- United States

- /

- Biotech

- /

- NasdaqGS:ALEC

Top Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As the U.S. market navigates a mix of slipping indices and rising Treasury yields, investors are keenly observing developments around tax legislation that could impact economic growth. Amid these broader market dynamics, penny stocks continue to capture attention for their unique blend of affordability and potential growth. Despite being an older term, penny stocks often represent smaller or newer companies that can offer significant opportunities when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| SideChannel (OTCPK:SDCH) | $0.0496 | $11.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (NYSE:TUYA) | $2.58 | $1.59B | ✅ 3 ⚠️ 3 View Analysis > |

| Perfect (NYSE:PERF) | $1.81 | $181.29M | ✅ 3 ⚠️ 0 View Analysis > |

| Global Mofy AI (NasdaqCM:GMM) | $2.9281 | $55.14M | ✅ 2 ⚠️ 4 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.48 | $53.75M | ✅ 1 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.54 | $86.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Table Trac (OTCPK:TBTC) | $4.7675 | $20.88M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.81 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.23 | $70.38M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.92 | $21.66M | ✅ 3 ⚠️ 6 View Analysis > |

Click here to see the full list of 718 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Alector (NasdaqGS:ALEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alector, Inc. is a late-stage clinical biotechnology company that develops therapies aimed at combating neurodegenerative diseases, with a market cap of approximately $127 million.

Operations: The company's revenue is derived entirely from its biotechnology segment, totaling $88.34 million.

Market Cap: $126.99M

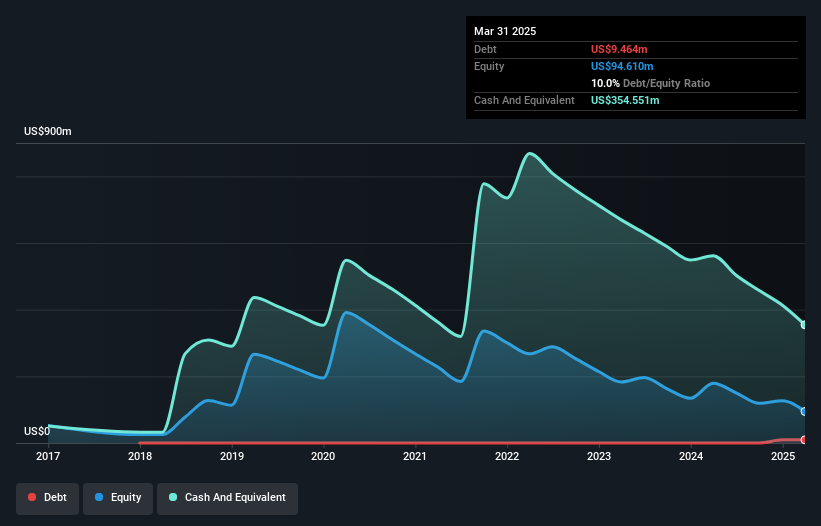

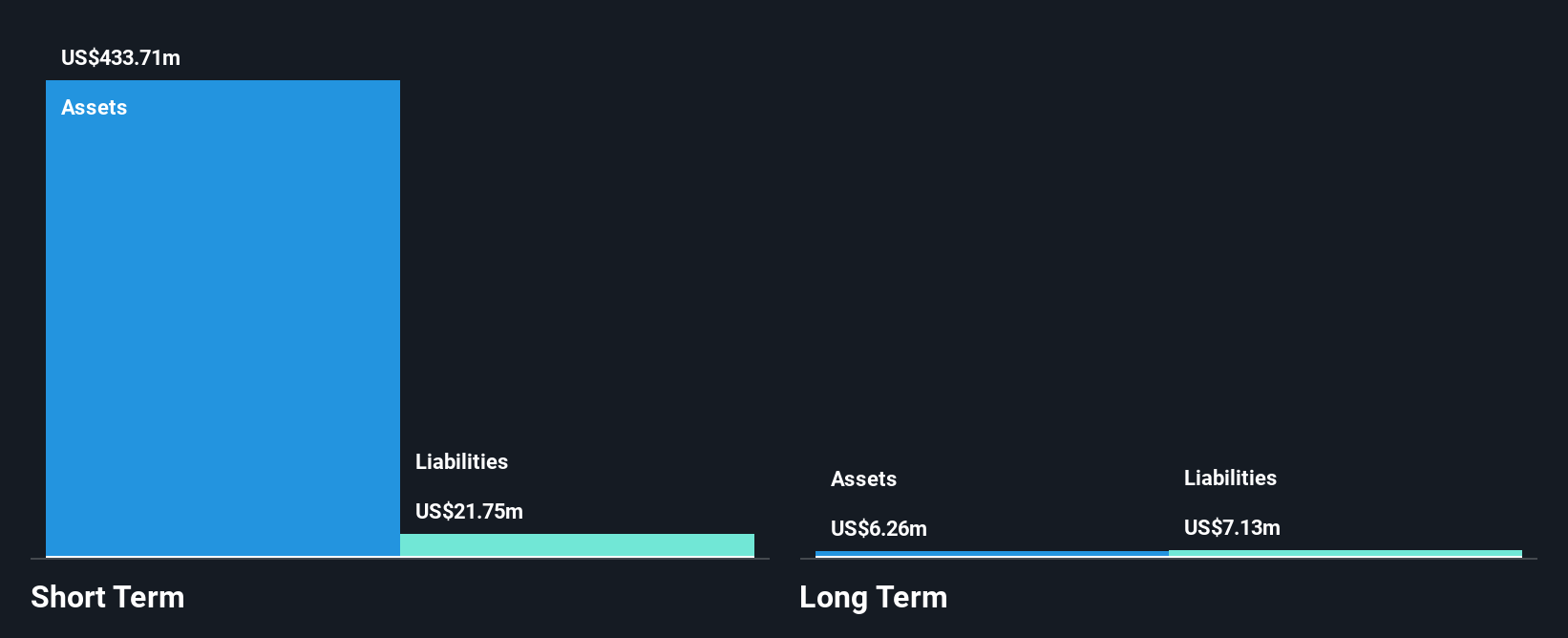

Alector, Inc., a biotechnology company focused on neurodegenerative diseases, has a market cap of approximately US$127 million and reported revenue of US$88.34 million. Despite being unprofitable with a net loss of US$40.47 million in Q1 2025, the company shows potential through its clinical trials such as PROGRESS-AD for Alzheimer's disease. The recent executive change with Dr. Giacomo Salvadore as Chief Medical Officer may bring strategic insights into their pipeline development. Alector's short-term assets exceed liabilities, providing financial stability despite high share price volatility and significant insider selling over the past quarter.

- Dive into the specifics of Alector here with our thorough balance sheet health report.

- Assess Alector's future earnings estimates with our detailed growth reports.

Atea Pharmaceuticals (NasdaqGS:AVIR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Atea Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company focused on discovering, developing, and commercializing oral antiviral therapeutics for serious viral infections, with a market cap of $240.48 million.

Operations: Atea Pharmaceuticals, Inc. has not reported any revenue segments as it is currently a clinical-stage biopharmaceutical company focused on the development of oral antiviral therapeutics for serious viral infections.

Market Cap: $240.48M

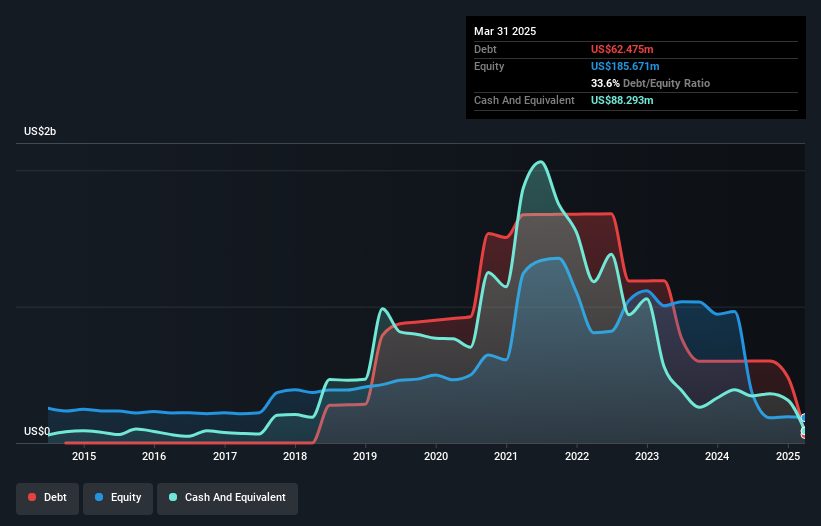

Atea Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company with a market cap of US$240.48 million, remains pre-revenue as it focuses on developing oral antiviral therapeutics. The recent Phase 2 study results for its hepatitis C treatment regimen demonstrated high efficacy and safety, meeting primary endpoints and paving the way for Phase 3 trials. Despite reporting a net loss of US$34.27 million in Q1 2025, the loss has improved from the previous year. Atea's strong cash position supports its ongoing research efforts and share repurchase program while maintaining financial flexibility to pursue long-term growth opportunities in antiviral therapies.

- Click to explore a detailed breakdown of our findings in Atea Pharmaceuticals' financial health report.

- Learn about Atea Pharmaceuticals' future growth trajectory here.

Chegg (NYSE:CHGG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chegg, Inc. offers personalized educational support services to students worldwide, focusing on essential academic and career skills, with a market cap of approximately $95.91 million.

Operations: The company's revenue primarily comes from its online retail segment, generating $564.61 million.

Market Cap: $95.91M

Chegg, Inc. faces challenges as it navigates compliance issues with the NYSE due to its share price falling below US$1.00, risking delisting if not rectified in six months. Despite being unprofitable and experiencing declining sales—US$121.39 million in Q1 2025 down from US$174.35 million a year ago—Chegg maintains a cash runway exceeding three years and reduced its debt-to-equity ratio significantly over five years. The company is also exploring strategic alternatives to maximize shareholder value while enhancing its educational offerings with innovative tools like Create and Solution Scout, potentially bolstering user engagement amidst competitive pressures from AI-driven platforms like Google's AIO.

- Click here and access our complete financial health analysis report to understand the dynamics of Chegg.

- Gain insights into Chegg's future direction by reviewing our growth report.

Summing It All Up

- Gain an insight into the universe of 718 US Penny Stocks by clicking here.

- Want To Explore Some Alternatives? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALEC

Alector

A late-stage clinical biotechnology company, develops therapies that is focused on counteracting the devastating progression of neurodegenerative diseases.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives