- United States

- /

- Entertainment

- /

- NYSE:TME

Tencent Music (NYSE:TME): Examining Valuation Following US-China Tariff Tensions and Tech Stock Declines

Reviewed by Kshitija Bhandaru

Tencent Music Entertainment Group (NYSE:TME) stock slipped alongside other US-listed Chinese tech firms after President Donald Trump floated the idea of sharply increasing tariffs on Chinese imports. The announcement fueled renewed investor caution over geopolitical risks and US-China relations.

See our latest analysis for Tencent Music Entertainment Group.

Tencent Music’s recent share price drop comes after an exceptional run this year. Despite the latest 4.4% pullback and ongoing trade tensions, its year-to-date price return is still an impressive 98%. Momentum has cooled a bit from its peak, but the company’s three-year total shareholder return of nearly 500% shows just how much long-term optimism remains behind the story.

If market volatility has you scanning for new opportunities, it might be an ideal time to expand your search and discover fast growing stocks with high insider ownership

With shares still well below most analyst price targets and strong multi-year gains on the scoreboard, the key question is whether Tencent Music remains undervalued today or if the current price already reflects all its future upside potential.

Most Popular Narrative: 20.9% Undervalued

With Tencent Music's fair value set at $28.34 by the most followed narrative, the last close price of $22.43 leaves considerable room for potential upside, sparking debate over what is truly driving analyst optimism.

Proprietary content development, exclusive partnerships (with Korean labels and Chinese artists), and investments in original artist incubation strengthen content differentiation, support premium pricing, and reduce long-term content costs. These factors contribute to higher gross margins and defendable market share.

What is behind this compelling price target? The narrative hinges on a transformation of revenue streams and margin power, along with ambitious forecasts for future profitability. Want to know which assumptions took analysts by surprise? You will need to see the full story.

Result: Fair Value of $28.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing growth in social entertainment and increased regulatory scrutiny could challenge Tencent Music’s profit outlook and long-term revenue predictability.

Find out about the key risks to this Tencent Music Entertainment Group narrative.

Another View: What Do the Market Ratios Say?

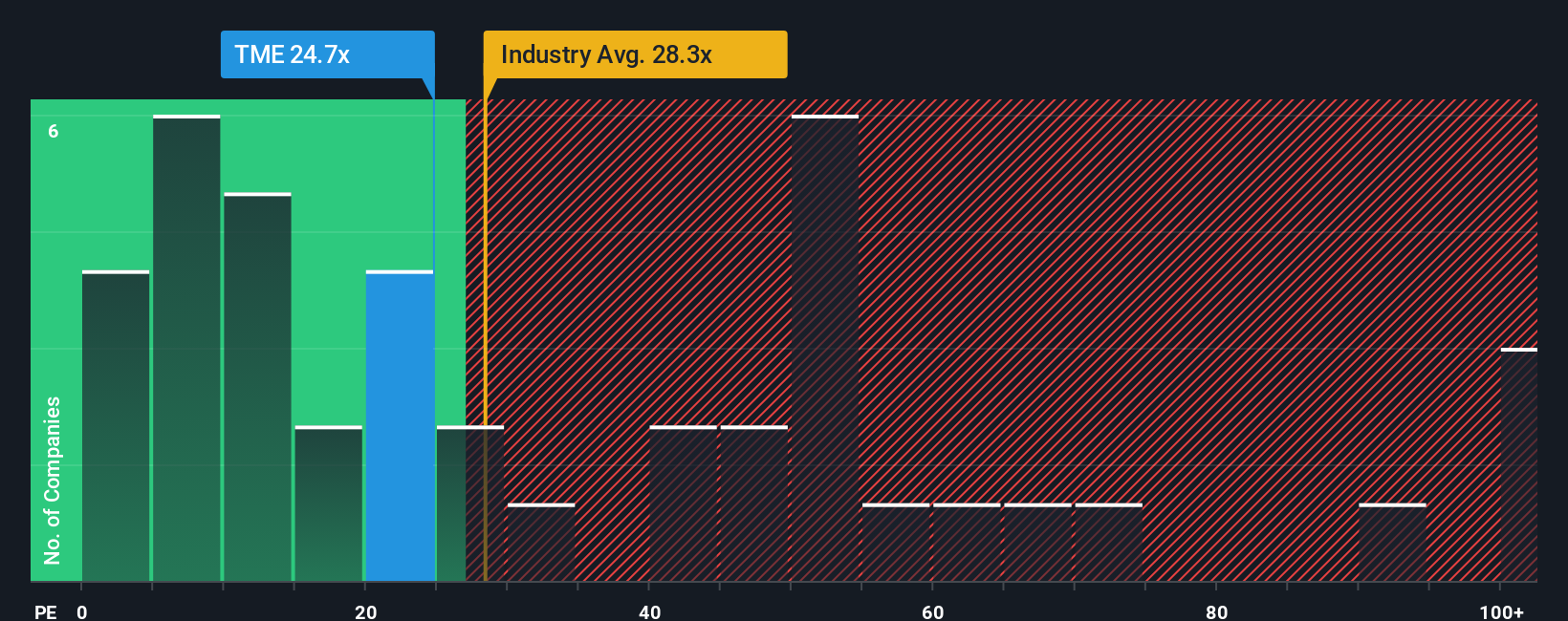

Market comparisons add a different perspective. Tencent Music is trading on a price-to-earnings ratio of 24.7 times, which is lower than the US Entertainment industry average of 28.3 times and well below the peer average of 71.7 times. Even so, it matches the fair ratio of 24.7. Does this suggest the share price may already reflect most of the opportunity, or is there still room for a re-rating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tencent Music Entertainment Group Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft your own story and reach your own conclusions. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Tencent Music Entertainment Group.

Looking for more investment ideas?

Set yourself up for investing success by checking out fresh stock picks tailored to different investing strategies. Don’t let opportunity pass you by.

- Tap into the potential of small companies showing strong fundamentals by checking out these 3586 penny stocks with strong financials with robust financials.

- Catch the momentum in healthcare innovation through these 33 healthcare AI stocks targeting medical breakthroughs and smart diagnostics.

- Energize your portfolio with future-focused earnings by considering these 19 dividend stocks with yields > 3% offering high yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Music Entertainment Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TME

Tencent Music Entertainment Group

Operates online music entertainment platforms that provides music streaming, online karaoke, and live streaming services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives