- United States

- /

- Biotech

- /

- NasdaqGS:ABUS

Arbutus Biopharma Corporation's (NASDAQ:ABUS) Shares Climb 29% But Its Business Is Yet to Catch Up

Arbutus Biopharma Corporation (NASDAQ:ABUS) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

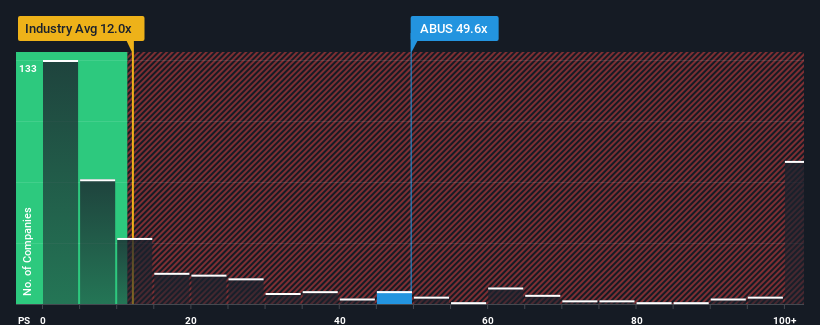

After such a large jump in price, Arbutus Biopharma may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 49.6x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 12x and even P/S lower than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Arbutus Biopharma

What Does Arbutus Biopharma's P/S Mean For Shareholders?

Arbutus Biopharma hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Arbutus Biopharma.How Is Arbutus Biopharma's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Arbutus Biopharma's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 61%. Even so, admirably revenue has lifted 72% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to slump, contracting by 12% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 210% growth per year, that's a disappointing outcome.

With this information, we find it concerning that Arbutus Biopharma is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Arbutus Biopharma's P/S Mean For Investors?

Shares in Arbutus Biopharma have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Arbutus Biopharma currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Arbutus Biopharma that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ABUS

Arbutus Biopharma

A biopharmaceutical company, develops novel therapeutics for chronic Hepatitis B virus (HBV) infection in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives