- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies (ADPT): How Genentech Exit Could Shift Valuation and Future Growth Strategy

Reviewed by Simply Wall St

If you are tracking Adaptive Biotechnologies (ADPT), the news that its strategic collaboration and license agreement with Genentech will be winding down might catch your attention. The deal, first signed in 2018 to jointly explore innovative cancer cell therapies, is set to terminate in early 2026. This will free Adaptive from previous exclusivity constraints in oncology. Notably, this change will unlock a $33.7 million boost in non-cash revenue later this year, adding detail to the financials and generating fresh questions about what is next for Adaptive's business model and its evolving roadmap.

This development follows a transformative year for Adaptive Biotechnologies. Over the past year, the stock has surged nearly 87%, with momentum accelerating in the past three months alone. The company has posted a striking 41% gain in that period. Shorter-term fluctuations, such as a dip last week, are being overshadowed by longer-term optimism and a healthy rebound over the last month. Adaptive continues to focus on its immune medicine initiatives, aims to achieve tighter cash burn targets, and is now exploring new partnerships since it is no longer bound by Genentech’s terms.

Given the recent gains and shake-up in Adaptive's partnership landscape, is this the moment to take a closer look at valuation, or are investors simply catching up to the company’s future growth prospects?

Most Popular Narrative: 9.8% Undervalued

According to the community narrative, Adaptive Biotechnologies is valued nearly 10% below its assessed fair value. This suggests analysts see upside potential from current prices.

Substantial expansion in the MRD clinical pharma pipeline, evidenced by a growing clinical trial backlog (now at $218 million, up 21% over the prior year) and increased use of clonoSEQ as a primary endpoint, points to potential future milestone payments and a high-quality revenue stream as regulatory momentum globally accelerates MRD adoption in drug development.

Curious how analysts arrive at this notable valuation? The reasoning is driven by aggressive pipeline growth, ambitious recurring revenue plans, and a projected profit outlook that resembles the trajectory of industry leaders. Interested in the details behind these positive projections? The numbers underlying this story might surprise you.

Result: Fair Value of $14.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing unprofitability and heavy reliance on key partnerships could quickly alter Adaptive’s outlook and challenge the current valuation narrative.

Find out about the key risks to this Adaptive Biotechnologies narrative.Another Angle: SWS DCF Model Sees Greater Upside

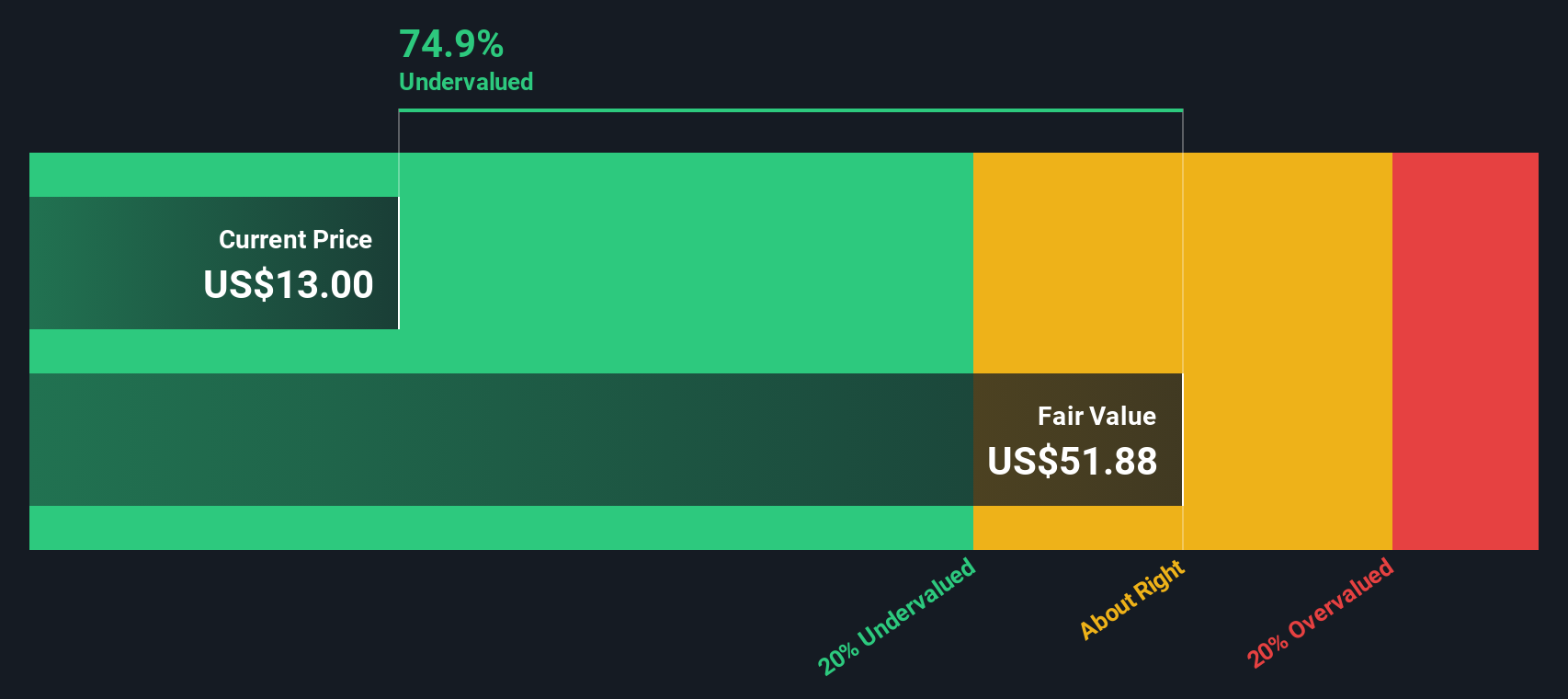

Looking from a different angle, the SWS DCF model suggests Adaptive Biotechnologies may be much more undervalued than the previous approach indicates. A long-term cash flow perspective may provide justification for optimism, even when current multiples appear expensive.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Adaptive Biotechnologies Narrative

If you are looking to form your own perspective rather than rely on the prevailing view, now is the perfect time to dig into the data and shape your own Adaptive Biotechnologies thesis in just a few minutes, so go ahead and do it your way.

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Investment Ideas?

Don’t let your next opportunity pass you by. With the right research tools, you can get ahead of the market and uncover overlooked gems or high-potential sectors. Use the Simply Wall Street Screener to steer your portfolio toward the kind of stocks that make you feel confident at every stage.

- Unlock real value by targeting undervalued stocks based on cash flows stocks that are trading below their cash flow potential. This approach can help you position yourself for gains that many investors may miss.

- Boost your passive income with dividend stocks with yields > 3% options offering reliable yields above 3%. These can be effective for building wealth in any market environment.

- Access the innovators transforming healthcare by considering healthcare AI stocks companies that use advanced artificial intelligence to improve patient outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives