- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Could Analyst Optimism on Neurotoxicity Give Arcellx (ACLX) an Edge in CAR-T Competition?

Reviewed by Sasha Jovanovic

- In late September 2025, Arcellx’s Chief Medical Officer sold 73 shares under a pre-arranged trading plan, while analysts cited improved regulatory prospects for the company’s anito-cel therapy targeting CAR-T treatment markets.

- Market participants are paying close attention to how Arcellx’s therapy compares to Johnson & Johnson’s Carvykti, especially regarding neurotoxicity outcomes in the CAR-T space.

- We'll explore how the regulatory advancements and neurotoxicity comparisons could shape Arcellx's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Arcellx's Investment Narrative?

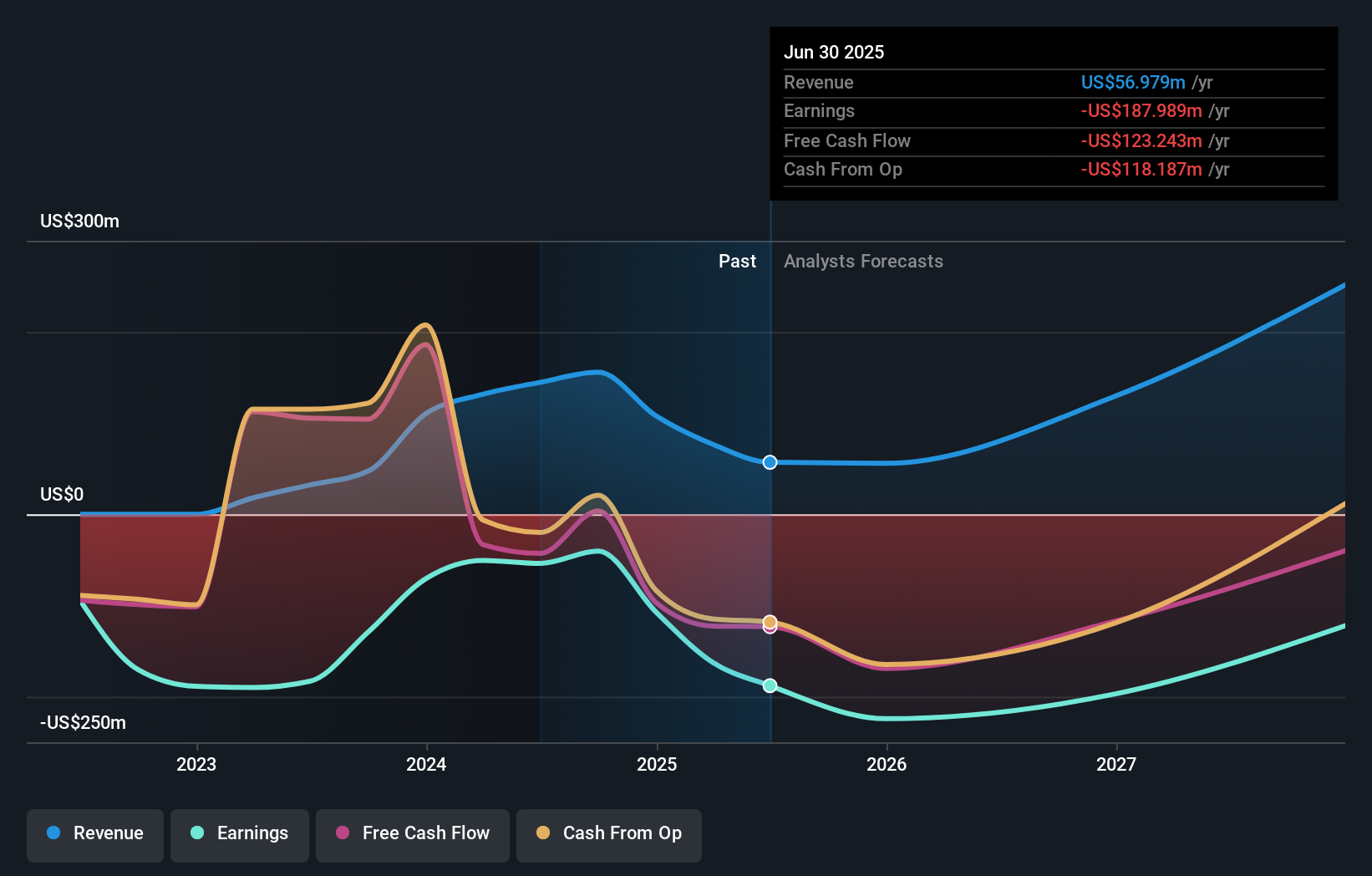

For anyone considering Arcellx, the core appeal lies in belief that its anito-cel therapy will become a meaningful contender in the fast-evolving CAR-T landscape, particularly as regulatory clarity improves and neurotoxicity concerns remain front-and-center. The recent news of the Chief Medical Officer’s minor stock sale and analyst price target increase fits squarely into this narrative, signaling that sentiment is shifting on regulatory risk, likely reinforcing confidence in upcoming commercial launch plans and late-stage trial progress. That said, Arcellx’s financials remain sharply negative, with widening losses, no forecasted path to profitability in the near term, and shares trading at a notable premium to industry book values. The news event is unlikely to materially change these key short-term catalysts or the biggest risks, such as steep operating losses or execution risk versus heavyweight competitors, but it’s another sign that regulatory milestones and neurotoxicity results will stay pivotal in shaping sentiment.

However, concerns over continued unprofitability remain front of mind for investors.

Exploring Other Perspectives

Explore 4 other fair value estimates on Arcellx - why the stock might be worth over 6x more than the current price!

Build Your Own Arcellx Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arcellx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcellx's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives