Aptinyx Inc. (NASDAQ:APTX) shareholders might be concerned after seeing the share price drop 21% in the last month. Taking a longer term view we see the stock is up over one year. However, its return of 15% does fall short of the market return of, 50%.

Check out our latest analysis for Aptinyx

We don't think Aptinyx's revenue of US$2,482,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Aptinyx comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

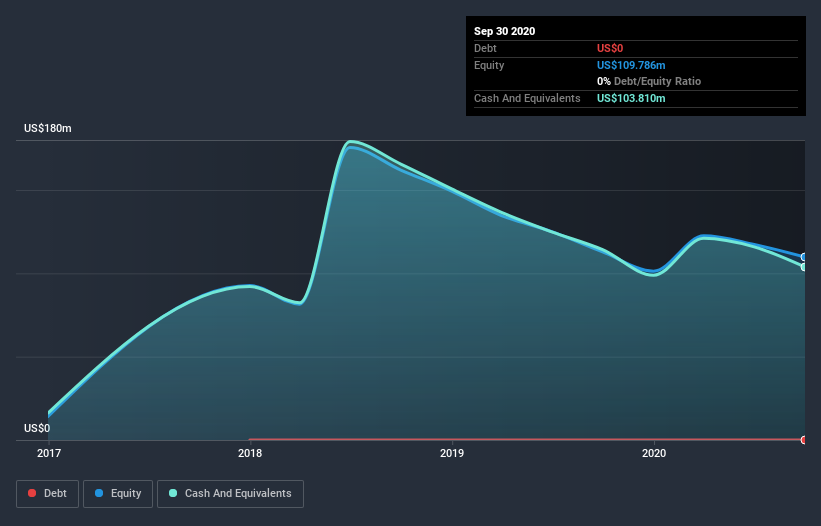

Aptinyx had cash in excess of all liabilities of US$99m when it last reported (September 2020). While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. With the share price up 154% in the last year , the market is seems hopeful about the potential, despite the cash burn. You can see in the image below, how Aptinyx's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

We're happy to report that Aptinyx are up 15% over the year. The bad news is that's no better than the average market return, which was roughly 50%. The stock trailed the market by 22% in that time, testament to the power of passive investing. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Aptinyx (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

We will like Aptinyx better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade Aptinyx, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:APTX

Aptinyx

Aptinyx Inc., a clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of novel, proprietary, and synthetic small molecules for the treatment of brain and nervous system disorders.

Mediocre balance sheet and slightly overvalued.