Zhihu (NYSE:ZH) Turns Profitable; Net Margin Inflection Supports Bullish Investor Narratives

Reviewed by Simply Wall St

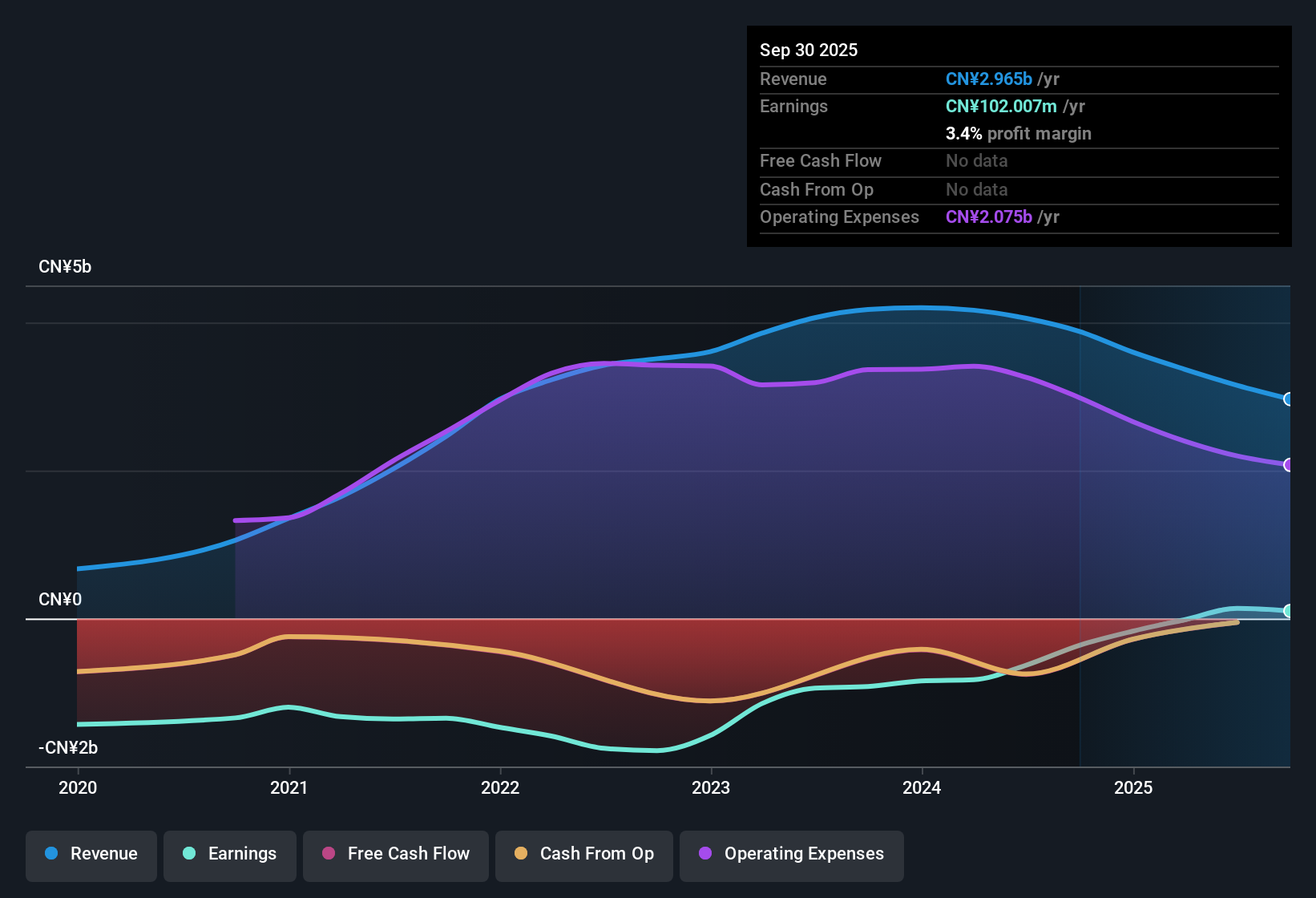

Zhihu (NYSE:ZH) just released its Q3 2025 earnings, posting revenue of 658.9 million CNY and a basic EPS of -0.58 CNY, with net income at -46.7 million CNY. Over the past year, the company’s revenue has ranged from 845 million CNY in Q3 2024 to a peak of 859.2 million CNY in Q4 2024. EPS figures have fluctuated sharply across quarters. With profit margins showing a pivotal shift, attention is focused on whether Zhihu can sustain this momentum amid uneven top-line performance.

See our full analysis for Zhihu.Up next, we’re laying out how these hard numbers compare to the prevailing narratives in the market, highlighting where consensus holds and where surprises may be hiding.

See what the community is saying about Zhihu

Net Margin Swings Signal Inflection

- Trailing 12-month net income reached 102.0 million CNY, marking a profit reversal from consistent losses in previous years and confirming the first full-year period of positive net margins for Zhihu.

- Consensus narrative points out that this profit milestone is heavily anchored in operational efficiency gains and successful integration of AI moderation, which has sharply reduced costs relative to stagnant revenue growth.

- While revenue climbed just 0.9% year over year, analysts credit margin expansion and cost discipline as the key levers. This challenges worries that topline stagnation alone would cap profit upside.

- Consensus also argues that this earnings quality, combined with increased trust and recurring profitability, could allow further margin improvement as current AI strategies scale.

What stands out is how dramatically cost and productivity changes have transformed the profit outlook, even before revenue momentum picks up. Consensus expects these trends to continue driving upside if scaled further. See how analysts summarize the full narrative and what they’re watching next: 📊 Read the full Zhihu Consensus Narrative.

Share Price Undervalued vs. DCF Fair Value

- At 3.66 CNY, Zhihu’s share price trades at a steep discount compared to the latest DCF fair value estimate of 15.44 CNY, highlighting the valuation gap for investors.

- Consensus narrative notes that this gap is shaped by a combination of strong forward earnings expectations and modest revenue forecasts.

- Analyst models imply a price-to-earnings ratio of 21.4x, below the peer group average of 37.4x, but above the industry mean of 19.5x. This suggests valuation is at a crossroads between sector optimism and stock-specific caution.

- Consensus draws attention to a 17% upside implied by analyst price targets, but cautions that this discount depends on Zhihu achieving its aggressive profit margin projections over the next three years.

Revenue Growth Lags Industry, Profit Surges

- Revenue for the trailing twelve months increased to 2.96 billion CNY, reflecting just 0.9% annual growth, trailing far behind the broader US market’s 10.5% average. However, EPS for the same period flipped to a positive 1.25 CNY.

- Consensus narrative stresses that, despite slow topline growth, analysts remain focused on Zhihu’s rapid earnings growth forecasts.

- Forecasted earnings per share are expected to more than triple by 2028, with profit margins rising from 4.4% to 10.4% in the next three years if current momentum continues.

- Consensus notes that while revenue figures may disappoint relative to sector standards, the core thesis rests on cost control and business quality driving higher earnings regardless of the sluggish revenue trend.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zhihu on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Shape your own view and craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Zhihu.

See What Else Is Out There

Zhihu’s biggest challenge is its sluggish revenue growth, which lags well behind industry averages despite major gains in profitability.

If slow top-line momentum is a concern, use our stable growth stocks screener (2073 results) to focus on companies that consistently deliver both reliable revenue and earnings expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhihu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZH

Zhihu

Operates an online content community in the People’s Republic of China.

Good value with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026