- United States

- /

- Biotech

- /

- NasdaqCM:AMRN

Amarin Corporation plc (NASDAQ:AMRN) Held Back By Insufficient Growth Even After Shares Climb 39%

Amarin Corporation plc (NASDAQ:AMRN) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 50% over that time.

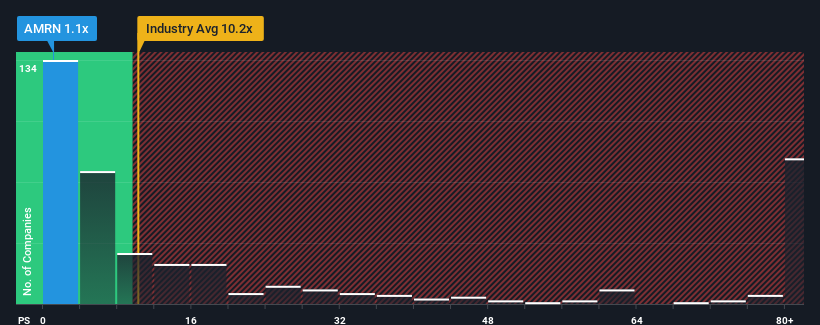

Although its price has surged higher, Amarin's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.2x and even P/S above 62x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Amarin

How Amarin Has Been Performing

Amarin hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Amarin will help you uncover what's on the horizon.How Is Amarin's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Amarin's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. As a result, revenue from three years ago have also fallen 60% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 6.3% per year as estimated by the three analysts watching the company. With the industry predicted to deliver 129% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Amarin's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Amarin's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that Amarin maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Amarin is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AMRN

Amarin

A pharmaceutical company, engages in the commercialization and development of therapeutics for the treatment of cardiovascular diseases in the United States, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives