- United States

- /

- Biotech

- /

- NasdaqGS:ASND

A Fresh Look at Ascendis Pharma (NasdaqGS:ASND) Valuation as Shareholder Returns Turn Positive

Reviewed by Kshitija Bhandaru

Ascendis Pharma (NasdaqGS:ASND) has seen its share price fluctuate recently, but returns over the past month and 3 months are both positive. Investors may be evaluating the company’s outlook in light of these ongoing moves.

See our latest analysis for Ascendis Pharma.

After a steady build over the past year, Ascendis Pharma’s 12-month total shareholder return sits at 43%. Notably, recent share price momentum reflects renewed investor enthusiasm. Upticks in the past three months suggest the market is warming to the company’s longer-term story, perhaps as growth potential becomes clearer or risk perceptions evolve.

If you're curious what other biotech and pharma stocks could be catching a similar tailwind, take the next step and explore See the full list for free.

With shares trading below analyst price targets and strong revenue growth reported, the big question is whether Ascendis Pharma is still undervalued or if the market has already baked in future expectations. Does a compelling entry point remain?

Most Popular Narrative: 20% Undervalued

Ascendis Pharma’s last close of $200.97 sits well below the fair value projected in the most popular narrative. This highlights a gap that has attracted considerable investor interest. What is driving this view? A string of clinical wins and commercial launches has catalyzed expectations for financial transformation ahead.

Regulatory progress and pipeline advancement, such as the priority review for TransCon CNP in achondroplasia and positive combination trial results, are paving the way for new blockbuster therapies and potential multi-billion EUR peak sales opportunities. This is enhancing future revenue growth and reducing revenue concentration risk.

Want the full story behind this eye-catching valuation gap? A bold growth vision underpins these numbers, built on accelerating pipeline momentum and a future profit leap most biotechs can only dream of. Ready to see the assumptions behind this narrative’s price target? Dive deeper to uncover the financial projections driving this bullish case.

Result: Fair Value of $251.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, progress is not guaranteed. Delays in regulatory approvals or unexpected competition could quickly challenge these bullish assumptions and reshape investor sentiment.

Find out about the key risks to this Ascendis Pharma narrative.

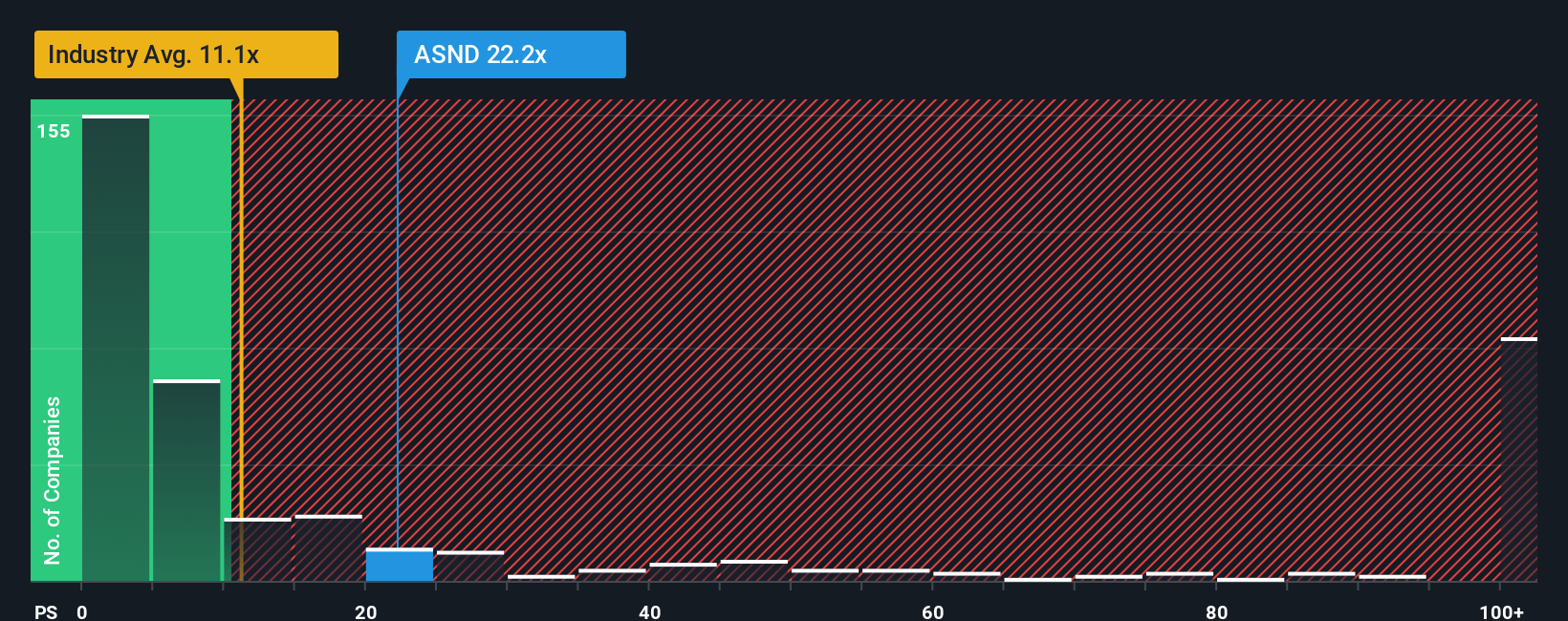

Another View: What Do Sales Ratios Say?

While the previous analysis suggests Ascendis Pharma is undervalued, a look at its sales ratio tells a different story. The company trades at a ratio of 21.2x, which is much higher than the US Biotechs industry average of 9.7x, and also above its fair ratio of 16.4x. This elevated pricing suggests the market already expects a lot from future growth, increasing the risk if those expectations are not met. Could this high valuation indicate that all the good news is already reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ascendis Pharma Narrative

If you have a different perspective or enjoy conducting your own analysis, you can shape your own narrative in just a few minutes using Do it your way.

A great starting point for your Ascendis Pharma research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your edge with smart stock screens designed to uncover tomorrow’s headlines. If you miss out, you risk leaving the best opportunities on the table.

- Unlock fresh sources of passive income by checking out these 19 dividend stocks with yields > 3% with attractive yields above 3%.

- Spot fast-moving disruptors in tech with these 24 AI penny stocks focused on artificial intelligence innovation and rapid market growth.

- Catch undervalued gems before they reach the spotlight using these 904 undervalued stocks based on cash flows based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASND

Ascendis Pharma

Operates as a biopharmaceutical company that focuses on developing TransCon-based therapies for unmet medical needs in Denmark, rest of Europe, North America, and internationally.

Exceptional growth potential and fair value.

Market Insights

Community Narratives