- United States

- /

- Biotech

- /

- NasdaqGM:ARDX

Ardelyx, Inc. (NASDAQ:ARDX) Reported Earnings Last Week And Analysts Are Already Upgrading Their Estimates

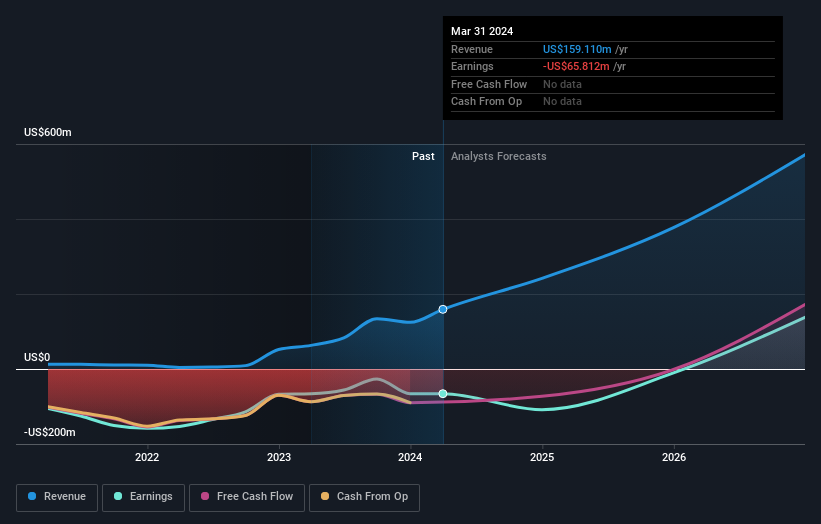

Ardelyx, Inc. (NASDAQ:ARDX) defied analyst predictions to release its first-quarter results, which were ahead of market expectations. The results were impressive, with revenues of US$46m exceeding analyst forecasts by 26%, and statutory losses of US$0.11 were likewise much smaller than the analysts had forecast. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Ardelyx after the latest results.

View our latest analysis for Ardelyx

After the latest results, the nine analysts covering Ardelyx are now predicting revenues of US$241.8m in 2024. If met, this would reflect a sizeable 52% improvement in revenue compared to the last 12 months. Losses are forecast to balloon 60% to US$0.45 per share. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$208.8m and losses of US$0.44 per share in 2024. So there's been quite a change-up of views after the recent consensus updates, withthe analysts noticeably increasing their revenue forecasts while also expecting losses per share to hold steady.

The consensus price target held steady at US$13.39despite the upgrade to revenue forecasts and ongoing losses. The analysts seems to think the business is otherwise performing roughly in line with expectations. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Ardelyx at US$16.00 per share, while the most bearish prices it at US$11.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Ardelyx shareholders.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of Ardelyx'shistorical trends, as the 75% annualised revenue growth to the end of 2024 is roughly in line with the 73% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 18% per year. So although Ardelyx is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target held steady at US$13.39, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Ardelyx. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Ardelyx going out to 2026, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Ardelyx , and understanding these should be part of your investment process.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ARDX

Ardelyx

Ardelyx, Inc. discovers, develops, and commercializes medicines to treat unmet medical needs in the United States and internationally.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026