- United States

- /

- Biotech

- /

- NasdaqGS:AMGN

Amgen (NasdaqGS:AMGN) Announces Promising MINT Trial Data For UPLIZNA In Generalized Myasthenia Gravis

Reviewed by Simply Wall St

Amgen (NasdaqGS:AMGN) has recently garnered attention due to promising Phase 3 MINT trial results for UPLIZNA in treating generalized myasthenia gravis, likely influencing its 14% price increase over the last quarter. These findings, emphasizing the drug's efficacy, coincide with Amgen's Q4 2024 earnings report, which showed a rise in revenue yet a decline in net income, reflecting a mixed financial performance. Despite the broader stock market experiencing declines, with the S&P 500 and Nasdaq suffering substantial drops, Amgen's significant focus on product development has potentially bolstered investor confidence. Key product developments, like the FDA approval for LUMAKRAS and the promising results from trials like WAYPOINT for TEZSPIRE and the ROCKET trial with Kyowa Kirin, may have mitigated investor concerns, helping to support Amgen's share price. The company's announcement of ongoing acquisition efforts could also contribute to optimistic market sentiment.

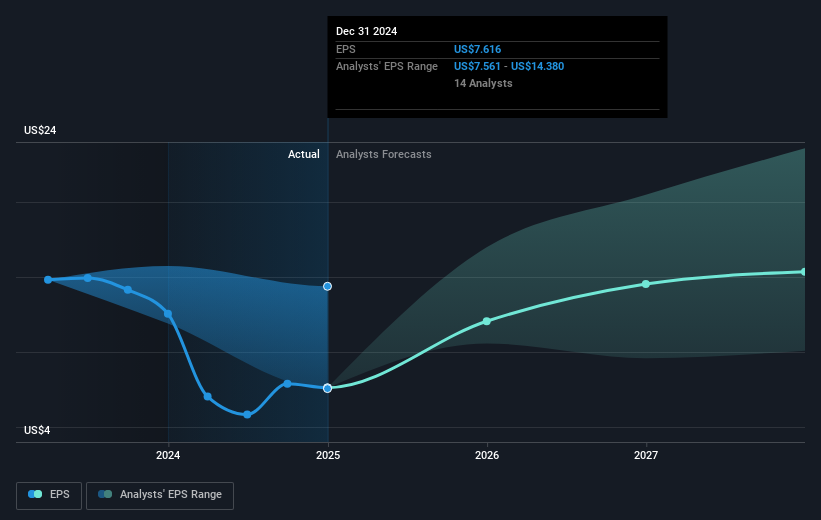

Understand Amgen's earnings outlook by examining our growth report.

Amgen's shares have delivered a total return of 77.86% over the past five years. During this period, the company exceeded the returns of the U.S. market and the Biotechs industry over the last year, highlighting its robust market positioning. A significant milestone was the U.S. Court of Appeals' decision on July 1, 2020, which upheld the validity of two of Amgen's patents for Enbrel. This court victory prevented Sandoz from selling a biosimilar, which likely provided considerable support for market confidence.

Additionally, Amgen's commitment to returning capital through dividends has been consistent over time. Most recently, the board declared a dividend of US$2.38 per share, reinforcing shareholder returns. Furthermore, the company's focus on R&D and strategic collaborations, such as the partnership announced on January 8, 2025, with Asher Biotherapeutics for cancer therapies, underlines its efforts to sustain growth and innovation, further consolidating investor trust.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMGN

Amgen

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide.

Moderate average dividend payer.

Market Insights

Community Narratives