- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

How Alnylam Pharmaceuticals' (ALNY) Entry to Genomic Data Alliance Could Shape Its Drug Pipeline Progress

Reviewed by Sasha Jovanovic

- Earlier this month, Illumina and Nashville Biosciences announced that Alnylam Pharmaceuticals joined the Alliance for Genomic Discovery, giving Alnylam access to an expansive clinical genomic database to accelerate drug target discovery, particularly in autoimmune and neurodegenerative diseases.

- This partnership bolsters Alnylam's ability to identify and validate novel therapeutic targets, reflecting growing collaboration between genomics leaders and RNA interference biotechs to advance precision medicine development.

- We'll now explore how this alliance access could support Alnylam's drug pipeline progress and reshape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alnylam Pharmaceuticals Investment Narrative Recap

To be a shareholder in Alnylam, you need to believe in the commercial sustainability of its RNA interference therapies, especially AMVUTTRA, and the company’s ability to expand into new indications. While joining the Alliance for Genomic Discovery strengthens Alnylam’s long-term pipeline innovation, it does not materially alter the short-term outlook, where AMVUTTRA’s international uptake and pricing pressures remain the main catalyst and risk in focus. The latest HELIOS-B Phase 3 results for AMVUTTRA, which showed significant reductions in mortality and cardiovascular events, are especially relevant, reinforcing confidence in the TTR franchise, currently Alnylam’s largest revenue driver and the linchpin of near-term growth expectations. However, amid optimism, investors should be aware that heightened payer pressures and ongoing net price adjustments could seriously affect realized revenues for...

Read the full narrative on Alnylam Pharmaceuticals (it's free!)

Alnylam Pharmaceuticals is forecast to achieve $7.0 billion in revenue and $1.9 billion in earnings by 2028. This outlook assumes annual revenue growth of 41.8% and an earnings increase of $2.2 billion from the current earnings of -$319.1 million.

Uncover how Alnylam Pharmaceuticals' forecasts yield a $447.15 fair value, in line with its current price.

Exploring Other Perspectives

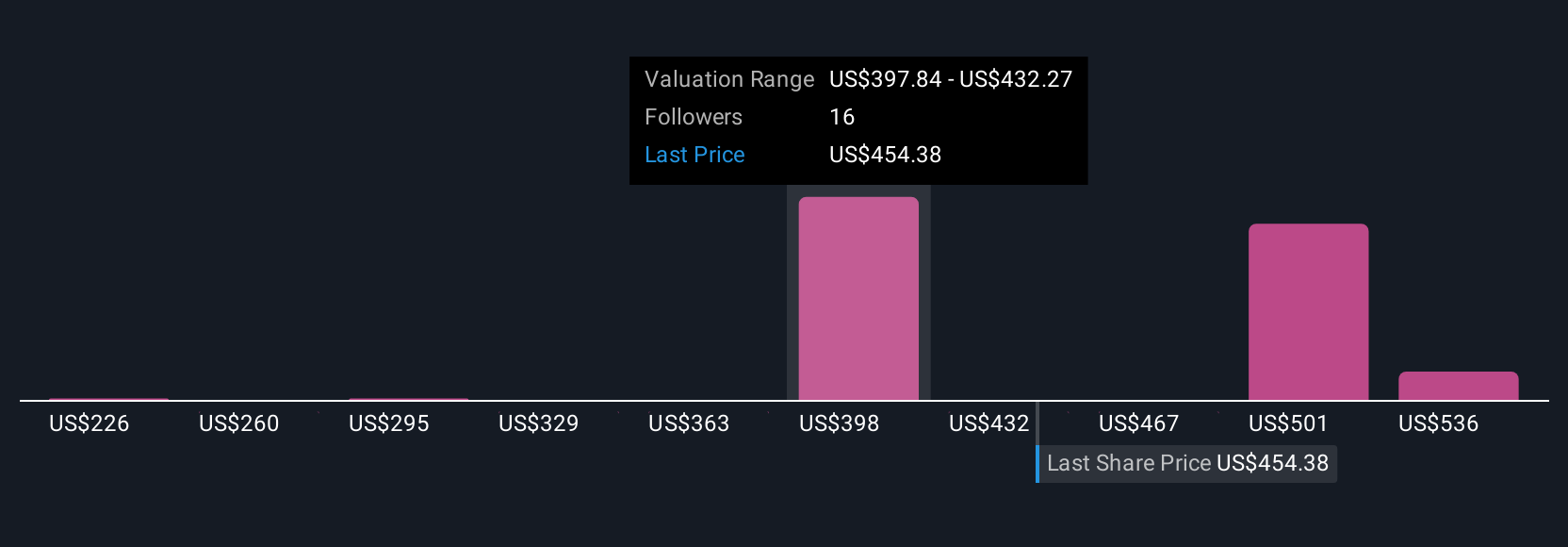

Six members of the Simply Wall St Community set Alnylam fair value estimates from US$225.68 to US$899.10, reflecting wide-ranging expectations. With pricing pressures as the key risk, you may want to explore several alternative viewpoints on the company’s performance and outlook.

Explore 6 other fair value estimates on Alnylam Pharmaceuticals - why the stock might be worth over 2x more than the current price!

Build Your Own Alnylam Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alnylam Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alnylam Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alnylam Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives