- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX) Stock Catapults 37% Though Its Price And Business Still Lag The Industry

Amylyx Pharmaceuticals, Inc. (NASDAQ:AMLX) shares have continued their recent momentum with a 37% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 85% share price drop in the last twelve months.

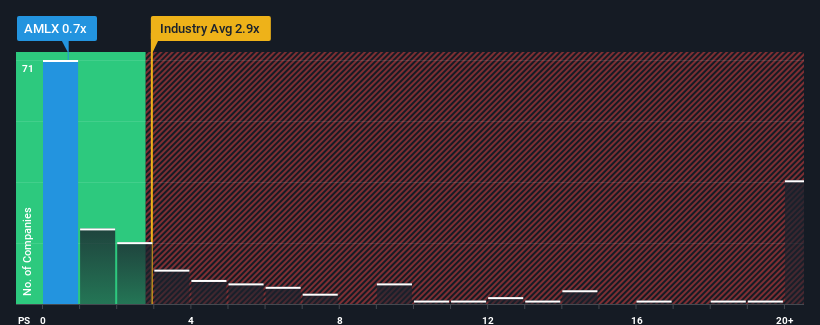

In spite of the firm bounce in price, Amylyx Pharmaceuticals may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.9x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Amylyx Pharmaceuticals

How Has Amylyx Pharmaceuticals Performed Recently?

Amylyx Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Amylyx Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Amylyx Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 56%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 82% per annum during the coming three years according to the six analysts following the company. Meanwhile, the broader industry is forecast to expand by 17% each year, which paints a poor picture.

With this in consideration, we find it intriguing that Amylyx Pharmaceuticals' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Even after such a strong price move, Amylyx Pharmaceuticals' P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Amylyx Pharmaceuticals' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Amylyx Pharmaceuticals' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Amylyx Pharmaceuticals that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A clinical-stage pharmaceutical company, engages in the discovery and development of treatment options for neurodegenerative diseases and endocrine conditions in the United States.

Medium-low with excellent balance sheet.

Market Insights

Community Narratives