- United States

- /

- Biotech

- /

- NasdaqGM:APGE

Apogee Therapeutics (APGE) Is Up 31.6% After $300M Equity Offering to Fund R&D Initiatives – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Apogee Therapeutics recently completed a follow-on equity offering, raising approximately US$300 million through the sale of 6,951,221 shares of common stock and pre-funded warrants.

- This significant capital raise strengthens Apogee’s ability to advance its clinical development efforts in inflammatory and immunology markets, including atopic dermatitis and asthma.

- We’ll explore how this substantial capital infusion could shape Apogee Therapeutics’ investment narrative, especially in relation to ongoing research and development funding.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

What Is Apogee Therapeutics' Investment Narrative?

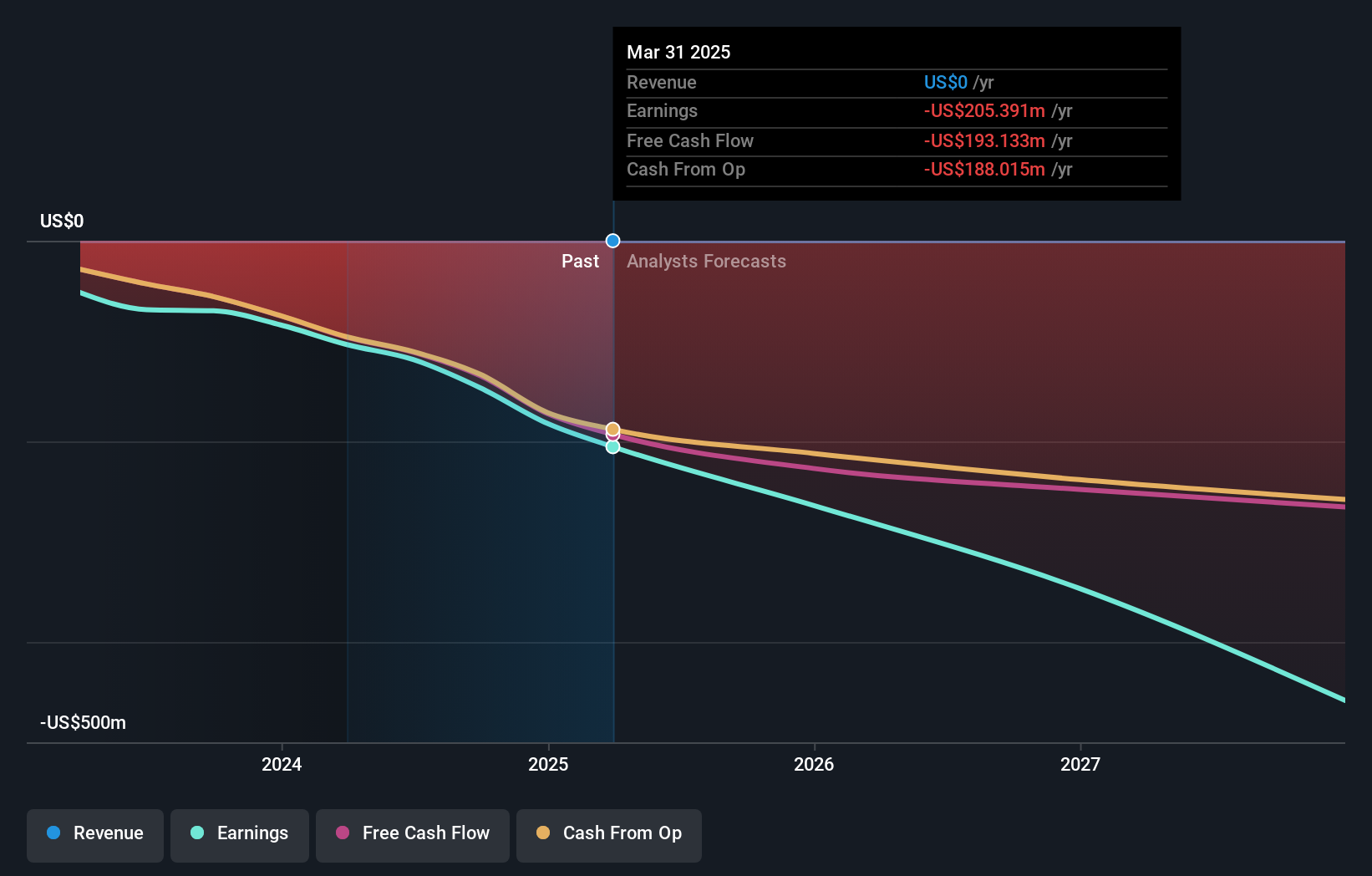

To be an Apogee Therapeutics shareholder, there’s a clear belief required in the pipeline’s ability to eventually deliver value in markets like atopic dermatitis and asthma, despite zero revenue today and ongoing, widening net losses (US$66.1 million for Q2 2025). The recent US$300 million equity raise directly impacts the investment narrative, it boosts Apogee’s cash runway and capacity to pursue its clinical catalysts, most notably the next milestones for APG777. This stronger balance sheet mitigates near-term funding risk, which, ahead of the raise, was a central uncertainty. At the same time, the share issuance increases potential dilution for existing holders, and the stock’s recent price drop post-offering is a reminder that new capital does not remove the need for positive data readouts and a clear path to future revenue. With clinical trial news on the horizon, both new funding and development risk have become the key issues to watch.

However, potential dilution from additional share unlocks is still a factor investors should factor in.

Exploring Other Perspectives

Explore 3 other fair value estimates on Apogee Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Apogee Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Apogee Therapeutics research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Apogee Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Apogee Therapeutics' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APGE

Apogee Therapeutics

A clinical stage biotechnology company, develops novel biologics for the treatment of atopic dermatitis (AD), asthma, eosinophilic esophagitis (EoE), chronic obstructive pulmonary disease (COPD), and other inflammatory and immunology indications.

Flawless balance sheet with low risk.

Market Insights

Community Narratives