- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

US Penny Stocks To Monitor In November 2024

Reviewed by Simply Wall St

As of mid-November 2024, the U.S. stock market has experienced a downturn, with major indexes recording weekly losses due to challenges faced by big-tech companies and concerns over interest rate policies. For investors willing to explore beyond the well-known giants, penny stocks—often representing smaller or newer enterprises—can still offer intriguing prospects. Despite being considered a somewhat outdated term, these stocks remain relevant for those seeking growth opportunities in companies that might pair affordability with potential financial resilience.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8379 | $6.09M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.69 | $2.15B | ★★★★★★ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.58M | ★★★★☆☆ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.22 | $529.41M | ★★★★★★ |

| Greenland Technologies Holding (NasdaqCM:GTEC) | $2.20 | $29.91M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.33M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.71 | $139.05M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.942 | $84.72M | ★★★★★☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Lantronix (NasdaqCM:LTRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lantronix, Inc. develops, markets, and sells industrial and enterprise IoT products and services across various regions including the Americas, Europe, the Middle East, Africa, and Asia Pacific Japan with a market cap of $108.89 million.

Operations: The company's revenue is generated from its Computer Networks segment, amounting to $161.72 million.

Market Cap: $108.89M

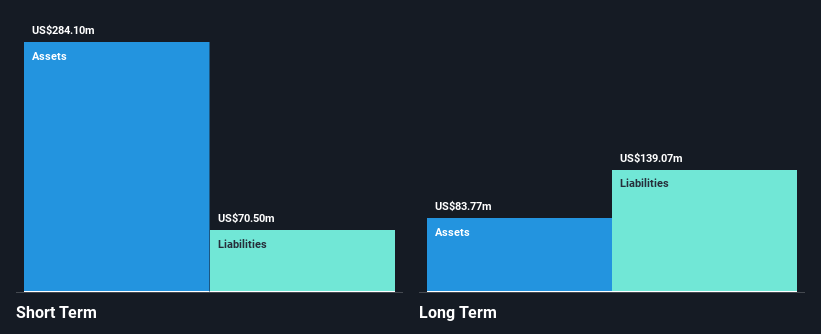

Lantronix, Inc. has demonstrated resilience in the penny stock market with a market cap of US$108.89 million and revenue of US$161.72 million from its Computer Networks segment. Despite being unprofitable, it has reduced losses over five years and maintains a positive cash flow runway for over three years. Recent earnings show sales growth to US$34.42 million in Q1 2025, though net losses increased slightly to US$2.5 million. The company is advancing IoT innovation with new AI-driven System-in-Package solutions, potentially enhancing its competitive position despite high share price volatility and board inexperience concerns.

- Dive into the specifics of Lantronix here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Lantronix's future.

Ardelyx (NasdaqGM:ARDX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ardelyx, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing medicines for gastrointestinal and cardiorenal conditions in the U.S. and internationally, with a market cap of approximately $1.18 billion.

Operations: The company's revenue of $251.85 million is derived from the development and commercialization of biopharmaceutical products.

Market Cap: $1.18B

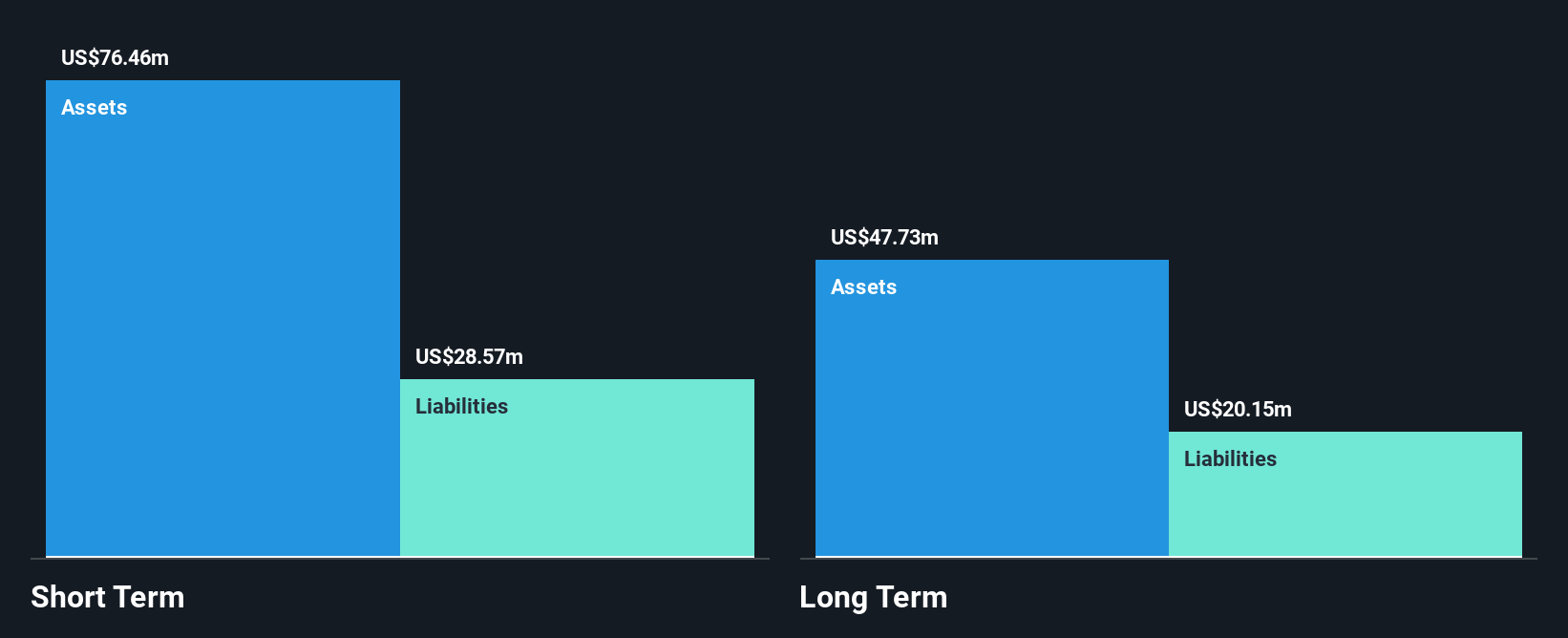

Ardelyx, Inc. stands out in the penny stock landscape with a market cap of US$1.18 billion and significant revenue growth, reporting US$98.24 million for Q3 2024 compared to US$56.39 million a year ago. Despite being unprofitable with a net loss of US$0.809 million this quarter, it has reduced losses over five years by 10.5% annually and maintains more cash than its total debt, indicating financial resilience. The company recently filed for a shelf registration worth $167.865 million and continues to advance its product portfolio with XPHOZAH®, approved by the FDA for managing hyperphosphatemia in CKD patients on dialysis.

- Click here to discover the nuances of Ardelyx with our detailed analytical financial health report.

- Gain insights into Ardelyx's outlook and expected performance with our report on the company's earnings estimates.

Connect Biopharma Holdings (NasdaqGM:CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for T cell-driven inflammatory diseases, with a market cap of $61.33 million.

Operations: Connect Biopharma Holdings Limited has not reported any revenue segments.

Market Cap: $61.33M

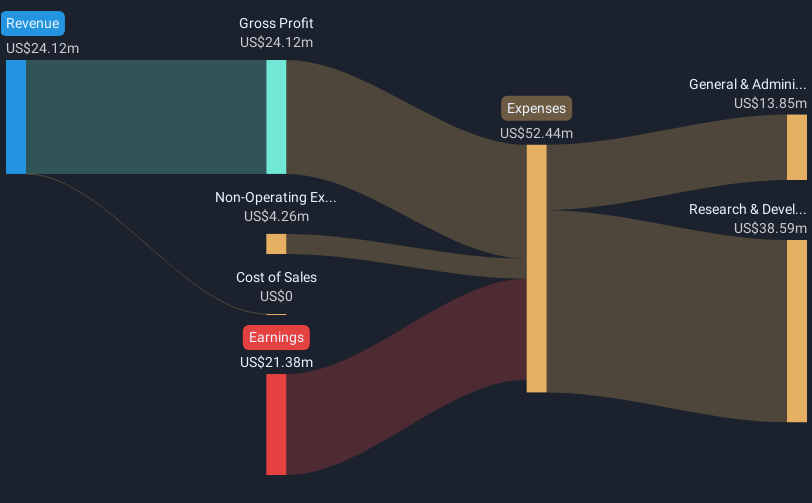

Connect Biopharma Holdings Limited, with a market cap of US$61.33 million, is navigating the penny stock realm with recent financial improvements. The company reported US$24.12 million in revenue for the half year ended June 30, 2024, marking a shift from pre-revenue status and achieving net income of US$7.65 million compared to a previous loss of US$30.47 million. Despite its unprofitability history and volatile share price, Connect Biopharma maintains sufficient cash runway exceeding three years and operates debt-free, positioning itself as financially stable within its sector while facing challenges in forecasted earnings decline over the next few years.

- Click here and access our complete financial health analysis report to understand the dynamics of Connect Biopharma Holdings.

- Assess Connect Biopharma Holdings' future earnings estimates with our detailed growth reports.

Key Takeaways

- Click here to access our complete index of 748 US Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARDX

Ardelyx

A biopharmaceutical company, discovers, develops, and commercializes medicines to treat gastrointestinal and cardiorenal therapeutic areas in the United States and internationally.

Exceptional growth potential and undervalued.