- United States

- /

- Entertainment

- /

- NYSE:SPOT

Walking a Fine Line - When will Spotify (NYSE:SPOT) Become and Stay Profitable

One of the biggest risks for shareholders is investing in promising technologies that fail to become profitable. In the early phases of a business, investors pour capital into young growth businesses, and in return they ultimately expect to see cash flows back or at least a stock price increase. Spotify Technology S.A.'s (NYSE:SPOT) business is at a key inflection point, where they must find a way to provide sustainable cash flows to investors.

Today, we will analyze how close is the company in terms of becoming profitable, as well as what are the main risks to sustaining that profitability.

Moving Towards Profitability

Spotify Technology S.A., together with its subsidiaries, provides audio streaming services worldwide. With the latest financial year loss of €581m and a trailing-twelve-month loss of €120m, the US$58b market-cap company alleviated its loss by moving closer towards its target of breakeven.

See our latest analysis for Spotify Technology

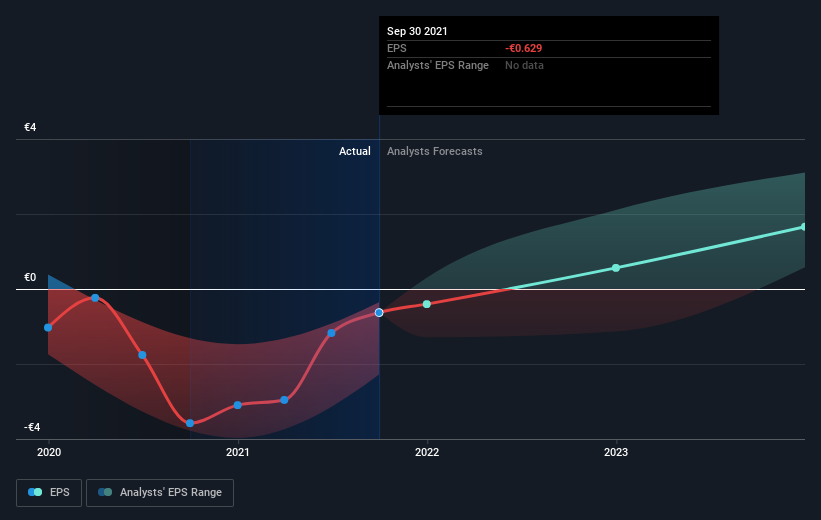

According to the 23 industry analysts covering Spotify Technology, the consensus is that breakeven is near. They expect the company to post a final loss in 2021, before turning a profit of €107m in 2022.

Working backwards from analyst estimates, it turns out that they expect the company to grow earnings 64% year-on-year, on average, which is rather optimistic!

Beyond the profitability estimates, there is a good predictor if a company is closer to becoming profitable soon. That is the state of free cash flows. Interestingly, Spotify has been free cash flow positive for a while, which means that the company can converge to profitability, and possibly that management is delaying the rise in order to set a better terrain for continuous operations.

Spotify currently has some debt. However, a company may have certain benefits if it is profitable and using the interest expense from debt in order to deduct taxes. As debt rarely makes sense to be undertaken by a cash positive young growth company, we can assume that Spotify's management expects to become profitable soon and carryover the losses incurred from debt repayments.

Sustainable Profitability

A company can jump in and out of profitability, but for it to create value for investors, it must be able to sustain profitability levels while continuously developing their product.

In order for it to be an attractive investment, we will inspect the possible reasons why profitability might come under pressure in the future:

- Barriers to entry: Spotify must continuously strive to develop features that bring their clients pleasure, while making it hard for competitors to reproduce the service with similar quality. For example, music.youtube.com has a very similar service which has leveraged its vast YouTube music library to allow users to stream music. This and similar platforms may prove a challenge in acquiring significant market share for Spotify.

- Continuing with the barriers to entry factor, Spotify needs to produce a better suggestion algorithm for its users, which would make them love the service. One of the inputs in producing a quality service, is user data for listening choices, which is solely owned by Spotify. Shared data is hard to monetize, but having informative data that is at their own discretion, can help create a more valuable service.

- Monetization: Spotify needs to develop its service high enough, that there is a meaningful difference between the experience of a free and a paid user, otherwise the company will experience high churn rates, and market share loss by the next hype app.

- New avenues of growth: the Joe Rogan experiment may provide good insight on the possibility to tap into the podcasting experience, where video resources are optional. The drawback of a project like this, is that the platform will have to embrace controversy, which should first be priced and requires courage on the part of management.

- Music as a low margin business: After the advance of the internet, music has become widely available and replicable. Companies have struggled and failed to derive profitability from the music business. This is a challenge for Spotify, but one which the company may be in a good position to overcome.

The above list does not serve to criticize management, rather to inform investors just how hard it might be to become sustainably profitable.

Conclusion & Next Steps:

Spotify will probably post profits somewhere in 2022. The recent debt undertaking and the consistent positive free cash flows are good indicators that the company is preparing to become profitable.

The challenge for Spotify, will be to remain sustainably profitable and grow margins for investors - this may be difficult, but Spotify is in a good position to execute.

This article is not intended to be a comprehensive analysis on Spotify Technology, so if you are interested in understanding the company at a deeper level, take a look at Spotify Technology's company page on Simply Wall St.

We've also put together a list of essential aspects you should look at:

- Valuation: What is Spotify Technology worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Spotify Technology is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Spotify Technology’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives