- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen (NasdaqGS:AMGN) Faces US$407 Million Verdict Over Antitrust Violations

Reviewed by Simply Wall St

Amgen (NasdaqGS:AMGN) recently faced a legal setback, with a U.S. District Court jury finding the company liable for antitrust violations and awarding Regeneron Pharmaceuticals $406.8 million in damages. Despite this outcome, Amgen's stock price remained flat over the past week, even as the broader market saw significant gains, with the S&P 500 and Dow Jones both climbing steadily. This legal decision and possible concerns about competition might have countered the general positive market sentiment, which was buoyed by U.S.-China trade developments and favorable economic indicators.

Be aware that Amgen is showing 2 possible red flags in our investment analysis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

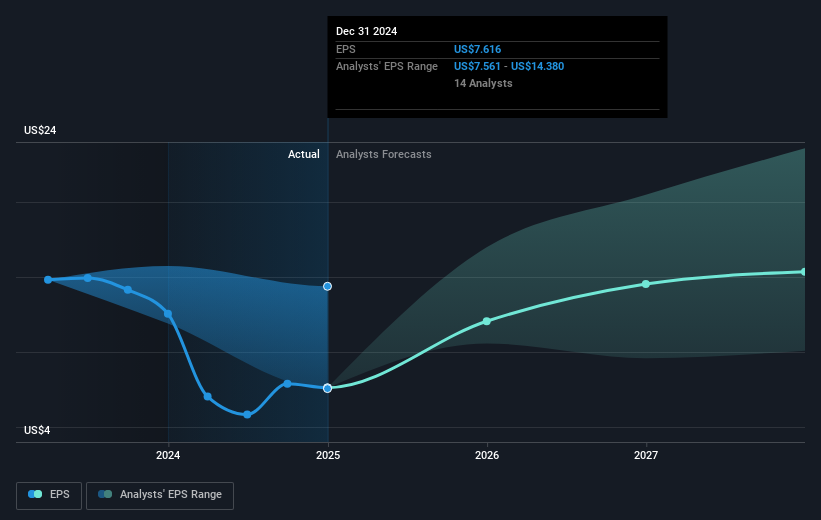

The recent legal verdict against Amgen could heighten concerns regarding its ability to sustain revenue and earnings growth. With biosimilar competition and antitrust liabilities, there's a risk of intensified pricing pressures affecting its market position. In your narrative, you pointed out ongoing pricing threats and regulatory scrutiny that Amgen might face, potentially compounding existing challenges in maintaining revenue stability and profit margins. Coupled with potential market share erosion, this could impact the ability to achieve forecast targets, potentially leading analysts to reassess the company's valuation.

Over the past five years, Amgen's total shareholder return, including dividends, was 41.23%. Despite these longer-term returns, Amgen's recent performance has lagged behind the broader US biotech industry, which saw a compression over the past year. Notably, Amgen achieved a 57.7% growth in earnings over the past year, outperforming the industry's 21.7% growth rate.

The legal decision is another variable in financial forecasts, which already reflect an expected decline in revenue growth rates. Current analyst earnings predictions anticipate a gradual increase in profit margins. This might influence Amgen’s capability to reach its price target of $315.52, particularly given a share price of $270.44. The market reflects a considered view that Amgen's stock might still be undervalued 16% below this target, conditional on future earnings and risk assessments aligning with analyst expectations.

Assess Amgen's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Amgen, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives