- United States

- /

- Biotech

- /

- NasdaqGS:HALO

High Growth Tech Stocks In The US Market With Promising Potential

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a surge, with the S&P 500 and Nasdaq Composite reaching new all-time highs following a robust June jobs report that exceeded expectations and fueled optimism in tech stocks. In this environment of strong economic indicators, identifying high growth tech stocks involves looking for companies with innovative technologies and solid business models that can capitalize on favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Circle Internet Group | 32.27% | 61.44% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| Ardelyx | 21.02% | 61.29% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.72% | 59.95% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 23.02% | 103.97% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Halozyme Therapeutics (HALO)

Simply Wall St Growth Rating: ★★★★☆☆

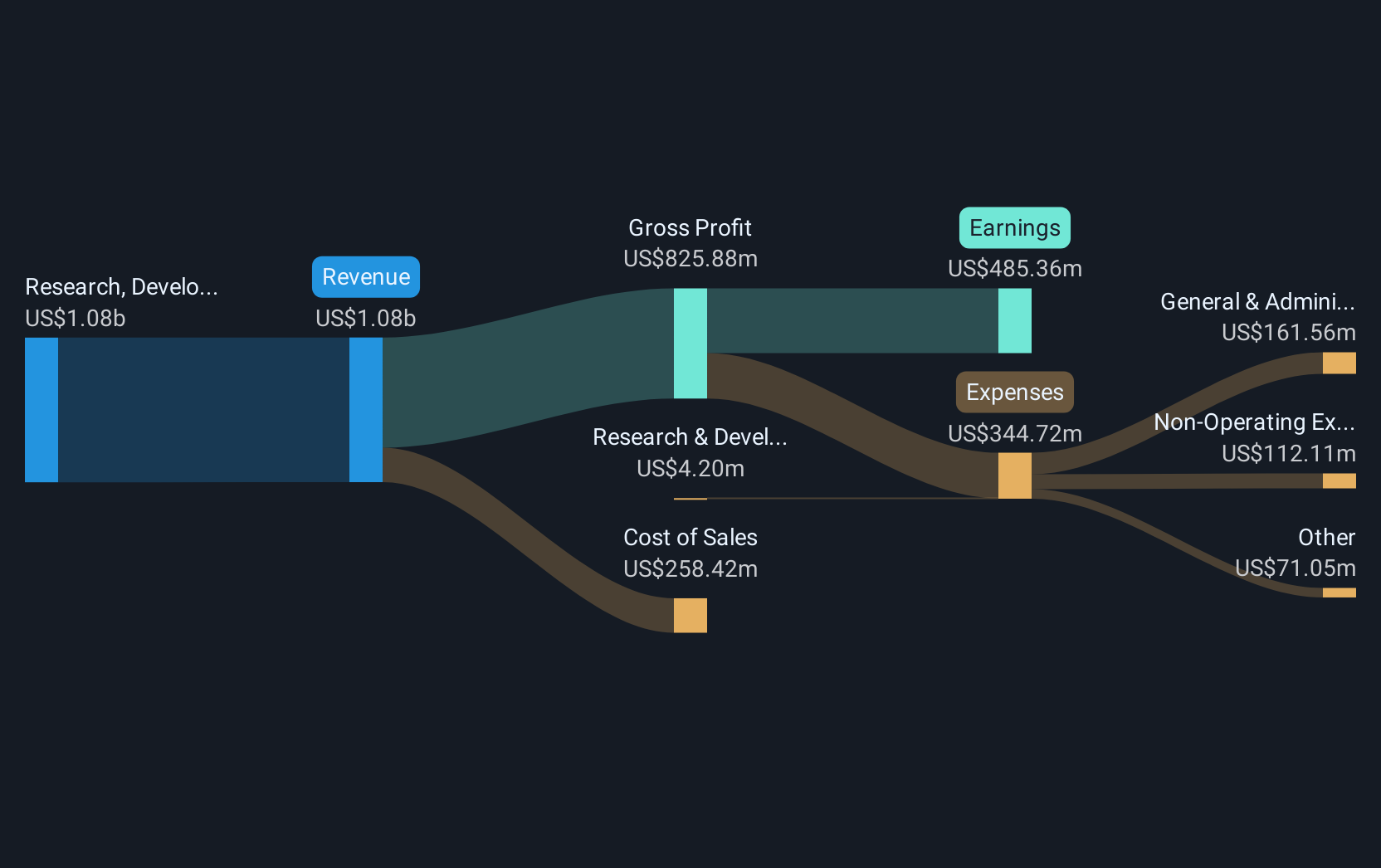

Overview: Halozyme Therapeutics, Inc. is a biopharmaceutical company that focuses on the research, development, and commercialization of proprietary enzymes and devices globally, with a market cap of $6.52 billion.

Operations: Halozyme Therapeutics generates revenue primarily through the research, development, and commercialization of its proprietary enzymes, amounting to $1.08 billion.

Halozyme Therapeutics has recently demonstrated robust growth, with a notable 52.2% earnings increase over the past year, surpassing the biotech industry's average of 21.7%. This growth trajectory is supported by strategic index reclassifications, seeing HALO added to both the Russell 1000 and Midcap Growth Indices while being removed from smaller Russell 2000 indices. Furthermore, HALO's innovative ENHANZE® technology contributed to argenx’s EC-approved VYVGART® for CIDP treatment—marking significant advancements in chronic inflammatory treatments. With revenue projected to rise at an annual rate of 12.4%, and earnings expected to grow faster than the US market average at approximately 14.8% annually, Halozyme is positioning itself as a dynamic player in high-growth biotechnology sectors.

- Click to explore a detailed breakdown of our findings in Halozyme Therapeutics' health report.

Understand Halozyme Therapeutics' track record by examining our Past report.

Ultragenyx Pharmaceutical (RARE)

Simply Wall St Growth Rating: ★★★★★☆

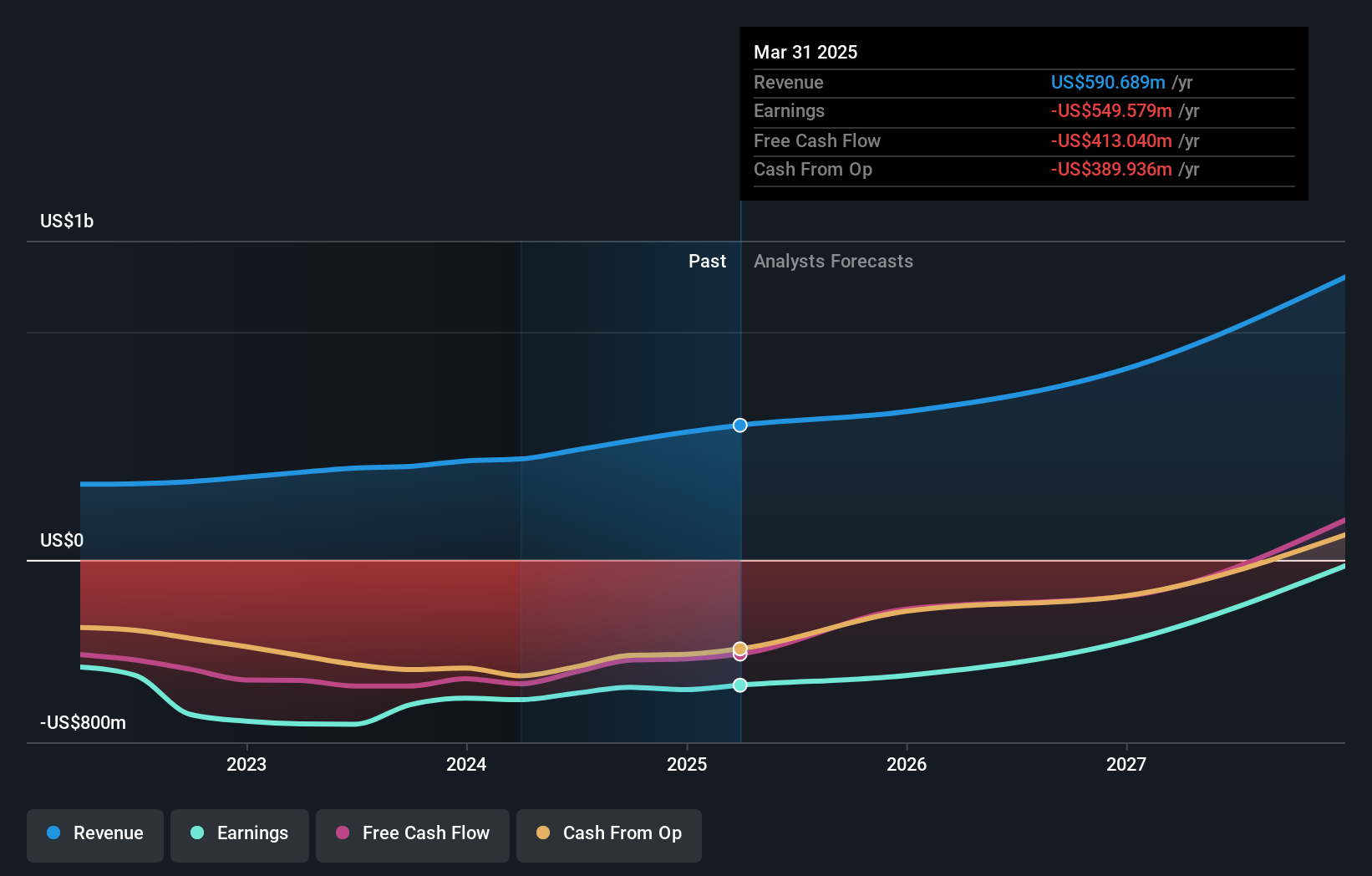

Overview: Ultragenyx Pharmaceutical Inc. is a biopharmaceutical company dedicated to developing and commercializing innovative treatments for rare and ultra-rare genetic diseases across multiple regions, with a market cap of approximately $3.42 billion.

Operations: The company generates revenue primarily through the identification, acquisition, development, and commercialization of novel products aimed at treating rare and ultra-rare genetic diseases, amounting to $590.69 million.

Ultragenyx Pharmaceutical is making significant strides in the biotech sector, notably with its recent FDA Breakthrough Therapy Designation for GTX-102 as a treatment for Angelman syndrome. This designation, underscored by positive Phase 1/2 study outcomes, accelerates the drug's development pathway, reflecting Ultragenyx's strong R&D commitment which aligns with its substantial annual revenue growth of 29.6% and earnings forecast to surge by 64.1% annually. The company’s strategic focus on rare genetic diseases not only diversifies its portfolio but also positions it well within a niche yet rapidly expanding market segment.

TKO Group Holdings (TKO)

Simply Wall St Growth Rating: ★★★★☆☆

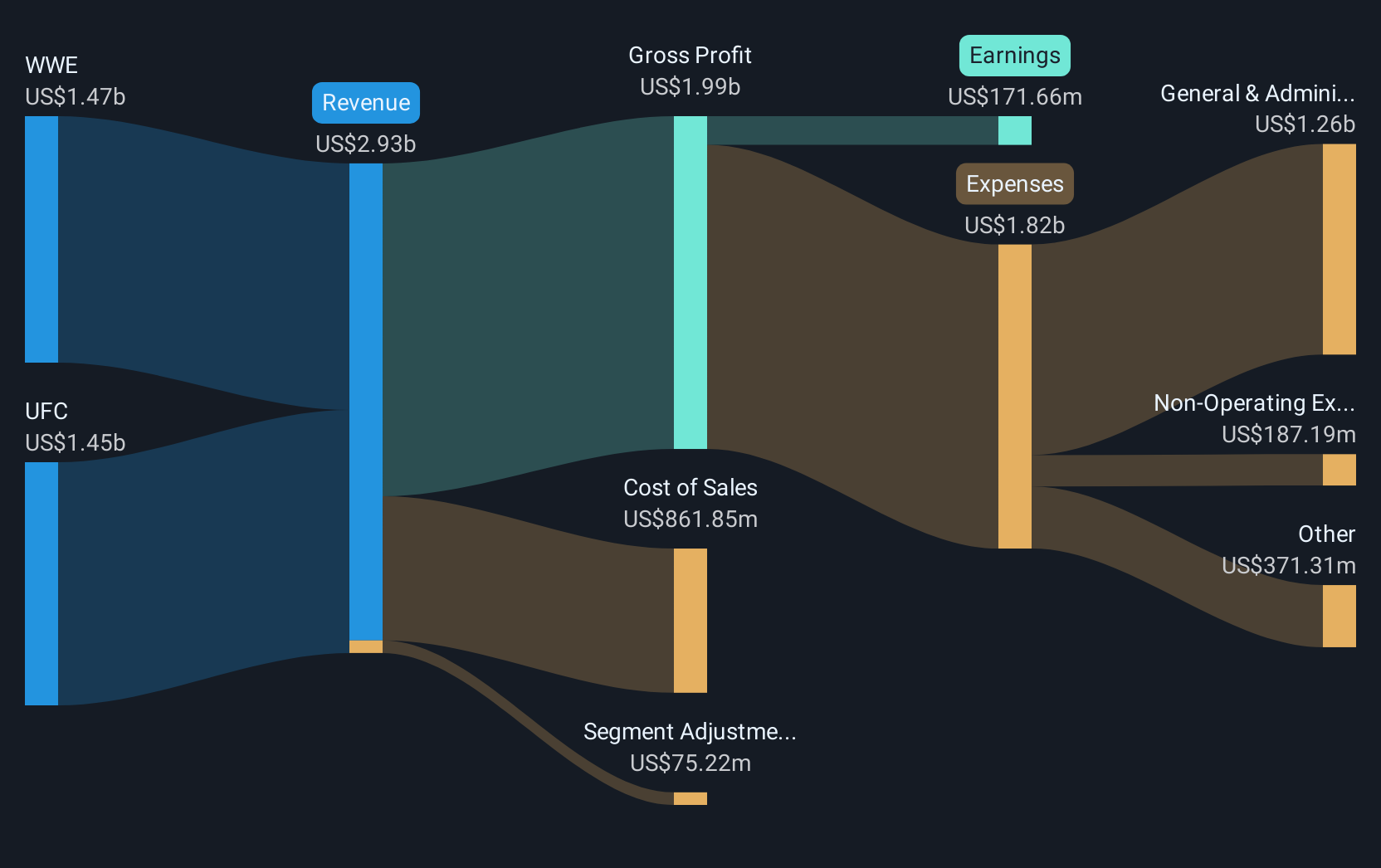

Overview: TKO Group Holdings, Inc. is a sports and entertainment company with a market capitalization of approximately $34.75 billion.

Operations: TKO Group Holdings generates revenue primarily from its UFC and WWE segments, with UFC contributing $1.45 billion and WWE $1.47 billion.

Amidst recent challenges, including being dropped from the Russell 2500 indices, TKO Group Holdings has shown resilience with a robust annual revenue forecast growth of 16.7% and an impressive earnings surge projected at 34.9%. The company's strategic emphasis on high-profile segments like UFC and WWE not only bolsters its market presence but also enhances its competitive edge in the entertainment industry. Additionally, TKO's commitment to innovation is evident from its R&D spending trends, aligning closely with industry demands and future growth prospects. This strategy positions TKO favorably within the dynamic tech landscape despite current legal battles and market adjustments.

- Unlock comprehensive insights into our analysis of TKO Group Holdings stock in this health report.

Explore historical data to track TKO Group Holdings' performance over time in our Past section.

Turning Ideas Into Actions

- Unlock our comprehensive list of 225 US High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives