- United States

- /

- Biotech

- /

- NasdaqGS:ANIK

Anika Therapeutics (ANIK): Losses Narrow 6.5% Annually, but Guidance Continues to Undercut Bullish Narratives

Reviewed by Simply Wall St

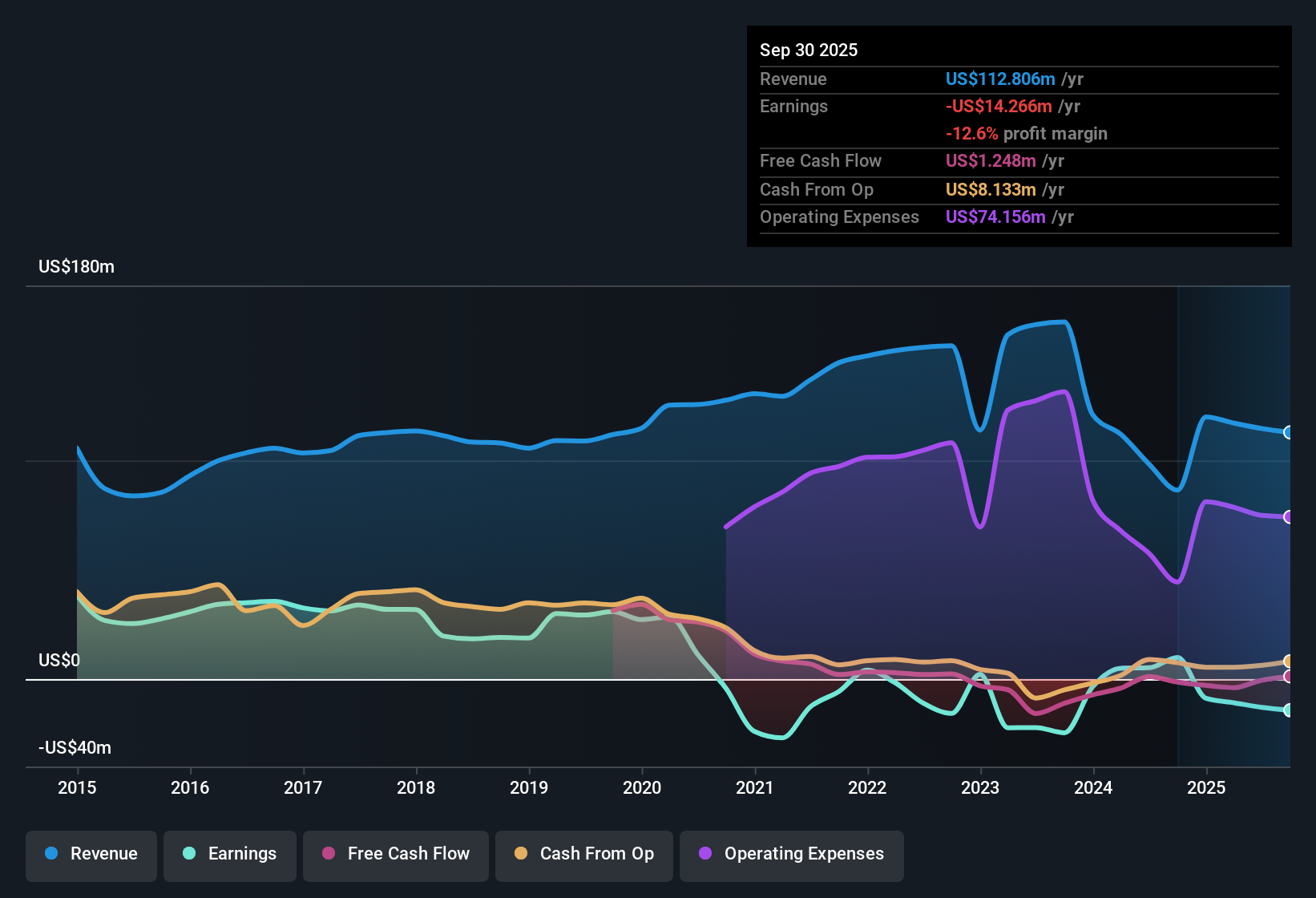

Anika Therapeutics (ANIK) remains unprofitable, but the company has narrowed its losses at a 6.5% annual rate over the last five years. Looking ahead, revenue is forecast to grow at 4.7% per year, which is below the broader US market’s expected 10.5% growth. Despite favorable signals from its discounted share price and a Price-to-Sales ratio well below industry peers, profitability remains out of reach, with no turnaround projected over the next three years.

See our full analysis for Anika Therapeutics.Let’s see how these earnings results align or diverge from the popular market narratives investors are following right now.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Sales Ratio at 1.2x Highlights Deep Discount

- Anika’s Price-to-Sales ratio stands at 1.2x compared to the US biotechnology average of 10.3x and the peer group average of 3x. This underscores its discounted valuation within the sector.

- Despite this low multiple, the market is not rewarding the stock with a higher share price, reflecting ongoing investor caution about the company’s outlook.

- The gap between Anika’s discounted multiple and its lack of projected profitability over the next three years presents a challenge for value-oriented investors searching for a turnaround.

- Even as the share price trades below the estimated DCF fair value of $28.71, further appreciation may require either sustainable margin improvements or clearer progress toward profitability.

Losses Narrow: 6.5% Annual Reduction Over Five Years

- Annual net losses have reduced by 6.5% per year for the past five years, indicating management is making progress on cost control, although true profitability remains out of reach.

- From the prevailing market view, this persistent but gradual improvement is seen as encouraging for long-term investors. However, the continued guidance for unprofitability tempers hopes for a near-term turnaround.

- Bulls typically argue that declining losses could foreshadow an inflection point, but the absence of margin improvement alongside low revenue growth means confidence in a swift recovery remains muted.

- Bears point to ongoing net losses despite cost discipline as a reason to remain skeptical, especially in comparison to peers who are already profitable or growing faster.

Revenue Growth Lags Broader Sector Momentum

- Revenue is projected to grow at 4.7% per year, which is notably below the US market’s forecasted rate of 10.5%. This makes Anika a slower growth story within its industry landscape.

- According to the prevailing market view, this forecast of below-market revenue expansion helps explain why the stock trades at such a steep valuation discount.

- Bulls may anticipate that successful product launches in orthopedics and regenerative medicine could add upside to guidance, but unless top-line momentum accelerates, valuation multiple expansion will remain limited.

- Bearish-leaning investors highlight this growth gap as a structural obstacle, especially since most peers with higher multiples also deliver faster revenue gains.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Anika Therapeutics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Anika’s slow revenue growth, ongoing net losses, and lack of projected profitability hold the company back compared to faster-growing, earnings-positive peers.

If you’re seeking more consistent performance, use our stable growth stocks screener (2074 results) to focus on companies delivering reliable revenue and earnings improvements quarter after quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANIK

Anika Therapeutics

A joint preservation company, creates and delivers advancements in early intervention orthopedic care in the areas of osteoarthritis (OA) pain management, regenerative solutions, sports medicine, and arthrosurface joint solutions in the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026