- United States

- /

- Biotech

- /

- NasdaqGS:APLS

With A 55% Price Drop For Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) You'll Still Get What You Pay For

The Apellis Pharmaceuticals, Inc. (NASDAQ:APLS) share price has fared very poorly over the last month, falling by a substantial 55%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 23% in that time.

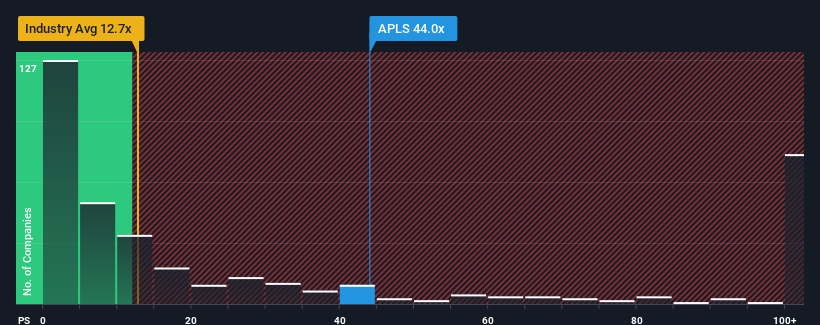

Even after such a large drop in price, Apellis Pharmaceuticals may still be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 44x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12.7x and even P/S lower than 4x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Apellis Pharmaceuticals

What Does Apellis Pharmaceuticals' Recent Performance Look Like?

Apellis Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Apellis Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is Apellis Pharmaceuticals' Revenue Growth Trending?

In order to justify its P/S ratio, Apellis Pharmaceuticals would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 31%. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 135% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 97% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Apellis Pharmaceuticals' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Apellis Pharmaceuticals' P/S Mean For Investors?

Apellis Pharmaceuticals' shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Apellis Pharmaceuticals shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Apellis Pharmaceuticals that you need to be mindful of.

If these risks are making you reconsider your opinion on Apellis Pharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:APLS

Apellis Pharmaceuticals

A commercial-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of novel therapeutic compounds to treat diseases with high unmet needs.

Undervalued with high growth potential.