- United States

- /

- Entertainment

- /

- NYSE:SPOT

The Bull Case For Spotify (SPOT) Could Change Following New Responsible AI Collaboration With Major Music Groups

Reviewed by Sasha Jovanovic

- Last month, Spotify announced plans to collaborate with Sony Music Group, Universal Music Group, Warner Music Group, Merlin, and Believe to develop responsible AI tools aiming to empower artists and uphold copyright within the evolving music industry landscape.

- This initiative highlights a broader commitment in the music sector to balance innovation in generative AI with the protection of creators’ rights and fair compensation as digital technologies rapidly reshape content creation and distribution.

- We'll explore how this major commitment to responsible AI product development with leading music rightsholders could impact Spotify's growth outlook and investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Spotify Technology Investment Narrative Recap

Spotify’s long-term appeal as an investment rests on its ability to lead music streaming innovation while improving profitability, despite high content costs and the need to scale new revenue streams. The latest alliance with major record labels to responsibly develop AI tools signals a strong industry commitment, but its effect on the upcoming Q3 earnings, widely viewed as the next short-term catalyst, appears limited, as label dependency and margin constraints remain the most immediate risks. In this context, the recent multi-year partnership with Warner Music Group stands out as highly relevant, underscoring how Spotify’s deepening label relationships directly link to both the potential for new artist-first features and the content cost pressures central to its investment debate. However, against this backdrop, investors should be aware that the real challenge may lie in Spotify’s persistent reliance on these same partners for music rights, which could limit future margin growth if not addressed...

Read the full narrative on Spotify Technology (it's free!)

Spotify Technology's narrative projects €23.8 billion revenue and €3.4 billion earnings by 2028. This requires 12.8% yearly revenue growth and a €2.6 billion earnings increase from €806.0 million.

Uncover how Spotify Technology's forecasts yield a $746.42 fair value, a 8% upside to its current price.

Exploring Other Perspectives

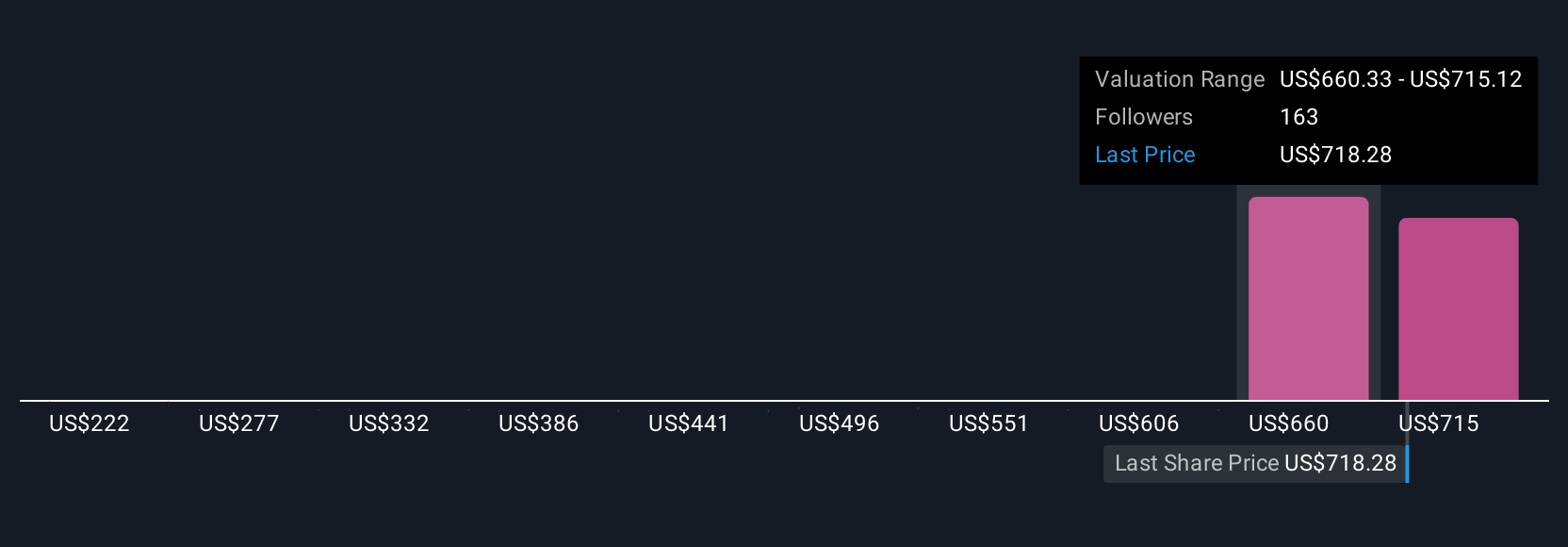

Twenty-two community fair value estimates range from US$299.68 to US$865.78 for Spotify, showing substantial variety in independent outlooks at Simply Wall St Community. With persistent dependence on major record labels as a key risk, you can see just how differently investors view the company’s earnings potential and long-term upside.

Explore 22 other fair value estimates on Spotify Technology - why the stock might be worth less than half the current price!

Build Your Own Spotify Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spotify Technology research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Spotify Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spotify Technology's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPOT

Spotify Technology

Provides audio streaming subscription services worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives