- United States

- /

- Interactive Media and Services

- /

- NYSE:TWTR

Twitter, Inc.'s (NYSE:TWTR) Latest Earnings Leave Us With More Questions

Twitter, Inc. (NYSE: TWTR) unquestionably left a significant mark in the 1st half of 2022. As the drama still unfolds, this is the most straightforward way to look at the situation: Twitter, the company that didn’t want to be bought out, is suing Elon Musk (who initially wanted to buy Twitter but now doesn’t want to), to force him to buy Twitter.

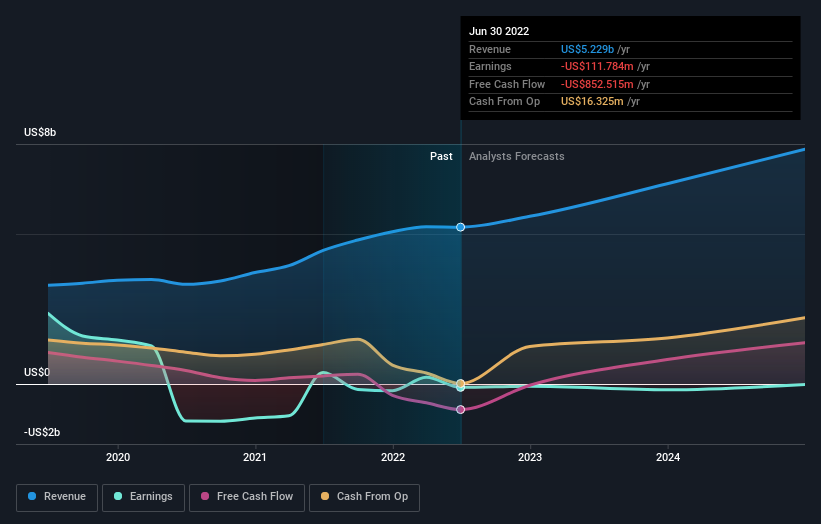

As ad revenue dips across the board, platform earnings seem to be suffering – bringing the growth story and US$44b sticker price into question.

Twitter’s second-quarter 2022 results:

- US$0.35 loss per share (down from US$0.082 profit in 2Q 2021).

- Revenue: US$1.18b (down 1.2% from 2Q 2021).

- Net loss: US$270.0m (down US$335.7m from profit in 2Q 2021).

Revenue missed analyst estimates by 12%. Earnings per share (EPS) also missed analyst estimates by 277%.

Other highlights:

- Costs and expenses: US$1.52b (+31% Y/Y)

- Subscription and other revenue: US$101m (-27% Y/Y)

Keen observers might notice a big increase in costs and expenses, that rose over 30%.

- Why are the costs up so much if the growth is missing?

- Why is this amount exceeding the inflation by a factor of 3?

- Which new products are in the pipeline and responsible for such costs?

There are too many questions at the moment, and despite the user growth, it didn’t translate into revenue growth.

Who owns Twitter? (Except for Elon Musk)

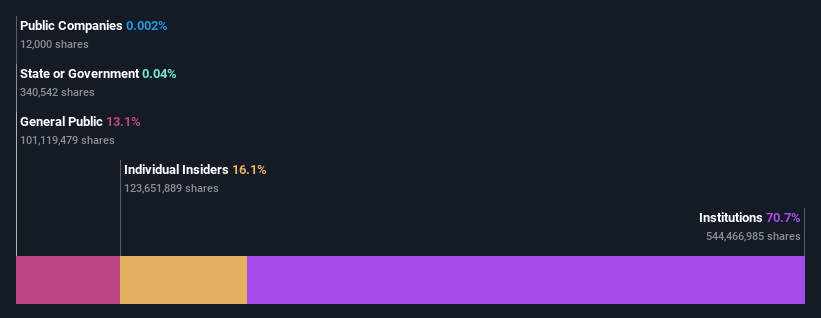

Twitter has a market capitalization of US$30b, so it's too big to fly under the radar. We'd expect to see institutions and retail investors owning a portion of the company. Looking at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry.

View our latest analysis for Twitter

What Does The Institutional Ownership Tell Us About Twitter?

Institutional investors compare their own returns to the returns of a commonly followed index. So they generally consider buying larger companies included in the relevant benchmark index.

Twitter already has institutions on the share registry, and they own a respectable stake in the company. This implies that the analysts working for those institutions have looked at the stock and like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'.

You can see Twitter's historical earnings and revenue below, but remember there's always more to the story.

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences.

The Vanguard Group, Inc. is currently the largest shareholder, with 11% of shares outstanding. For context, the second largest shareholder holds about 9.5% of the shares outstanding, followed by ownership of 6.7% by the third-largest shareholder. Looking at the shareholder registry, we can see that the top 11 shareholders control 50% of the ownership, meaning that no single shareholder has a majority interest in the ownership.

Insider Ownership Of Twitter

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management runs the business, but the CEO will answer to the board, even if they are a member of it.

Our information suggests that insiders maintain a significant holding in Twitter, Inc. It has a market capitalization of just US$30b, and insiders have US$4.9b worth of shares in their names. That's quite significant. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 13% ownership, the general public, mostly comprised of individual investors, has some degree of sway over Twitter. While this group can't necessarily call the shots, it can certainly influence how the company is run.

Next Steps:

Twitter's latest earnings are not inspiring confidence, yet Elon Musk's takeover drama has created some kind of price floor. It is a very dangerous situation since the upside is at US$54.20, but the downside is unknown. Any breaking news could collapse the stock. But, for the moment's notice, that is unlikely to happen until the case enters the Delaware court in October.

While it is well worth considering the different groups that own a company, other factors are even more important. Consider, for instance, the ever-present investment risk. We've identified 1 warning sign with Twitter, and understanding them should be part of your investment process.

But ultimately, it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Twitter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:TWTR

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives