- United States

- /

- Biotech

- /

- NasdaqGS:AUTL

We're Hopeful That Autolus Therapeutics (NASDAQ:AUTL) Will Use Its Cash Wisely

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So, the natural question for Autolus Therapeutics (NASDAQ:AUTL) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Autolus Therapeutics

Does Autolus Therapeutics Have A Long Cash Runway?

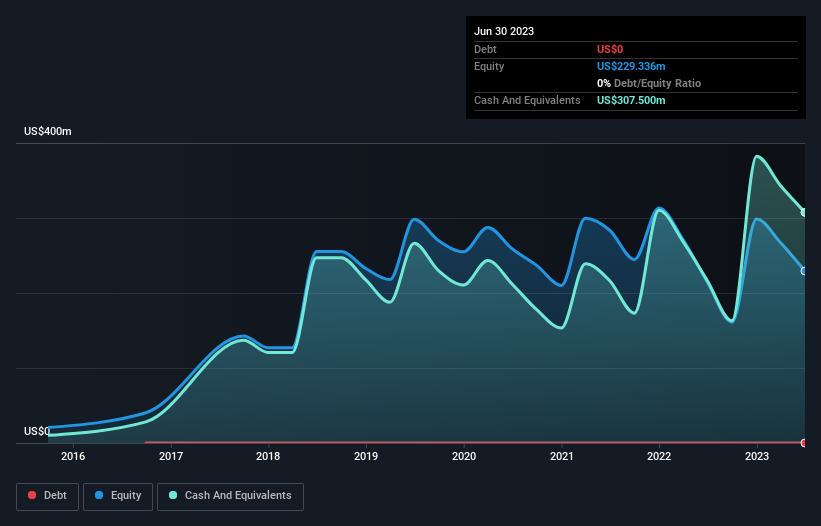

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Autolus Therapeutics last reported its balance sheet in June 2023, it had zero debt and cash worth US$308m. In the last year, its cash burn was US$142m. Therefore, from June 2023 it had 2.2 years of cash runway. Importantly, analysts think that Autolus Therapeutics will reach cashflow breakeven in 3 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Autolus Therapeutics Growing?

Some investors might find it troubling that Autolus Therapeutics is actually increasing its cash burn, which is up 20% in the last year. On a more positive note, the operating revenue improved by 103% over the period, offering an indication that the expenditure may well be worthwhile. If revenue is maintained once spending on growth decreases, that could well pay off! We think it is growing rather well, upon reflection. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Autolus Therapeutics Raise Cash?

While Autolus Therapeutics seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Autolus Therapeutics' cash burn of US$142m is about 20% of its US$710m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

Is Autolus Therapeutics' Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Autolus Therapeutics' revenue growth was relatively promising. One real positive is that analysts are forecasting that the company will reach breakeven. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. On another note, Autolus Therapeutics has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AUTL

Autolus Therapeutics

A clinical-stage biopharmaceutical company, develops T cell therapies for the treatment of cancer and autoimmune diseases in United Kingdom and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives