- United States

- /

- Biotech

- /

- NasdaqGS:ALLO

We're Not Worried About Allogene Therapeutics' (NASDAQ:ALLO) Cash Burn

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Allogene Therapeutics (NASDAQ:ALLO) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

See our latest analysis for Allogene Therapeutics

Does Allogene Therapeutics Have A Long Cash Runway?

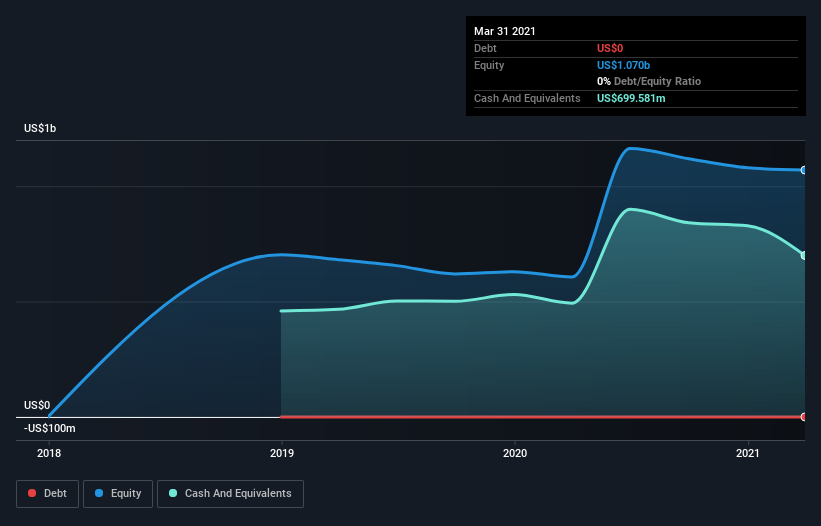

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Allogene Therapeutics last reported its balance sheet in March 2021, it had zero debt and cash worth US$700m. In the last year, its cash burn was US$184m. So it had a cash runway of about 3.8 years from March 2021. Importantly, analysts think that Allogene Therapeutics will reach cashflow breakeven in 4 years. That means it doesn't have a great deal of breathing room, but it shouldn't really need more cash, considering that cash burn should be continually reducing. You can see how its cash balance has changed over time in the image below.

How Is Allogene Therapeutics' Cash Burn Changing Over Time?

Whilst it's great to see that Allogene Therapeutics has already begun generating revenue from operations, last year it only produced US$38m, so we don't think it is generating significant revenue, at this point. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. With cash burn dropping by 8.4% it seems management feel the company is spending enough to advance its business plans at an appropriate pace. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Allogene Therapeutics To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Allogene Therapeutics to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Allogene Therapeutics has a market capitalisation of US$3.2b and burnt through US$184m last year, which is 5.7% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Allogene Therapeutics' Cash Burn?

As you can probably tell by now, we're not too worried about Allogene Therapeutics' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its weak point is its cash burn reduction, but even that wasn't too bad! One real positive is that analysts are forecasting that the company will reach breakeven. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking an in-depth view of risks, we've identified 4 warning signs for Allogene Therapeutics that you should be aware of before investing.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Allogene Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ALLO

Allogene Therapeutics

A clinical stage immuno-oncology company, develops and commercializes genetically engineered allogeneic T cell therapies for the treatment of cancer and autoimmune diseases.

Flawless balance sheet slight.

Market Insights

Community Narratives