The harsh reality for Agenus Inc. (NASDAQ:AGEN) shareholders is that its auditors, KPMG LLP - Klynveld Peat Marwick Goerdeler, expressed doubts about its ability to continue as a going concern, in its reported results to December 2021. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for Agenus

What Is Agenus's Net Debt?

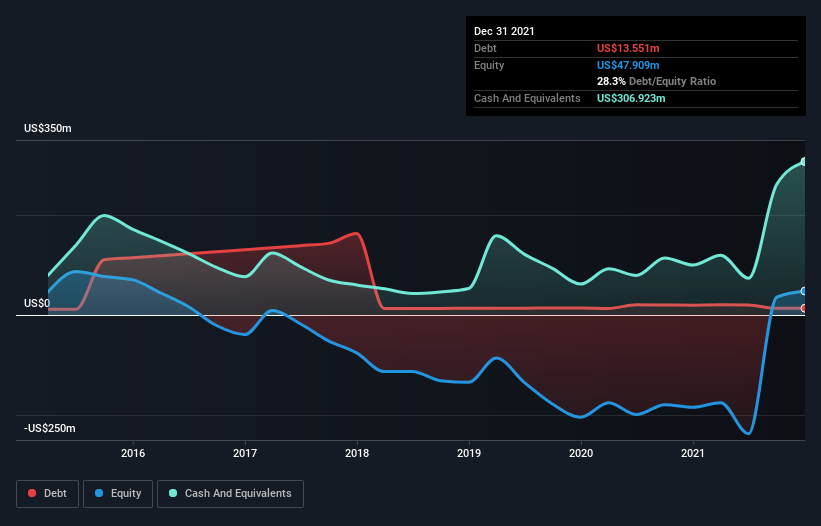

The image below, which you can click on for greater detail, shows that Agenus had debt of US$13.6m at the end of December 2021, a reduction from US$19.7m over a year. However, its balance sheet shows it holds US$306.9m in cash, so it actually has US$293.4m net cash.

How Healthy Is Agenus' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Agenus had liabilities of US$156.9m due within 12 months and liabilities of US$261.1m due beyond that. On the other hand, it had cash of US$306.9m and US$1.52m worth of receivables due within a year. So its liabilities total US$109.6m more than the combination of its cash and short-term receivables.

Of course, Agenus has a market capitalization of US$748.3m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Agenus also has more cash than debt, so we're pretty confident it can manage its debt safely.

We also note that Agenus improved its EBIT from a last year's loss to a positive US$37m. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Agenus can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Agenus may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, Agenus saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

Although Agenus's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of US$293.4m. So while Agenus does not have a great balance sheet, it's certainly not too bad. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Agenus has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Agenus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AGEN

Agenus

A clinical-stage biotechnology company, discovers and develops therapies to activate the body's immune system against cancer and infections in the United States and internationally.

Medium-low and undervalued.

Market Insights

Community Narratives