- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

Agios Pharmaceuticals' (NASDAQ:AGIO) growing losses don't faze investors as the stock climbs 3.5% this past week

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). For example, the Agios Pharmaceuticals, Inc. (NASDAQ:AGIO) share price is up 89% in the last 1 year, clearly besting the market return of around 20% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 2.3% higher than it was three years ago.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Agios Pharmaceuticals

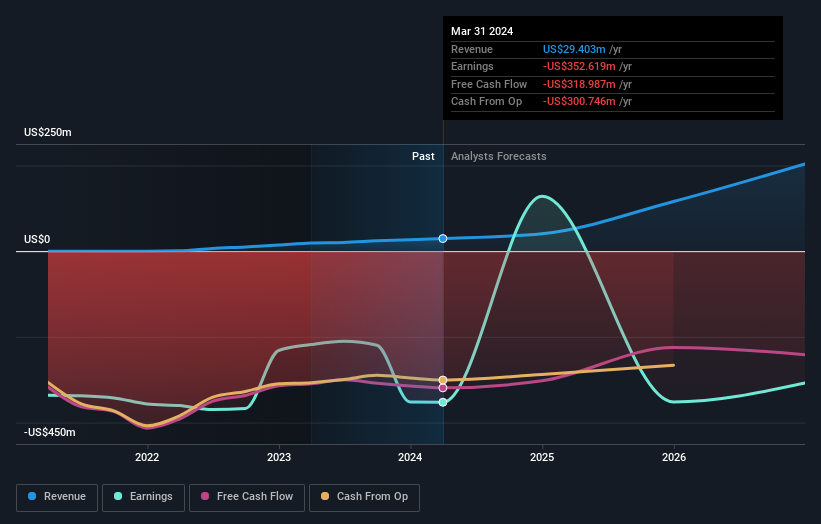

Because Agios Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last twelve months, Agios Pharmaceuticals' revenue grew by 55%. That's a head and shoulders above most loss-making companies. The solid 89% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. If that's the case, now might be the time to take a close look at Agios Pharmaceuticals. Since we evolved from monkeys, we think in linear terms by nature. So if growth goes exponential, opportunity may exist for the enlightened.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. If you are thinking of buying or selling Agios Pharmaceuticals stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Agios Pharmaceuticals has rewarded shareholders with a total shareholder return of 89% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.7% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Agios Pharmaceuticals better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Agios Pharmaceuticals you should know about.

But note: Agios Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade Agios Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives