- United States

- /

- Entertainment

- /

- NYSE:TKO

Assessing TKO Group Holdings (TKO) Valuation as UFC Media Rights and Portfolio Growth Fuel Investor Interest

Reviewed by Kshitija Bhandaru

TKO Group Holdings (TKO) is catching attention after recent positive commentary from investment professionals, along with expanded coverage of its portfolio moves and growth outlook. Investors are particularly eyeing the upcoming UFC media rights renewal as a possible revenue driver.

See our latest analysis for TKO Group Holdings.

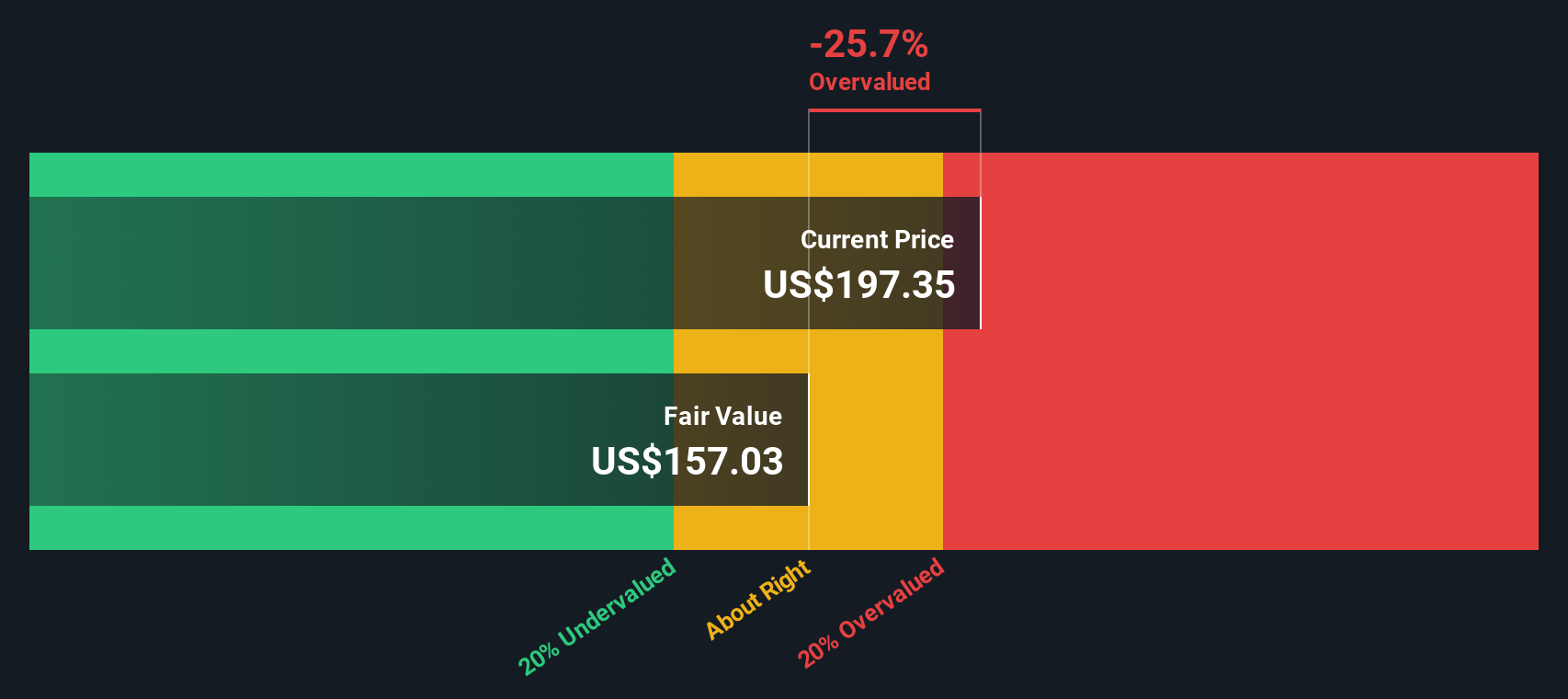

Momentum has been building for TKO Group Holdings, with its share price up nearly 34% year-to-date and a standout 1-year total shareholder return of 51.1%. Catalysts such as recent acquisitions and optimism around the UFC media rights renewal appear to have sparked greater enthusiasm, lifting sentiment and supporting TKO’s premium valuation compared to its fair value estimate.

If growth stories like TKO’s have you watching the market for what’s next, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

With such strong gains already on the table and investor optimism running high, the key question now is whether TKO Group Holdings is still undervalued or if current prices already reflect much of the anticipated growth. This could mean there is limited upside for new buyers.

Price-to-Earnings of 74.5x: Is it justified?

With TKO Group Holdings trading at a price-to-earnings ratio of 74.5x, the stock commands a premium compared to its latest closing price of $191.21. Compared to its peers and the broader industry, this high multiple suggests investors expect robust profit growth ahead, even as valuation risk increases at elevated levels.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of company earnings. For TKO, this multiple is particularly noteworthy because it far exceeds not just the industry average but also the average for similar entertainment companies. Such a high P/E may reflect optimism about future earnings, brand strength, or strategic initiatives, but it also sets a high bar for delivering those results.

Currently, TKO’s P/E of 74.5x tops the US Entertainment industry average of 28.1x and the peer group average of 61.3x. In addition, it is more than double the estimated fair price-to-earnings ratio of 36.3x, indicating the market’s willingness to pay a premium for exposure to the company’s unique growth story. If sentiment shifts or growth does not materialize as expected, shares could quickly re-rate to a lower multiple.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 74.5x (OVERVALUED)

However, risks such as slowing revenue growth or unmet profit expectations could quickly temper optimism. This could make TKO’s valuation vulnerable to sudden corrections.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: DCF Model Offers a Different Perspective

While high price-to-earnings ratios suggest TKO Group Holdings is richly valued, our DCF model tells a similar story. Based on this method, TKO’s current share price of $191.21 is above the estimated fair value of $156.4, which may indicate a possibly overvalued situation. Does this signal caution for momentum investors, or is there more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

If you want to challenge these findings or take a hands-on approach, you can build your own investment thesis for TKO Group Holdings in just a few minutes. Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always keeping an eye out for fresh opportunities. If you want your next move to make an impact, don’t wait—see what’s possible beyond TKO Group Holdings with the powerful Simply Wall St Screener.

- Capitalize on the pursuit of breakthrough medical advancements by exploring these 33 healthcare AI stocks, which features AI-powered healthcare innovators set to transform patient outcomes.

- Chase high-yield potential and boost your passive income with these 18 dividend stocks with yields > 3%, focusing on companies offering strong dividend returns above 3%.

- Catch the wave of digital asset adoption and check out these 79 cryptocurrency and blockchain stocks, with businesses at the forefront of cryptocurrency and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives