- United States

- /

- Pharma

- /

- NasdaqGS:AMLX

A Look at Amylyx Pharmaceuticals’s Valuation After Joining a Major Industry Index

Reviewed by Kshitija Bhandaru

Price-to-Book of 8.5x: Is it justified?

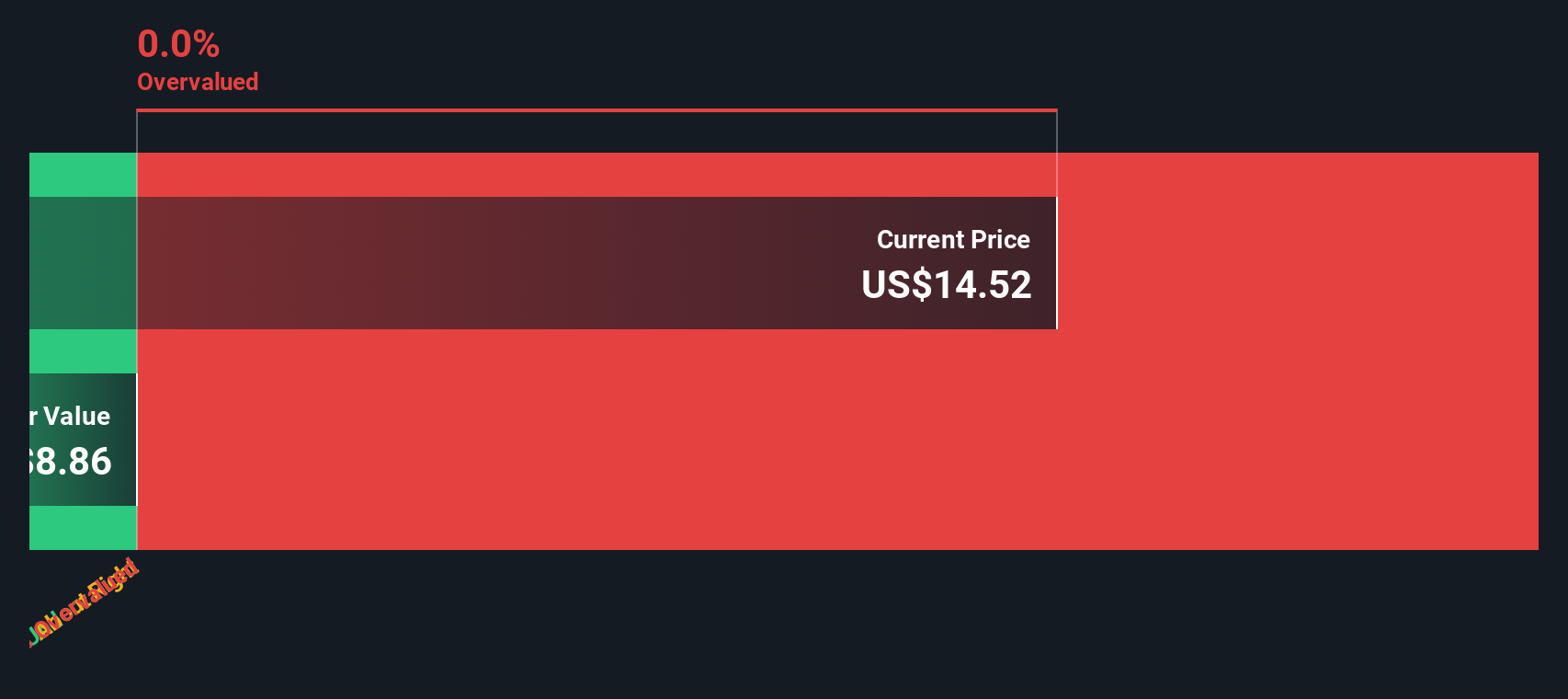

Based on the latest data, Amylyx Pharmaceuticals is trading at a Price-to-Book (P/B) ratio of 8.5x. This is notably higher than both the US Pharmaceuticals industry average of 2.1x and its peer group average of 2.5x. The current market price is therefore much higher than the book value of the company's assets.

The Price-to-Book ratio measures a company's market value compared to its book value. This metric is commonly used for asset-heavy industries like pharmaceuticals and biotech. A high P/B ratio can reflect investor confidence in future growth. However, for unprofitable companies, it may raise concerns about overvaluation.

Amylyx is not profitable and has minimal revenue, yet trades at a high multiple. Investors could be paying a premium for anticipated future growth or pipeline developments that may not occur as quickly as expected. The elevated ratio indicates that the market is pricing in significant optimism.

Result: Fair Value of $13.31 (OVERVALUED)

See our latest analysis for Amylyx Pharmaceuticals.However, challenges remain if Amylyx's revenue growth slows or if clinical trials face setbacks. Either of these could undermine the current market optimism.

Find out about the key risks to this Amylyx Pharmaceuticals narrative.Another View: Looking Beyond Book Value

Our DCF model takes future cash flows into account. However, right now, there is not enough data to calculate a fair value using this approach. As a result, the high market price is supported only by current market optimism. Could this signal risk ahead, or is the market seeing something more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amylyx Pharmaceuticals Narrative

If you have a different take on these numbers or want to dig into the details yourself, it's easy to craft your own view in just a few minutes. Do it your way

A great starting point for your Amylyx Pharmaceuticals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for Your Next Investment Move?

Don’t let opportunity pass you by. If you want to be ahead of the curve, Simply Wall Street’s tailored screeners make finding standout stocks quick and effective.

- Spot companies shaking up artificial intelligence by jumping straight into AI penny stocks for a look at tomorrow’s game changers today.

- Uncover undervalued picks poised for a breakout by using undervalued stocks based on cash flows and seize the best value plays before everyone else.

- Chase higher income potential and stability by starting with dividend stocks with yields > 3% to find stocks offering attractive yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMLX

Amylyx Pharmaceuticals

A clinical-stage pharmaceutical company, engages in the discovery and development of treatment options for neurodegenerative diseases and endocrine conditions in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives