- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

Arcellx (ACLX): Assessing Valuation Following Regulatory Tailwinds and Late-Stage Progress for Lead CAR-T Therapy

Reviewed by Kshitija Bhandaru

Arcellx (ACLX) is drawing attention after recent regulatory developments cleared hurdles for its lead CAR-T therapy, anitocabtagene autoleucel. Momentum appears to be building as late-stage clinical progress comes under a brighter spotlight.

See our latest analysis for Arcellx.

Recent weeks have seen Arcellx benefit from a more upbeat regulatory climate and renewed attention on its lead CAR-T therapy. Investor sentiment has been buoyed by confidence in late-stage trial progress and competitor comparisons. Despite brief dips, the stock’s 30-day share price return of 19.4% and three-year total shareholder return approaching 350% highlight clear momentum building for the company as commercial prospects come into focus.

With the biotech sector heating up, it’s the perfect moment to see which other innovators are making moves. Check out See the full list for free..

With shares rallying sharply in recent weeks, investors are now asking whether Arcellx is still trading below its true value, or if the market has already priced in its future growth. Is this a buying opportunity, or has optimism run ahead of reality?

Price-to-Book Ratio of 12.3x: Is it justified?

Arcellx trades at a price-to-book ratio of 12.3 times, which is slightly higher than its peer average of 12.1 times and far above the broader US Biotechs industry average of 2.6 times. This premium suggests the market is attributing significant value to Arcellx's future prospects and clinical pipeline, despite its current unprofitable status.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets. For biotech firms, especially those not yet profitable, this multiple often reflects expectations about future commercial successes rather than historical earnings or assets. In Arcellx's case, this elevated ratio signals strong optimism built on rapid revenue growth potential and positive regulatory tailwinds.

Compared to the industry norm, Arcellx's 12.3x price-to-book ratio stands out as particularly expensive. The US Biotech sector as a whole sits at just 2.6x, making Arcellx's premium difficult to ignore. The company's valuation hinges on the market's belief in outpaced growth versus peers, but investors should be mindful of the gap.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 12.3x (OVERVALUED)

However, risks remain, including clinical trial setbacks or delays in regulatory approvals. These factors could quickly change sentiment around Arcellx’s current valuation.

Find out about the key risks to this Arcellx narrative.

Another View: What Does the SWS DCF Model Show?

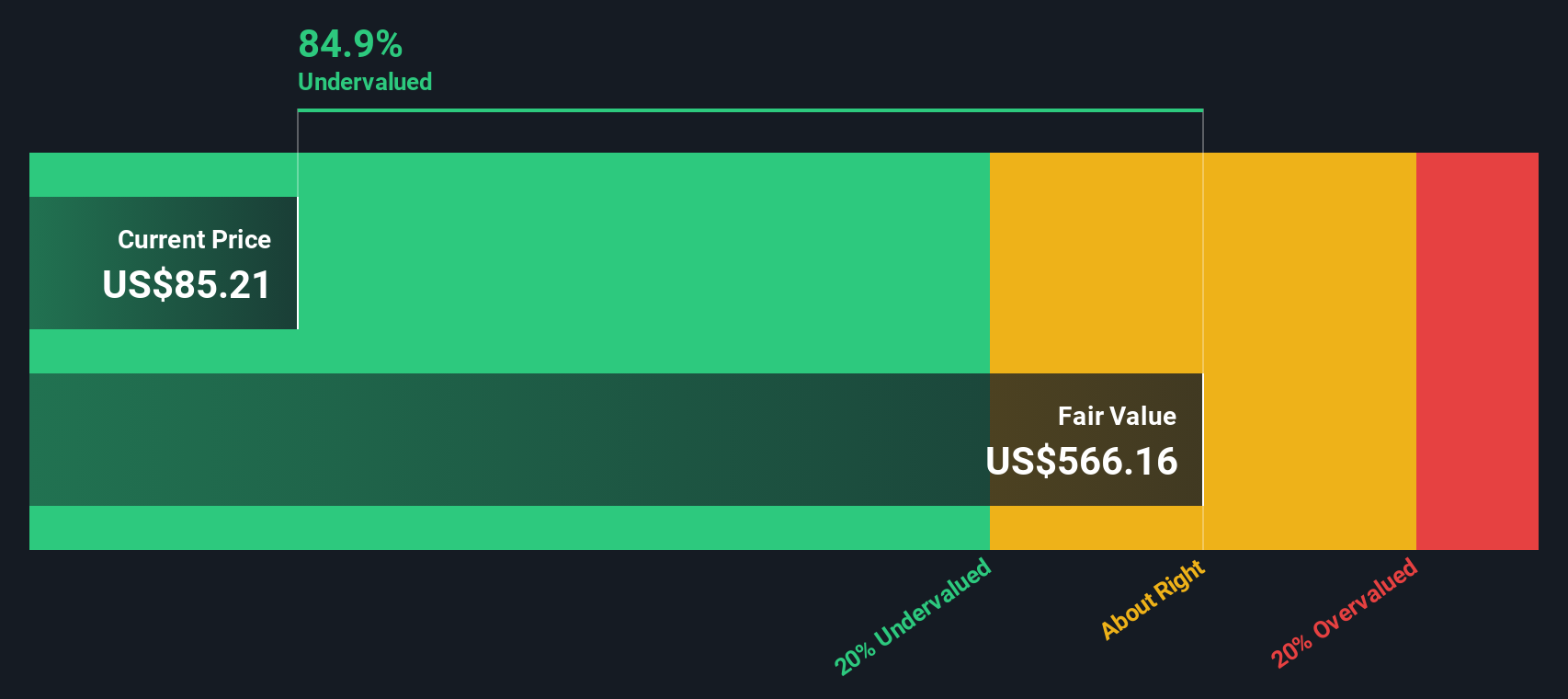

Looking at Arcellx from another angle, our DCF model reaches a notably different conclusion. The SWS DCF suggests Arcellx's fair value could be over $550 per share, which is dramatically higher than its current price. If the cash flow potential is accurate, could the market be overlooking something significant?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you want to dig into the details yourself or approach Arcellx from your own perspective, it only takes a few minutes to build your own view, so why not Do it your way.

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let exciting opportunities slip by—boost your portfolio with fresh stocks and themes uncovered by some of the market’s smartest tools. Make your next move count.

- Capture potential big winners early by scanning for growth stories among these 3582 penny stocks with strong financials with standout financial health.

- Unlock attractive returns by targeting these 19 dividend stocks with yields > 3% offering yields above 3% for steady income.

- Ride the next tech revolution by uncovering tomorrow's breakthroughs with these 24 AI penny stocks leading AI innovations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives