- United States

- /

- Entertainment

- /

- NYSE:WWE

World Wrestling Entertainment (NYSE:WWE) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that World Wrestling Entertainment, Inc. (NYSE:WWE) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for World Wrestling Entertainment

How Much Debt Does World Wrestling Entertainment Carry?

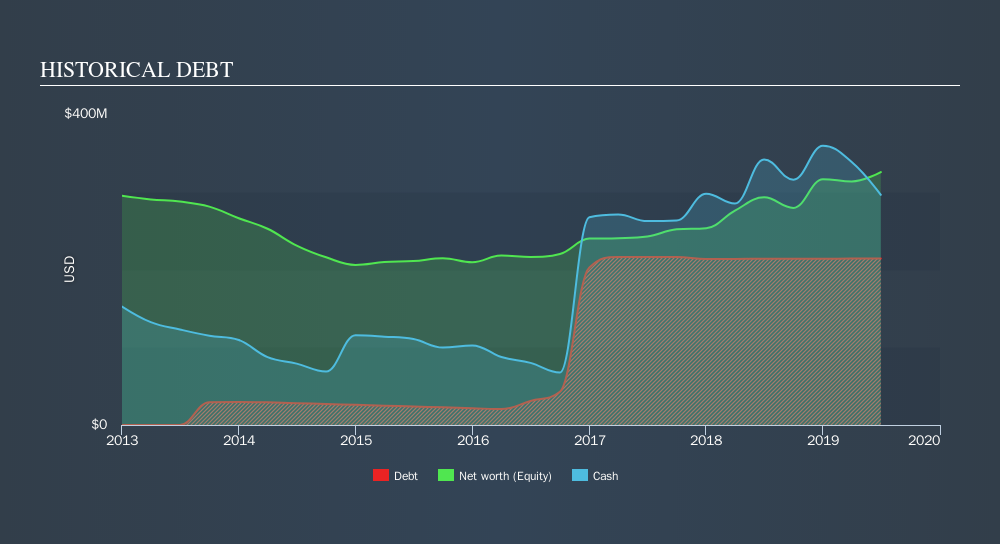

The chart below, which you can click on for greater detail, shows that World Wrestling Entertainment had US$214.1m in debt in June 2019; about the same as the year before. However, its balance sheet shows it holds US$296.1m in cash, so it actually has US$81.9m net cash.

A Look At World Wrestling Entertainment's Liabilities

We can see from the most recent balance sheet that World Wrestling Entertainment had liabilities of US$374.1m falling due within a year, and liabilities of US$43.5m due beyond that. On the other hand, it had cash of US$296.1m and US$132.1m worth of receivables due within a year. So it actually has US$10.5m more liquid assets than total liabilities.

This state of affairs indicates that World Wrestling Entertainment's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$5.52b company is struggling for cash, we still think it's worth monitoring its balance sheet. Succinctly put, World Wrestling Entertainment boasts net cash, so it's fair to say it does not have a heavy debt load!

But the bad news is that World Wrestling Entertainment has seen its EBIT plunge 18% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if World Wrestling Entertainment can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While World Wrestling Entertainment has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, World Wrestling Entertainment recorded free cash flow worth a fulsome 95% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that World Wrestling Entertainment has net cash of US$81.9m, as well as more liquid assets than liabilities. The cherry on top was that in converted 95% of that EBIT to free cash flow, bringing in US$52m. So we don't have any problem with World Wrestling Entertainment's use of debt. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that World Wrestling Entertainment insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:WWE

World Wrestling Entertainment

World Wrestling Entertainment, Inc., an integrated media and entertainment company, engages in the sports entertainment business in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives