- United States

- /

- Biotech

- /

- OTCPK:FREH.Y

Industry Analysts Just Upgraded Their AnPac Bio-Medical Science Co., Ltd. (NASDAQ:ANPC) Revenue Forecasts By 55%

AnPac Bio-Medical Science Co., Ltd. (NASDAQ:ANPC) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

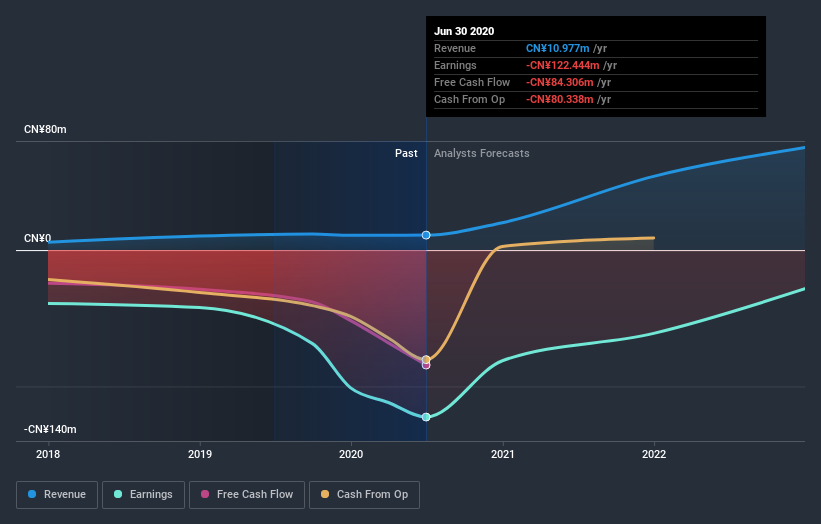

Following the upgrade, the current consensus from AnPac Bio-Medical Science's dual analysts is for revenues of CN¥20m in 2020 which - if met - would reflect a huge 83% increase on its sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 40% to CN¥7.23. However, before this estimates update, the consensus had been expecting revenues of CN¥13m and CN¥7.36 per share in losses. So there's been quite a change-up of views after the recent consensus updates, withthe analysts noticeably increasing their revenue forecasts while also expecting losses per share to hold steady.

See our latest analysis for AnPac Bio-Medical Science

The consensus price target held steady at US$13.00 despite the upgrade to revenue forecasts and ongoing losses. Analysts seem to think the business is otherwise performing roughly in line with expectations. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic AnPac Bio-Medical Science analyst has a price target of US$18.00 per share, while the most pessimistic values it at US$8.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. One thing stands out from these estimates, which is that AnPac Bio-Medical Science is forecast to grow faster in the future than it has in the past, with revenues expected to grow 83%. If achieved, this would be a much better result than the 2.3% annual decline over the past year. Compare this against analyst estimates for the wider industry, which suggest that (in aggregate) industry revenues are expected to grow 21% next year. Not only are AnPac Bio-Medical Science's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting AnPac Bio-Medical Science is moving incrementally towards profitability. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at AnPac Bio-Medical Science.

Analysts are clearly in love with AnPac Bio-Medical Science at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as a short cash runway. You can learn more, and discover the 4 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade AnPac Bio-Medical Science, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:FREH.Y

Fresh2 Group

A biotechnology company, researches, develops, markets, and sells multi-cancer screening and detection tests using cancer differentiation analysis technology and device to corporations and life insurance companies in the People’s Republic of China.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives