- United States

- /

- Interactive Media and Services

- /

- OTCPK:LOVL.Q

Did You Manage To Avoid Spark Networks's (NYSEMKT:LOV) 10% Share Price Drop?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in Spark Networks SE (NYSEMKT:LOV) have tasted that bitter downside in the last year, as the share price dropped 10%. That's well bellow the market return of 6.2%. We wouldn't rush to judgement on Spark Networks because we don't have a long term history to look at. The share price has dropped 20% in three months.

View our latest analysis for Spark Networks

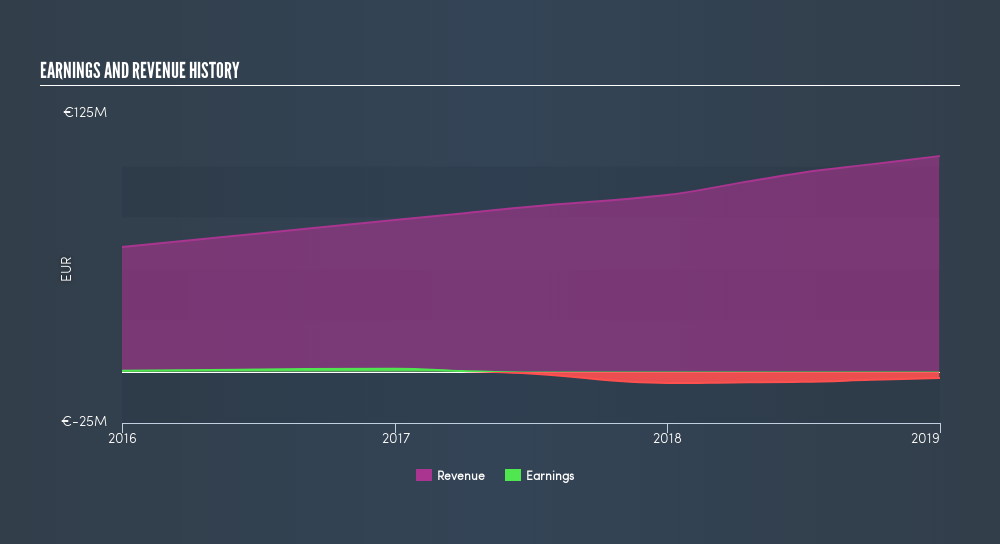

Spark Networks isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, Spark Networks increased its revenue by 22%. We think that is pretty nice growth. Meanwhile, the share price is down 10% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

This free interactive report on Spark Networks's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Spark Networks shareholders are down 10% for the year, the market itself is up 6.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's worth noting that the last three months did the real damage, with a 20% decline. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:LOVL.Q

Spark Networks

Operates online dating sites and mobile applications in the he United States, Canada, Australia, the United Kingdom, and France.

Medium and slightly overvalued.

Similar Companies

Market Insights

Community Narratives