- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music (NYSE:TME) Valuation in Focus After Strong Q2 Earnings and Rapid Revenue Growth

Reviewed by Simply Wall St

Tencent Music Entertainment Group (NYSE:TME) just released its second-quarter earnings, and investors are taking notice. The company delivered a strong set of numbers with both revenue and net income climbing significantly compared to last year. With these results in hand, many are wondering whether the upbeat financials will spark a new wave of interest in the stock or if the gains are already reflected in its price.

This upbeat report appears to fit a wider pattern for the company. After a surge of more than 41% in the past three months and a remarkable 140% leap over the past year, Tencent Music Entertainment Group has clearly been on investors’ watchlists. These strong earnings follow a series of positive quarters and steady revenue growth, setting a tone that appears more optimistic than what was seen last year.

After such a run-up, is Tencent Music Entertainment Group trading at a bargain given its current momentum and results, or is the market already pricing in all the good news and future growth?

Most Popular Narrative: 9.9% Undervalued

According to community narrative, Tencent Music Entertainment Group is currently viewed as undervalued, with a fair value estimate above its latest closing price. The valuation is driven by bullish assumptions around future revenue growth, evolving user engagement, and expanded earnings potential in the coming years.

Proprietary content development, exclusive partnerships with Korean labels and Chinese artists, and investments in original artist incubation strengthen content differentiation, support premium pricing, and reduce long-term content costs. These factors contribute to higher gross margins and a defensible market share.

What secret numbers are powering this bullish forecast? The narrative points to sky-high growth projections and bold earnings targets, but leaves the real math hidden. This raises questions about just how much runway is expected. Want to discover which metrics analysts are quietly using to justify the company's fair value? The answers are all in the details of the full narrative.

Result: Fair Value of $28.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising regulatory pressures and increased spending on new ventures could constrain Tencent Music’s profit growth. This may challenge the optimistic narrative outlined by analysts.

Find out about the key risks to this Tencent Music Entertainment Group narrative.Another View: SWS DCF Model Offers a Caution

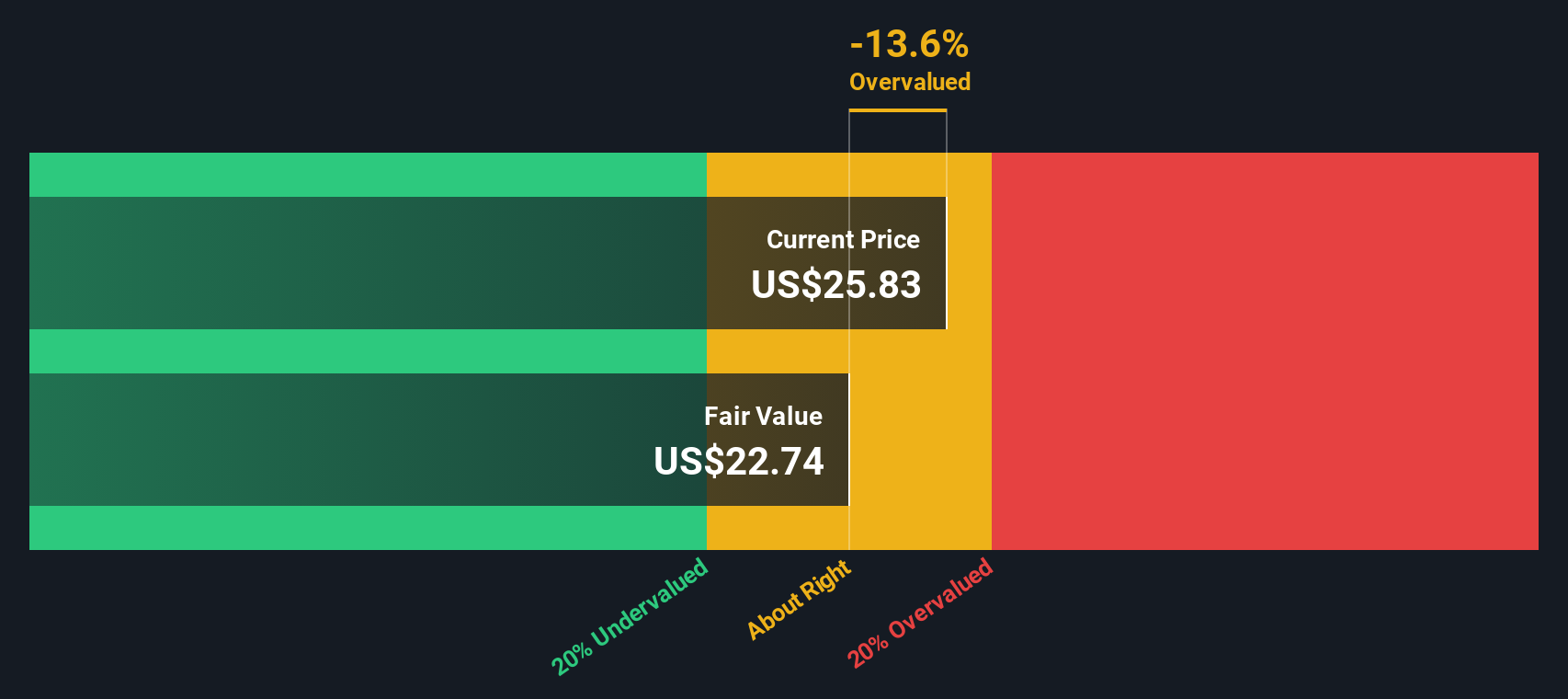

While the earlier valuation suggested Tencent Music Entertainment Group is trading below fair value, our DCF model takes a more conservative stance. This approach raises new questions about how much upside may remain for the stock.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tencent Music Entertainment Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tencent Music Entertainment Group Narrative

If you are not fully convinced by these narratives or would rather dig into the numbers yourself, you can assemble your own take in just a few minutes, or simply do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tencent Music Entertainment Group.

Ready for Your Next Investment Move?

Staying ahead means always tracking new opportunities and thinking differently. The market is filled with high-potential stocks beyond Tencent Music Entertainment Group, and now is the time to spot tomorrow’s trends before the crowd. Use these specially curated stock ideas to keep your portfolio on the front foot:

- Target steady growth and income by surveying leading businesses with yields above 3%. dividend stocks with yields > 3% gives you instant access to companies rewarding shareholders for the long haul.

- Uncover hidden stars shaping healthcare’s future as you explore innovation and disruption among healthcare AI stocks making breakthroughs in medical technology with AI.

- Tap into the next frontier of digital assets by reviewing the most credible market players in cryptocurrency and blockchain stocks actively driving advancements in blockchain and crypto finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives