- United States

- /

- Pharma

- /

- NasdaqGM:AQST

Aquestive Therapeutics (AQST) Is Up 6.8% After FDA Clears Path for Needle-Free Epinephrine Film Approval

Reviewed by Simply Wall St

- In September 2025, Aquestive Therapeutics announced that the FDA will not require an advisory committee meeting for its Anaphylm sublingual epinephrine film, clearing a smoother regulatory path toward a potential launch.

- This decision signals increased confidence in both the product's regulatory prospects and the potential for accelerated adoption of needle-free epinephrine treatments.

- We'll explore how this clear regulatory pathway for Anaphylm could reshape Aquestive Therapeutics' investment outlook and market positioning.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aquestive Therapeutics Investment Narrative Recap

To be a shareholder in Aquestive Therapeutics today, you need confidence that Anaphylm’s pioneering sublingual epinephrine film will receive FDA approval and achieve commercial success. The FDA’s choice to skip an advisory committee meeting has enhanced momentum for the Anaphylm launch, now the immediate catalyst for the stock, but the company’s reliance on timely regulatory clearance and successful execution remains the largest near-term risk. The news provides a smoother regulatory path but does not eliminate uncertainties around market penetration or ongoing financial losses.

Among recent announcements, the June 2025 FDA acceptance of the New Drug Application for Anaphylm closely ties to the current catalyst. This regulatory milestone set up the January 2026 decision date, and the September FDA update could accelerate approval, potentially increasing near-term revenue prospects and investor optimism ahead of this critical inflection point.

Yet, despite improving odds for approval, investors should be aware that if Anaphylm struggles to secure payer coverage and rapid adoption...

Read the full narrative on Aquestive Therapeutics (it's free!)

Aquestive Therapeutics' outlook anticipates $125.9 million in revenue and $29.2 million in earnings by 2028. This scenario assumes a 41.8% annual revenue growth rate and a $94.2 million increase in earnings from the current -$65.0 million.

Uncover how Aquestive Therapeutics' forecasts yield a $8.58 fair value, a 65% upside to its current price.

Exploring Other Perspectives

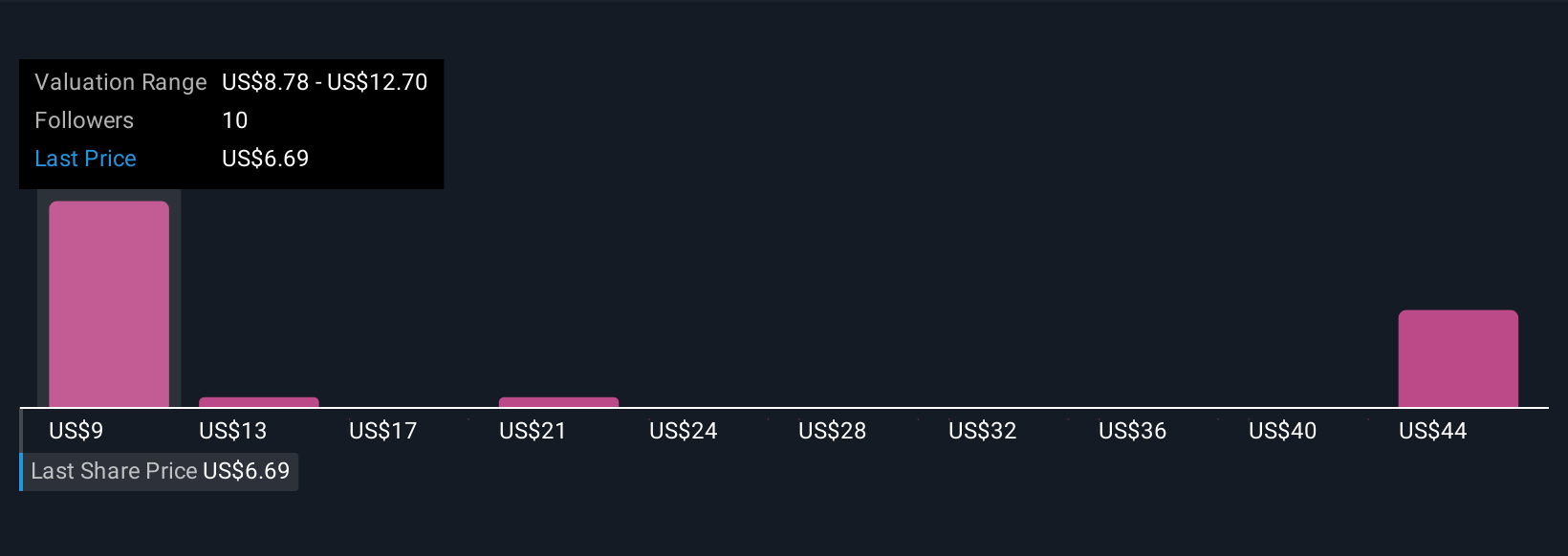

Fair value estimates from four Simply Wall St Community members range from US$8.58 to US$47.98 per share, underscoring wide divergence in expectations. While many see strong future growth as a catalyst for higher valuations, you should consider how these differing outlooks reflect both the promise and unresolved risks facing Aquestive Therapeutics.

Explore 4 other fair value estimates on Aquestive Therapeutics - why the stock might be worth just $8.58!

Build Your Own Aquestive Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aquestive Therapeutics research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Aquestive Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aquestive Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AQST

Aquestive Therapeutics

Operates as a pharmaceutical company in the United States and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives