, penny stocks remain a compelling area for investors looking to explore opportunities in smaller or newer companies that might offer growth potential at lower price points. While the term "penny stocks" might seem outdated, these investments can still provide value when paired with strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8781 | $6.23M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.12M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.3M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $91.9M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $47.19M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.06 | $53.61M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $23.94M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.91 | $83.05M | ★★★★★☆ |

| SideChannel (OTCPK:SDCH) | $0.03906 | $8.77M | ★★★★★★ |

Click here to see the full list of 702 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

908 Devices (NasdaqGM:MASS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 908 Devices Inc. is a commercial-stage technology company that offers handheld and desktop mass spectrometry devices for use in life sciences research, bioprocessing, pharma/biopharma, forensics, and related markets, with a market cap of $82.53 million.

Operations: The company's revenue is derived entirely from its Scientific & Technical Instruments segment, totaling $55.16 million.

Market Cap: $82.53M

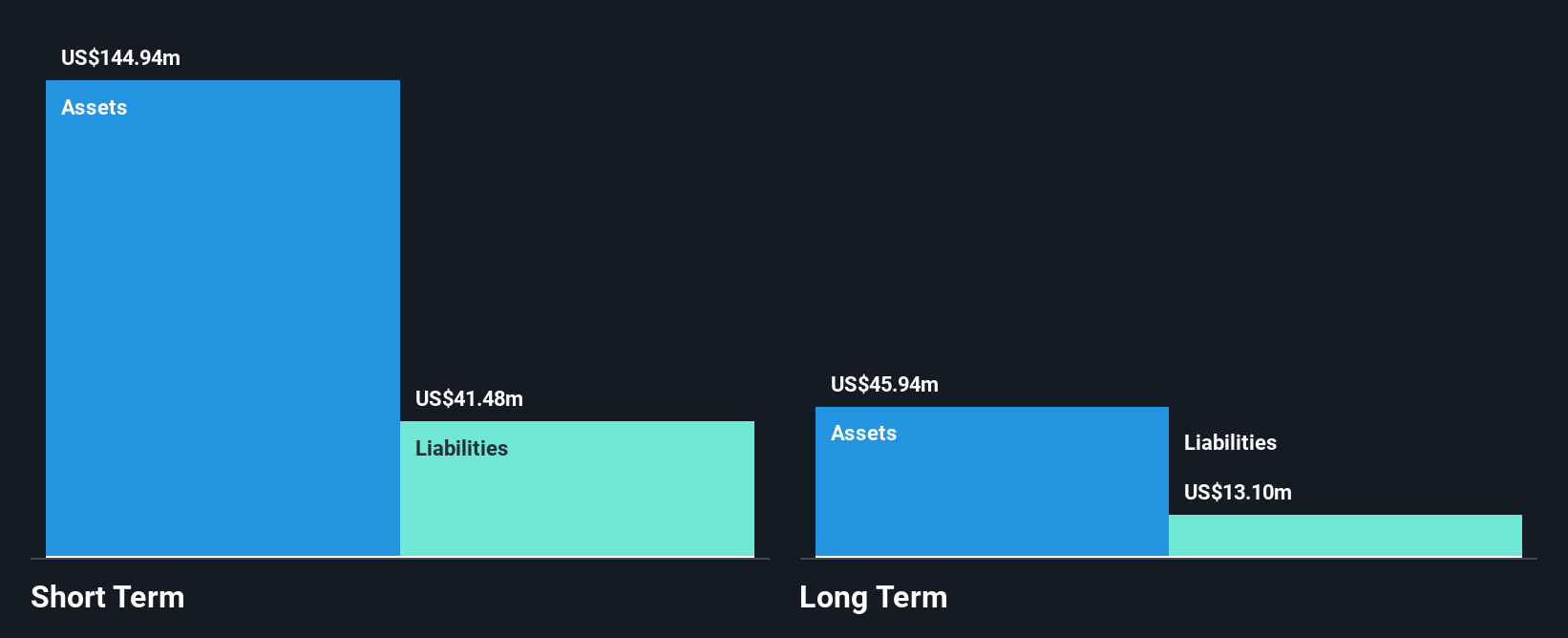

908 Devices Inc. has been navigating a challenging financial landscape, marked by significant losses and volatility. Despite being debt-free with sufficient cash runway for over two years, the company remains unprofitable and is not expected to reach profitability in the near term. Recent organizational restructuring and relocation of manufacturing operations aim to enhance operational efficiency, potentially saving US$6.6 million annually starting in 2025-2026. However, these changes come with an estimated one-time severance charge of US$0.4 million to US$0.6 million and a substantial goodwill impairment of US$30.52 million reported recently, highlighting ongoing financial pressures despite revenue growth projections.

- Dive into the specifics of 908 Devices here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into 908 Devices' future.

Atea Pharmaceuticals (NasdaqGS:AVIR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing antiviral therapeutics for viral infections, with a market cap of approximately $250.86 million.

Operations: Atea Pharmaceuticals, Inc. currently does not report any revenue segments.

Market Cap: $250.86M

Atea Pharmaceuticals, Inc. remains a pre-revenue entity with a market cap of approximately US$250.86 million, operating in the high-risk biopharmaceutical sector. Despite its unprofitable status and increasing losses over the past five years, Atea is debt-free and possesses a cash runway sufficient for over three years at current burn rates. The company recently reported promising Phase 2 results for its hepatitis C treatment regimen, achieving high efficacy and safety benchmarks that support progression to Phase 3 trials. However, significant insider selling has occurred recently, which may concern potential investors about internal confidence levels.

- Navigate through the intricacies of Atea Pharmaceuticals with our comprehensive balance sheet health report here.

- Assess Atea Pharmaceuticals' future earnings estimates with our detailed growth reports.

Valens Semiconductor (NYSE:VLN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Valens Semiconductor Ltd. provides semiconductor products for the audio-video and automotive industries, with a market cap of $259.34 million.

Operations: The company generates revenue from two main segments: $22.67 million from automotive and $40.47 million from audio-video.

Market Cap: $259.34M

Valens Semiconductor, with a market cap of $259.34 million, operates in the semiconductor sector focusing on audio-video and automotive industries. It reported $22.67 million in automotive revenue and $40.47 million from audio-video, though it remains unprofitable with a negative return on equity of -18.01%. Recent strategic shifts include forming a Cross Industry Business Unit to target high-growth markets like medical and machine vision sectors, alongside executive changes aimed at driving growth. A share buyback program worth $10 million has been announced, reflecting management's confidence despite its volatile share price and ongoing losses reduction efforts.

- Click here to discover the nuances of Valens Semiconductor with our detailed analytical financial health report.

- Evaluate Valens Semiconductor's prospects by accessing our earnings growth report.

Seize The Opportunity

- Discover the full array of 702 US Penny Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 908 Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MASS

908 Devices

A commercial-stage technology company, provides various purpose-built handheld and desktop mass spectrometry devices to interrogate unknown and invisible materials in life sciences research, bioprocessing, pharma/biopharma, forensics, and adjacent markets.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives