- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

US High Growth Tech Stocks To Watch In Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market faces a slight downturn with key indices like the S&P 500 and Nasdaq Composite experiencing declines, investors are keenly observing how ongoing tariff discussions and Federal Reserve decisions might impact economic growth and corporate profits. In this environment of cautious optimism, identifying high-growth tech stocks that can navigate these challenges is crucial for building a resilient portfolio.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.40% | 34.10% | ★★★★★★ |

| Ardelyx | 20.63% | 59.87% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.42% | 58.25% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| TG Therapeutics | 26.12% | 38.99% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

MannKind (NasdaqGM:MNKD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MannKind Corporation is a biopharmaceutical company that develops and commercializes therapeutic products for endocrine and orphan lung diseases in the United States, with a market cap of approximately $1.52 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which amounts to $285.50 million.

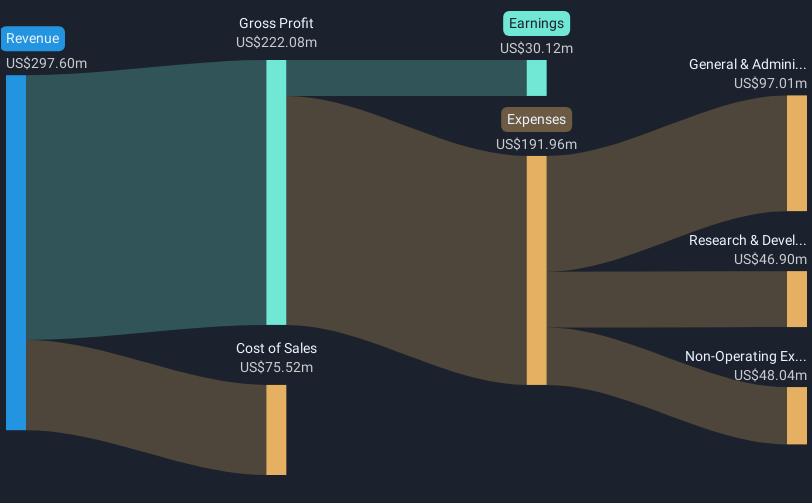

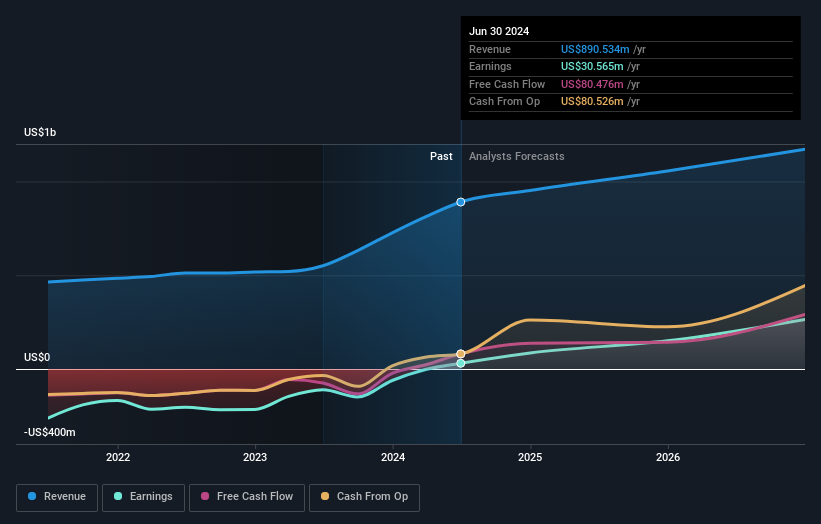

MannKind's recent achievements underscore its potential in the high-tech biopharmaceutical sector, particularly with its innovative inhaled insulin products. In 2024, the company reported a significant revenue increase to $285.5 million from $198.96 million the previous year and turned a net profit of $27.59 million, reversing a prior loss of $11.94 million. These financial improvements coincide with promising clinical trial outcomes for Afrezza, enhancing its market position amidst growing demand for non-invasive treatment options. Furthermore, MannKind's active participation in major healthcare conferences and its strategic R&D investments reflect a robust commitment to advancing diabetes care through technological innovation.

- Dive into the specifics of MannKind here with our thorough health report.

Assess MannKind's past performance with our detailed historical performance reports.

ACADIA Pharmaceuticals (NasdaqGS:ACAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ACADIA Pharmaceuticals Inc. is a biopharmaceutical company dedicated to developing and commercializing medicines for central nervous system disorders and rare diseases in the United States, with a market cap of approximately $2.49 billion.

Operations: The company generates revenue primarily through the development and commercialization of innovative medicines, amounting to $957.80 million. The focus is on central nervous system disorders and rare diseases within the U.S. market.

ACADIA Pharmaceuticals, demonstrating robust growth in the biotech sector, reported a notable increase in revenue to $259.6 million for Q4 2024, up from $231.04 million the previous year. This financial uplift is coupled with a surge in net income to $143.74 million from $45.8 million, reflecting an earnings growth of 19.6% annually which surpasses the US market average of 13.9%. The company's commitment to innovation is evident from its R&D focus, crucially supporting its pipeline development and regulatory successes such as DAYBUE’s FDA approval for Rett syndrome treatment across various age groups. ACADIA's strategic presentations at key industry conferences and recent advancements in clinical trials underscore its proactive approach in addressing complex medical needs while outpacing typical market growth rates.

- Navigate through the intricacies of ACADIA Pharmaceuticals with our comprehensive health report here.

Understand ACADIA Pharmaceuticals' track record by examining our Past report.

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of approximately $676.05 million.

Operations: The company generates revenue through its insurance customer acquisition platform, primarily categorized under Internet Information Providers, amounting to $1.00 billion.

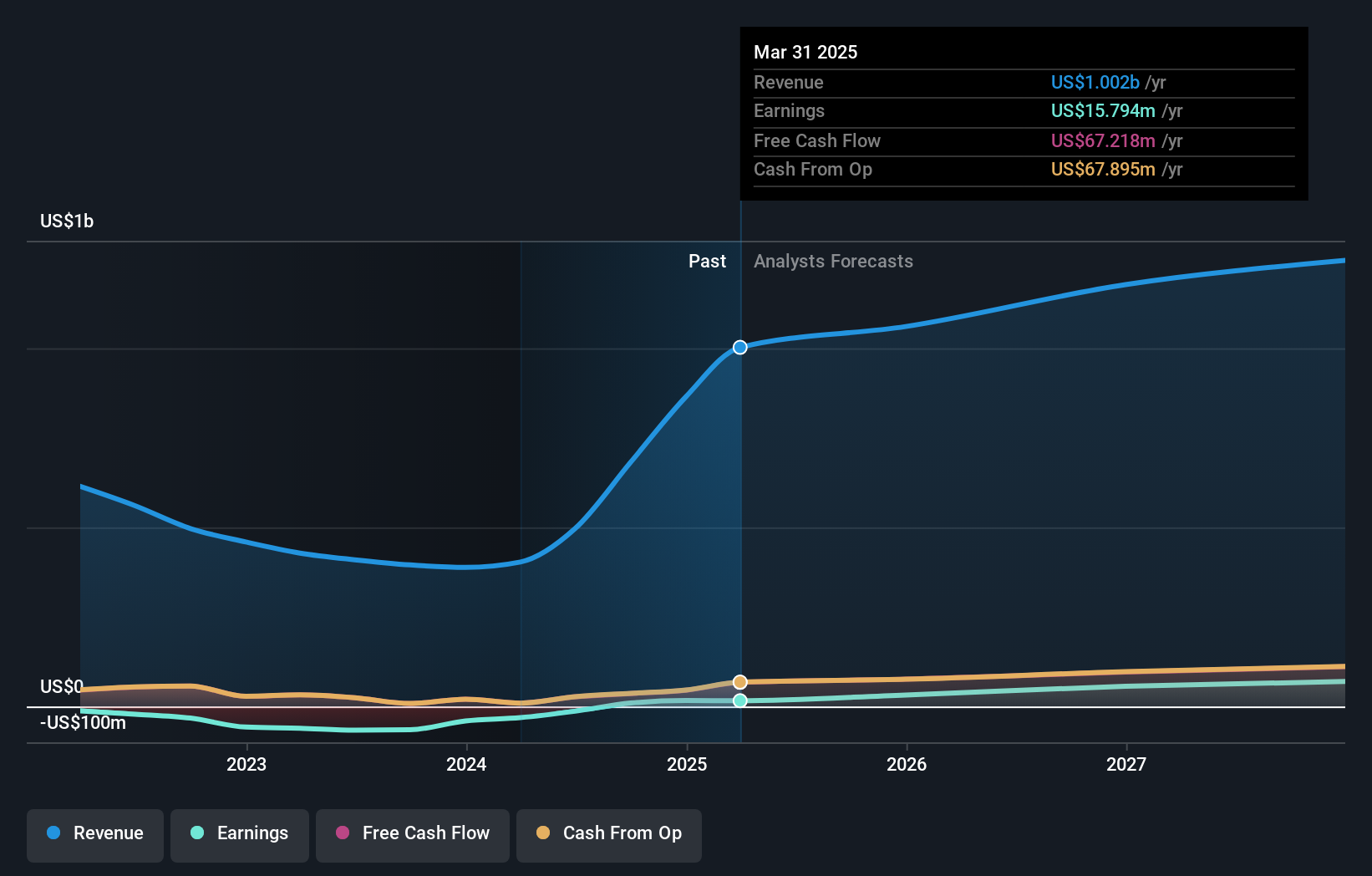

MediaAlpha, amidst a transformative phase in the tech sector, has shown resilience and adaptability. With a reported 86% year-over-year projected revenue increase for Q1 2025 and a shift from net losses to earnings—USD 16.63 million annually—the company's trajectory is noteworthy. This growth is underpinned by strategic leadership appointments aimed at enhancing its market position within the insurance tech landscape, such as Keith Cramer’s role as Chief Revenue Officer focusing on Property & Casualty Insurance verticals. Moreover, MediaAlpha’s R&D commitment is reflected in its substantial investment relative to revenue, positioning it well for sustained innovation and competitive edge in evolving digital marketspaces.

- Click here to discover the nuances of MediaAlpha with our detailed analytical health report.

Gain insights into MediaAlpha's past trends and performance with our Past report.

Key Takeaways

- Reveal the 231 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MannKind, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives