- United States

- /

- Biotech

- /

- NasdaqGS:ALKS

Easy Come, Easy Go: How Alkermes (NASDAQ:ALKS) Shareholders Got Unlucky And Saw 76% Of Their Cash Evaporate

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of Alkermes plc (NASDAQ:ALKS); the share price is down a whopping 76% in the last three years. That would be a disturbing experience. And more recent buyers are having a tough time too, with a drop of 50% in the last year. The falls have accelerated recently, with the share price down 17% in the last three months. But this could be related to the weak market, which is down 9.3% in the same period.

See our latest analysis for Alkermes

Alkermes wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Alkermes saw its revenue grow by 14% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 38% per year is due to the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

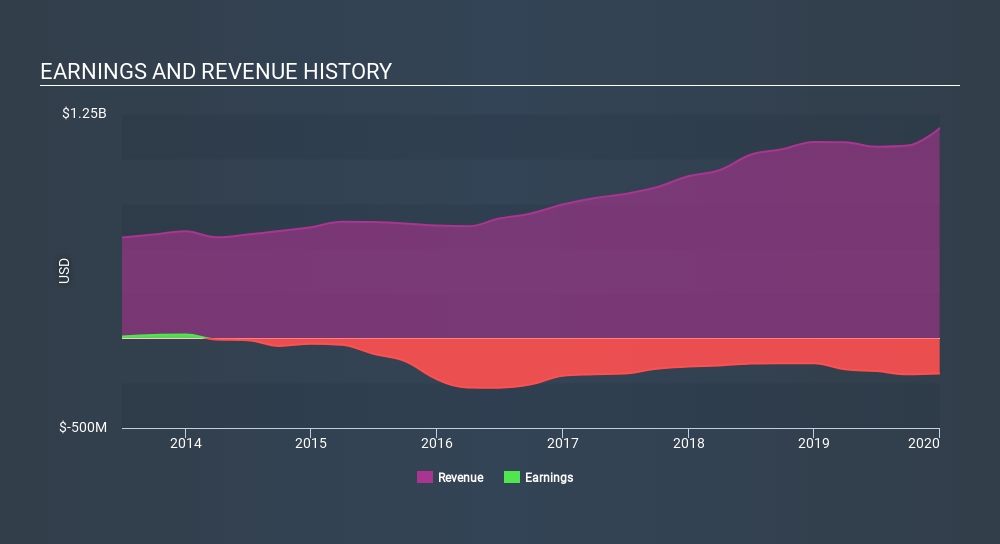

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Alkermes in this interactive graph of future profit estimates.

A Different Perspective

Alkermes shareholders are down 50% for the year, but the market itself is up 1.4%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 24% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Alkermes better, we need to consider many other factors. Even so, be aware that Alkermes is showing 2 warning signs in our investment analysis , you should know about...

Alkermes is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:ALKS

Alkermes

A biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives