- United States

- /

- Biotech

- /

- NasdaqGS:ALNY

Dr. Phillip A. Sharp Retirement From Alnylam Pharmaceuticals (NasdaqGS:ALNY) Board Announced

Reviewed by Simply Wall St

Alnylam Pharmaceuticals (NasdaqGS:ALNY)'s share price increased by 2.2% last week, a rise that coincided with the announcement of Dr. Phillip A. Sharp's upcoming retirement from the Board of Directors. Dr. Sharp, a co-founder and long-standing advisor, significantly impacted the company's trajectory. Despite broader market challenges, such as tariff-related sell-offs that caused the Nasdaq Composite to decline by 1.1%, Alnylam maintained resilient performance. The general market saw a 1.9% drop over the same period, primarily affected by U.S. tariff uncertainties impacting tech stocks. However, Alnylam's strategic positioning and investor confidence in its leadership contributed to a positive price move. As Dr. Sharp transitions to Alnylam's Scientific Advisory Board, the company's ability to retain his expertise while navigating executive changes may have bolstered investor sentiment, contrasting with broader market turbulence.

Click here and access our complete analysis report to understand the dynamics of Alnylam Pharmaceuticals.

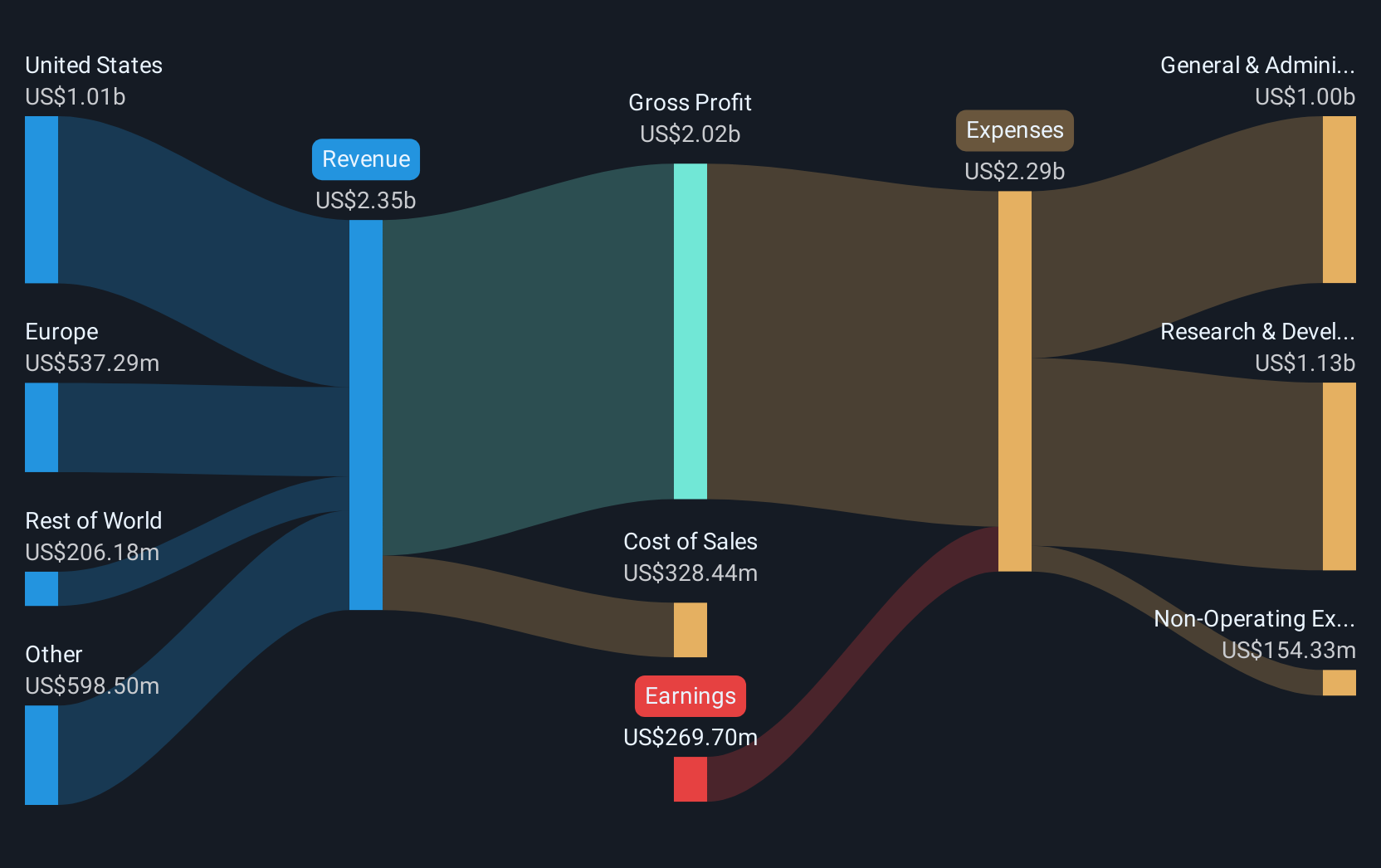

Over the last five years, Alnylam Pharmaceuticals' total shareholder returns, combining share price and dividends, surged by 144.61%. This growth significantly outperformed many peers, with the company's stock appreciating despite broader market volatility. Key developments underpinning this performance include Alnylam's impressive revenue growth, with annual increases of 15.8% over the period and expectations for continued revenue growth at 22.9% annually. These factors have bolstered investor confidence even as the company remains in growth mode rather than profit maximization.

Significant advances in Alnylam's product pipeline also supported its long-term growth. The successful HELIOS-B Phase 3 study for vutrisiran, which showed improvements in cardiac outcomes, and the ongoing FDA review anticipated for late March 2025, have positioned the company well for future innovations. Additionally, strategic partnerships, like the expansion with Medison Pharma and the collaboration with Dicerna Pharmaceuticals, have established a strong foundation for market innovation and penetration in various regions.

- Discover whether Alnylam Pharmaceuticals is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Assess the downside scenarios for Alnylam Pharmaceuticals with our risk evaluation.

- Invested in Alnylam Pharmaceuticals? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alnylam Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALNY

Alnylam Pharmaceuticals

Alnylam Pharmaceuticals, Inc. discovers, develops, and commercializes therapeutics based on ribonucleic acid interference.

Exceptional growth potential with adequate balance sheet.